Economic calendar (Universal time)

The economic calendar does not contain many events today. The indicator from overseas at 12:30 (the number of initial applications for unemployment benefits, USA) can help influence the situation.

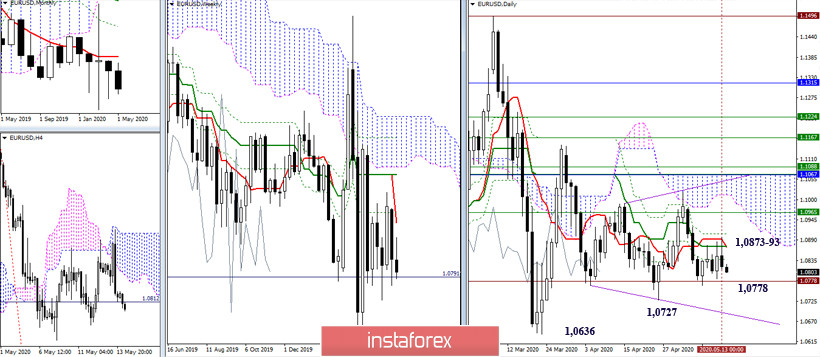

EUR / USD

Yesterday, the pair indicated an increase in bearish sentiment and a rebound from levels after retesting the resistance in the region of 1.0873 - 93 (daily cross). As a result, the main focus now is on support - 1.0778 (historical level) - 1.0727 - 1.0636 (minimum extrema + trend line) again. The player to increase did not manage to leave the zone of prevailing consolidation of the last days yesterday. So, let's see if the opponent succeeds.

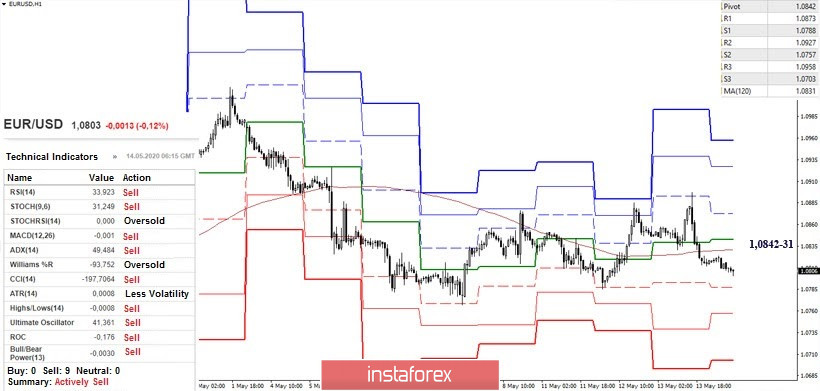

Using the support of the lower halves yesterday, the players to increase tried to break through the resistance of the higher time intervals again, but failed. Now, the analyzed technical tools on H1 give preference to players for a decline. The intraday supports are the classic pivot levels (1.0788 - 1.0757 - 1.0703). A change in the current state of affairs is possible with reliable consolidation above the key resistance of the lower halves, which have joined forces at 1.0842-31 (central Pivot level + weekly long-term trend) today. In this case, the daily consolidation will most likely destroy again the plans for lowering that were outlined the day before.

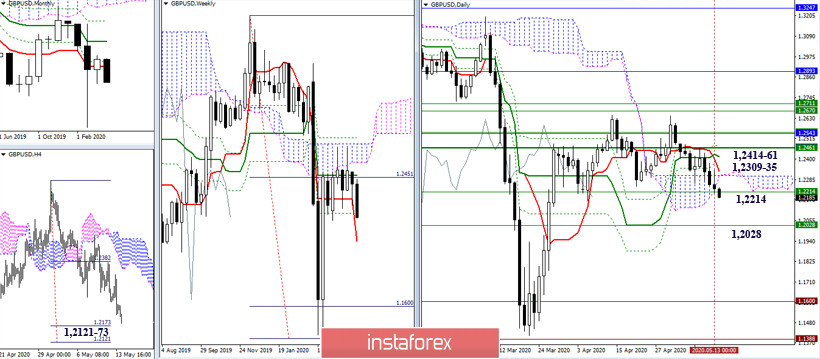

GBP / USD

A successful attack against the weekly Fibo Kijun (1.2214) and consolidation in the bearish zone relative to the daily cloud will allow players to lower plans to plan for a further decline. The following support can be noted at 1.2121-73 (target for breakdown of the H4 cloud) and 1.2028 (daily Tenkan). The nearest significant resistance today can be identified at 1.2309-35 (daily cloud + Tenkan) and 1.2414-61 (daily Kijun + weekly Kijun + monthly Tenkan).

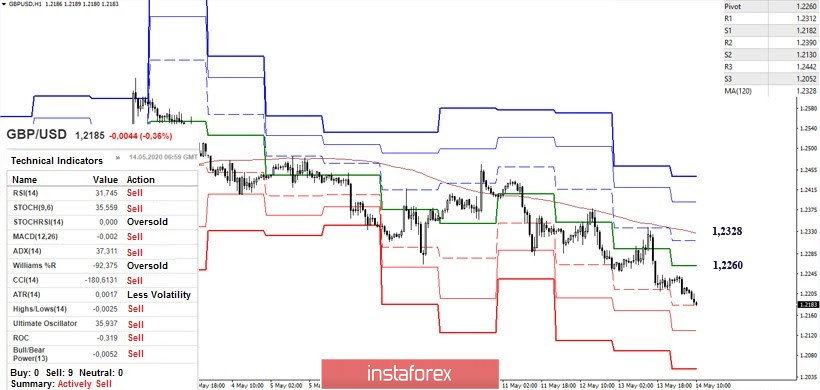

The key resistance of the lower halves yesterday helped to complete the corrective rise, after which the bears restored the downward trend. Now the bearish trend is in its active phase, the first support for the classic Pivot levels 1.2182 is being tested, while the levels of 1.2130 and 1.2052 are waiting for their turn. In case of an upward correction, the main H1 resistances today are located at 1.2260 (central Pivot-level of the day) and 1.2328 (weekly long-term trend).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)