So, we are asked to forget about the existence of any European macroeconomic statistics and proceed from the fact that there is only an American one. And even if it is very, very bad, it can only lead to a weakening of the dollar for a while. And in those wonderful moments when no macroeconomic data is published for the United States, the dollar should strengthen. The formula is simple, although strange. But the facts are unstoppable.

On the other hand, sometimes this arrangement plays in favor of European currencies. For example, the pound ignored the remarkable data on GDP and industrial production, which, in theory, should have led to its serious collapse. Thus, according to preliminary estimates, the GDP of the United Kingdom in the first quarter decreased by 1.6%. This, of course, is not as scary as the expected decline of 2.0%, but still. Indeed, restrictive measures due to the coronavirus, which is so joyfully hung up for the unfolding economic crisis, were introduced only in the second half of March. That is, at the very end of the quarter. And this was enough to ensure that the pace of economic growth instantly turned into the pace of economic recession. In addition, the decline in industrial production accelerated from -3.4% to -8.2%. In March. So again, the economy stopped only at the very end of the month, and the recession is already very, very impressive. But the funny thing is that the decline has been going on for twelve months in a row. So the attempts to blame everything on the coronavirus epidemic look somehow awkward and even stupid. After all, it turns out that the epidemic, at least in the UK, began as early as April last year. Or it is necessary to recognize that the coronavirus epidemic is not the cause of the global economic crisis, but only hastened its onset.

Industrial Production (UK):

But this is something else. Everything on the other side of the English Channel is much more interesting. Indeed, the decline in industrial production in Europe accelerated from -2.2% to -12.9%. And the funniest thing is that the decline in industry has been going on for 17 months in a row. That is, since November 2018. However, politicians around the world completely refuse to acknowledge the fact that problems in the economy have matured for a very, very long time and hastily appoint the coronavirus as the culprit. Naturally, in the person of China. Well, from the point of view of the markets, it is probably not bad that the single European currency and the pound simply ignored their macroeconomic data. Otherwise, they would have to decline in the morning.

Industrial Production (Europe):

But American statistics do not cause fake interest among all market participants. However, it is quite strange. As soon as it became known that the growth rate of producer prices suddenly turned into a decline, and even by 1.2% instead of the expected 0.3%, the dollar began to lose its position. And this is quite logical. However, the energy was enough for about half an hour or maybe for an hour. After that, the dollar began to strengthen and fully recouped all its losses. Anyway, it was able to strengthen quite well at the end of the day. The fact is that data on producer prices have not brought anything new. The fact that the United States is steadily slipping into deflation, in addition to a crazy increase in unemployment, became completely clear as early as Tuesday, when inflation data was published. Data on producer prices only removed the last doubt. So it is not surprising that there was not the same reaction as after the publication of inflation data. The subsequent strengthening of the dollar is much more interesting. But the logic here is extremely simple. The United States is an integral part and cornerstone of the global economy. Many countries simply live off exports to the United States. So if everything is so bad in America itself, then others will be even worse, or maybe it has already become. At the same time, since many countries are elementarily tied to exports to the United States, and therefore to American consumer activity, then, while the labor market in America does not normalize, other countries may simply forget about any kind of economic growth. To simply put it, according to this scheme, even if the world begins to recover, it will start from the United States. So, it's better to invest money right away where it's faster to make a profit. Everything is very, very simple. So it is not surprising that the dollar, albeit slowly, is constantly strengthening.

Producer Price Index (United States):

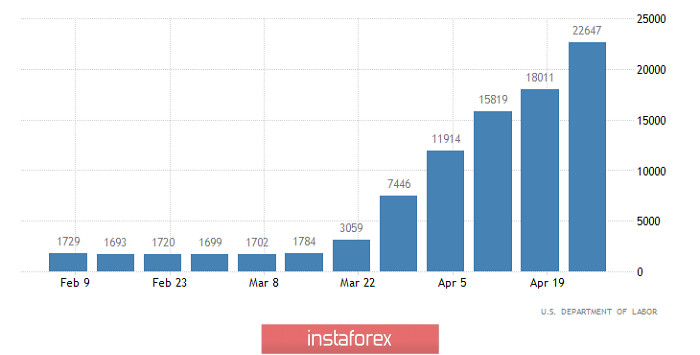

At the same time, we should not forget that periodically the dollar nevertheless becomes cheaper. Let it be for a while. Over the previous two weeks, the publication of data on applications for unemployment benefits was the reason for its weakening. Yes, the next day the dollar began to rise again. But it has become cheaper now. And today's publication of data on applications will certainly not be an exception to the rule. There are good reasons. On the one hand, of course, we can rejoice at the fact that the number of initial applications for unemployment benefits is steadily decreasing. But you must admit, the expected 2,450 thousand still looks impressive. Moreover, this is more than ten times the normal number of initial appeals. Moreover, after the rapidly growing number of unemployed, there will simply be no one to dismiss sooner or later, and the growth in the number of initial calls will stop initially. Much more important is not that people lose their jobs, but whether they can find a new one. But with this, everything is sad, since the number of repeated applications continues to grow, and today another record can be set; however, with a negative sign. It is expected that the repeated applications will be as much as 25,650 thousand. So unemployment is becoming more and more likely to become protracted. The main thing is that it does not become permanent. So there's plenty to be sad about. And if we rely on the experience of previous weeks, the dollar may well fall in price at the end of the day. Growth will resume tomorrow.

Repeated Unemployment Claims (United States):

During the downward movement, the EUR/USD currency pair managed to return the quote to the area of 1.0800, winning back most of the surge on May 12. It can be assumed that if the downward mood persists, the quote will find a foothold in the region of 1.0775/1.0785 once again, as it was a period earlier. In this case, the pullback/correction will not take long, as a result, maintaining the existing sequence of measures.

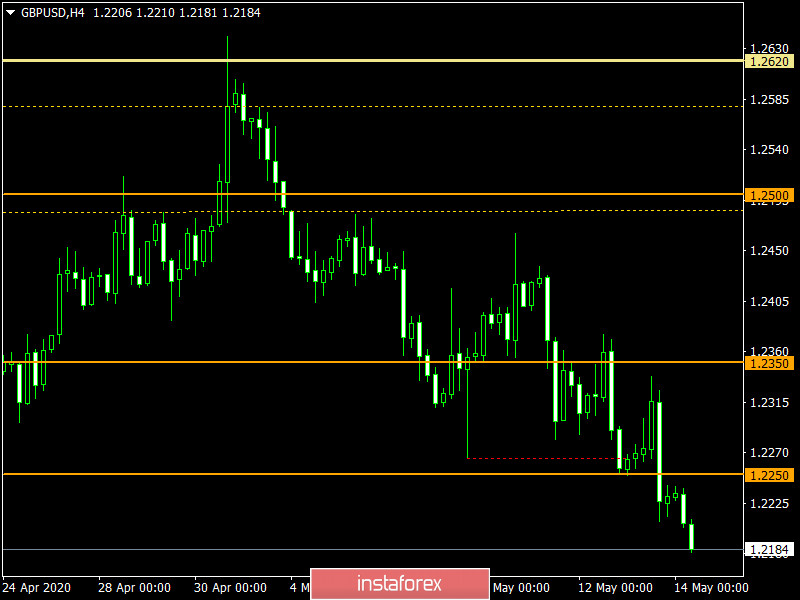

The GBP/USD currency pair continued to show downward interest, during which the quote managed to break through the level of 1.2250, consolidating below it. It can be assumed that if the specified infusion is preserved, the quote will move towards the subsequent level of 1.2150, which reflects the local minimum on April 7.