The demand for the US dollar continues to rise amid the data that awaits us ahead regarding the economic consequences of the coronavirus pandemic. An interesting forecast was published yesterday, according to which the loss of the world economy from the consequences of the pandemic can range from $ 5.8 trillion to $ 8.8 trillion. The worst-case scenario, which envisages a reduction in the economy by 8.8 trillion, is associated with longer quarantine and social distance measures. The more optimal scenario, however, also does not inspire investors, because the global GDP will still lose more than $ 5.8 trillion if the economies of developed countries begin to reopen in June this year

US Democrats submitted another proposal to help the US economy, suggesting the expansion of measures to stimulate its growth. According to data, the US House of Representatives prepared a new bill that is aimed to assist US households and those who were unemployed during the pandemic. However, support from Republicans, as well as the White House, has not yet been noted, but its voting will most likely take place today. The result may support the markets that have dipped after recent corporate reports and weak fundamental statistics.

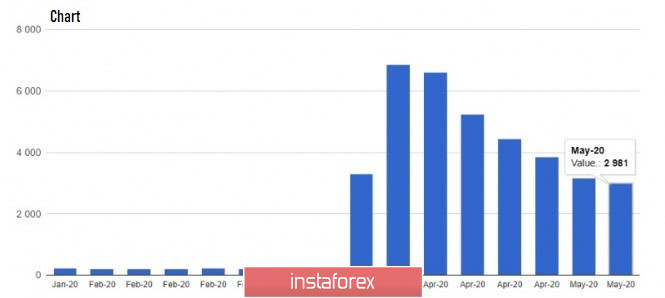

The data published yesterday on the US labor market turned out to be slightly worse than the forecasts of economists. Nevertheless, the fact that the figures were decreasing is good news. According to the report of the US Department of Labor, initial applications for unemployment benefits in the US for the week of May 2 to 9 amounted to 2.98 million, higher than the forecast of economists, which is 2.5 million. Since the middle of March this year, the number of applications has exceeded more than 36 million.

Another important data on US retail sales will be published today, after which the consumer sentiment will be available for assessment. Recent data has revealed that consumers were increasingly filled with pessimism that they believe that recession will persist even after the reopening of the economy. Optimistic scenarios of the Fed and the White House were also believed to remain only on paper. According to economists, retail sales are expected to fall by more than 11% in April, after declining by 8% in March. A bigger-than-expected drop will lead to a revision of forecasts, with which the rate of economic decline will become worse, and only safe haven assets will strengthen.

As for the technical picture of the EUR/USD pair, a break and consolidation above the resistance of 1.0820 may increase the demand for risky assets, which will lead to an upward correction of the trading instrument to the area of the upper border of the side channel 1.0895. If reports on the US economy fail to please market participants, demand for risky assets will decline, which will lead to a breakdown of a large minimum of 1.0770, as well as movement of the euro down to 1.0700 and 1.0630.

USD/CAD

The Canadian dollar is gradually regaining its position against the US dollar amid the strengthening of oil quotes and the speech given by the head of the Bank of Canada yesterday. According to Stephen Poloz, liquidity improvement programs helped restore the good functioning of many financial markets, but there is still considerable uncertainty about the future course of the pandemic and its impact on the economy. Nevertheless, Poloz is confident that the current banking system and financial markets are strong enough to cope with the situation caused by the pandemic, even though it will leave behind a higher level of debt. Poloz also said that the best scenario for economic recovery is possible, as the prospects of energy prices are positive.

As for the technical picture of the USD/CAD pair, quotes have clamped in a triangle on the daily chart, beyond which can lead to a powerful impulse movement. If the situation in the economy does not improve, and oil quotes go down again, a breakthrough of resistance in the area of 1.4140 can lead to a rapid rise of the trading instrument to the 1.4260 high, and then a turn to the resistance area of 1.4425. Meanwhile, if the situation gradually improves, a repeated decline to the support area of 1.3910 and 1.3850 is possible, the break of which will push the pair to the area of 1.3730 and 1.3640, where the 200-day moving average passes.