The US dollar rose yesterday against other world currencies due to the statements of Fed Chairman Jerome Powell, which once again called on the White House and the US Congress to allocate additional funds to ensure the stability of the seriously damaged economy caused by the coronavirus pandemic. The previous measures were already quick and powerful, but their influence is weakening, so new incentives are needed to allow the economy to survive until the pandemic begins to subside. Only after that will the recovery and revitalization of the US economy will begin.

The US dollar began its sharp increase against the euro after Powell said that the prospects are extremely uncertain and are subject to significant downside risks, which pushes the period of economic recovery for several months ahead. Jerome Powell noted that recovery may take some time, and there is a feeling that it will be slower than previously expected.

Many economists are waiting for the pandemic to recede and the US economy to open up fully, since only after that will it be possible to conduct a more thorough analysis of the situation, and see clearer the damages inflicted by the pandemic. Powell believes that additional measures will be needed to assist business and the economy, because although additional fiscal support can be quite expensive, the situation may become even worse if assistance and measures are not provided. The Fed chairman is confident that long-term problems will not happen, as the Fed and the White House administration have collected all the tools, from lending to decisions regarding fiscal policy, to ensure the survival of the economy. Powell also said that now is time to fully utilize the available tools to support the economy, until the recovery begins to go in full swing.

Meanwhile, unemployment is expected to peak in the next month or so, after which the economy should recover significantly.

When asked whether the Federal Reserve will resort to negative interest rates or take on new measures, the Fed chairman answered unequivocally that no one is going to change the current monetary policy, and he will only consider reducing the stimulus measures after the current crisis ends.

From the entire speech, it can be concluded that no matter how the US Central Bank does not count on a quick economic recovery after the coronavirus pandemic, nervousness is visible in their ranks, which affected the markets. However, after measures were taken, it began to gradually recover and decline.

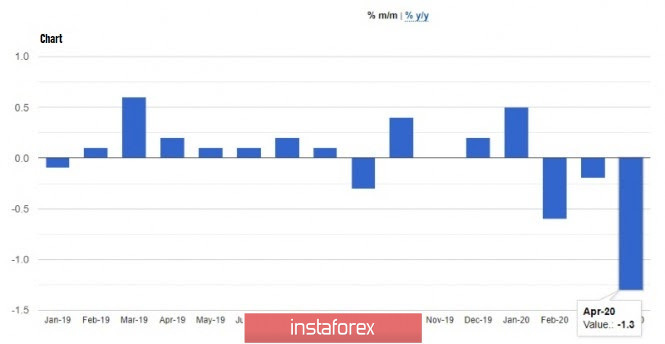

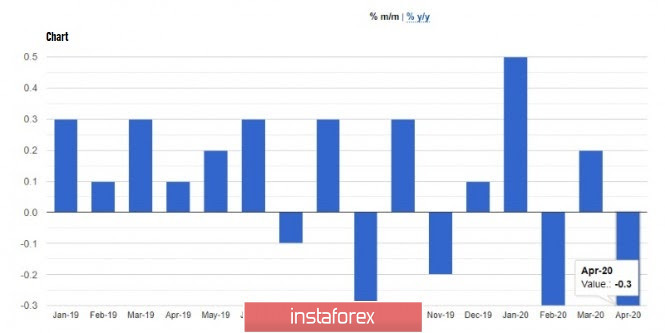

The report published yesterday on producer price index indicated a decline, which was due to the coronavirus pandemic that paralyzed all economic activity in the country. According to the report of the US Department of Labor, the final demand index in April fell by 1.3%, worse than the 0.5% forecast, and is akin to what was observed in the post-crisis December 2009. Core inflation, which does not take into account volatile prices for food and energy, fell by 0.3%, but increased by 0.6% if compared with 2019.

The Wall Street Journal published a survey yesterday, which revealed that economists expect a 32% decrease in US GDP in the 2nd quarter of this year, and a sag of 6.6% in general in 2020. The report also contained an interesting point in which experts disagree on whether the economy should be launched now, where 29.8% of economists believe that now is the time for such, while more than 31% believe that it should be postponed for a while.

As for the technical picture of the EUR/USD pair, the unsuccessful attempt to break above the resistance level of 1.0890 yesterday led to the instant decline of risky assets, so the next task of buyers at the end of the week is to maintain the quotes above the support level of 1.0785, which was formed last week. If bulls are not active when the pair approaches this level, annual lows will be updated and reach below the level of 1.0600. However, bulls have a good enough opportunity today to return the quotes to the resistance level of 1.0845 and close the week above this level, which may update the highs of 1.0890 and go beyond it, which will allow moving to the levels of 1.0980 and 1.1040 possible.