Economic calendar (Universal time)

Today, there are a lot of diverse statistics. You can highlight the following for the rest of the day:

Basic retail sales index (12:30, USA);

Retail sales (12:30, USA);

The number of open vacancies in the labor market (14:00, USA).

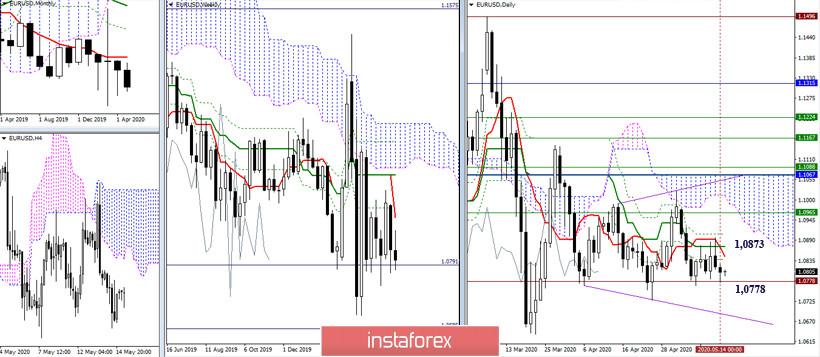

EUR / USD

Retesting the historical support located at 1.0778 indicated a slowdown again. The players to decline failed to break through the level. As a result, the pair continues to remain in the zone of the established daily consolidation on the last working day of the week. The historical level of 1.0778 retains its significance, then bearish landmarks are located at 1.0727 - 1.0636 (minimum extrema + trend line). The resistance of the day cross led by Kijun (1.0873) today did not also change its location and significance.

Yesterday, the support for the higher halves strengthened the first classic pivot level, this was the reason for the next slowdown and the development of an upward correction. The key low level resistance levels today are in the range of 1.0801 - 26 (central pivot level + weekly long-term trend). Consolidating above will give the advantage of lower halves to players increasing, while the pair will remain in the daily consolidation zone, so a significant change in the nature of the movement in the near future may not happen. Also today, the resistances of the classic pivot levels are located at 1.0827 - 1.0850 - 1.0876, while support is located at 1.0778 - 1.0752 - 1.0729.

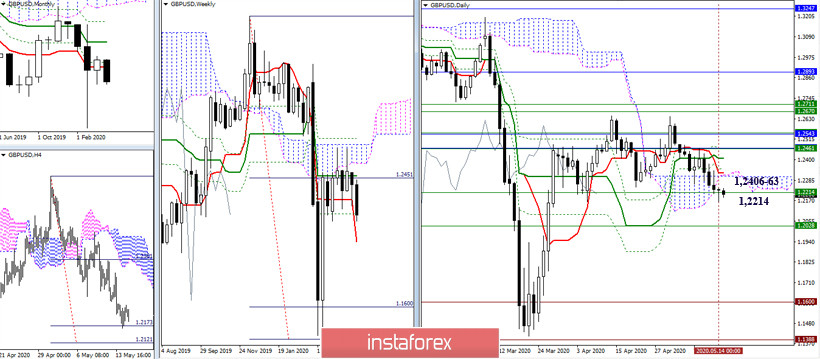

GBP / USD

The pair failed to break through the support of the weekly Fibo Kijun (1.2214), closing the last day above the level. Today, the result is important and interesting when closing the week. The development of an upward correction can quickly return the pair to resistance 1.2309 - 24 (daily cloud + Tenkan). Consolidating above will return the benefits to players on the rise, whose interests will continue to rest on the final frontier cross lines (1.2406 - 63), strengthened by several other high-side resistance (1.2460 - 1.2540 - 50). A breakdown of the current support (1.2214) will make it possible to 100% develop the target for a breakdown of the H4 cloud and open the way to other landmarks.

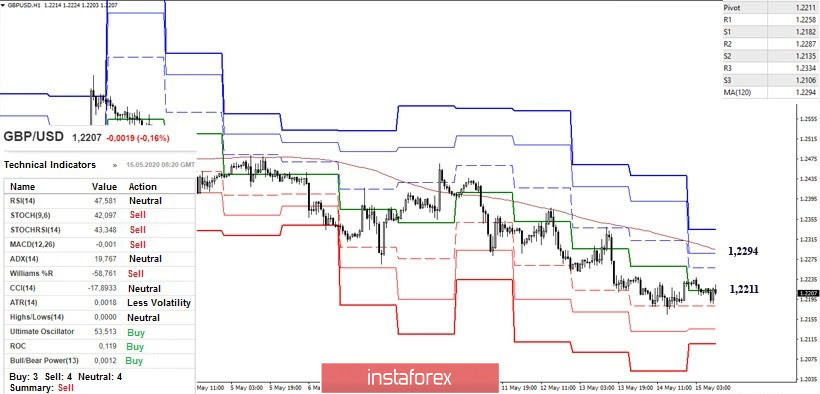

On H1, the pair is in the correction zone and is fighting for the central pivot level (1.2211). The next guideline for the development of the upward correction is the weekly long-term trend (1.2294). If you exit the correction zone and resume the decline, the intraday support will be the classic pivot levels 1.2135 and 1.2106.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)