Hello, traders!

Last week, the US dollar was the undisputed favorite in the currency market and strengthened against all major competitors. In particular, the EUR/USD currency pair lost 0.20% on the decline.

The US currency was supported by the statement of US Federal Reserve Chairman Jerome Powell that interest rates will not have a negative impact on economic stimulus.

Market participants were also concerned about the likelihood of a second wave of COVID-19. Let me remind you that some virologists are considering this possibility, and in several countries, there are prerequisites for the beginning of the second wave of coronavirus infection, which also supports the US dollar as a safe asset.

Well, let's look at the charts of the main currency pair of the Forex market, and traditionally start with a weekly timeframe.

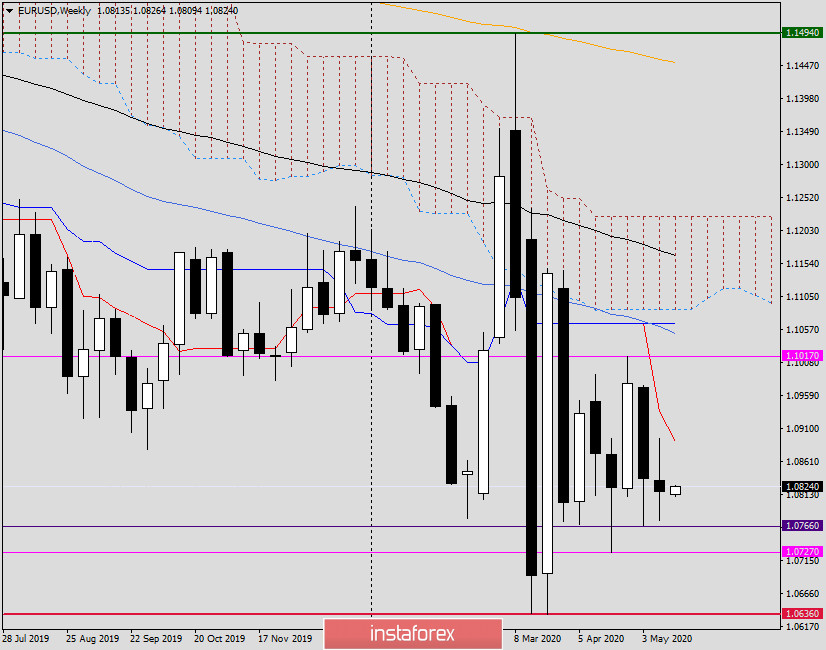

Weekly

Looking at the last weekly candle, we can state the uncertainty of investors. As you can see, the candle has approximately equidistant shadows and a small bearish body with a closing price above one of the key levels of 1.0800. That is, by and large, nothing has changed.

At the bottom, support is still provided by the levels of 1.0766 and 1.0727, and below the key mark 1.0636. The nearest weekly resistance is on the way to another important level of 1.0900. As you can see, right under this mark is the Tenkan line of the Ichimoku indicator and the trading highs are on May 11-15.

I believe that only the update of previous highs, the breakdown of the Tenkan line, and the closing of weekly trading above 1.0900 will open the way to further goals, which are located in the area of 1.0974-1.1017. The bearish scenario will begin to be implemented after the census of past lows and the alternate breakdown of the support levels of 1.0766 and 1.0727. For sellers, it will be extremely important to end the week below 1.0700. In this case, the probability of repeated testing for a breakdown of the key support level 1.0636 is high.

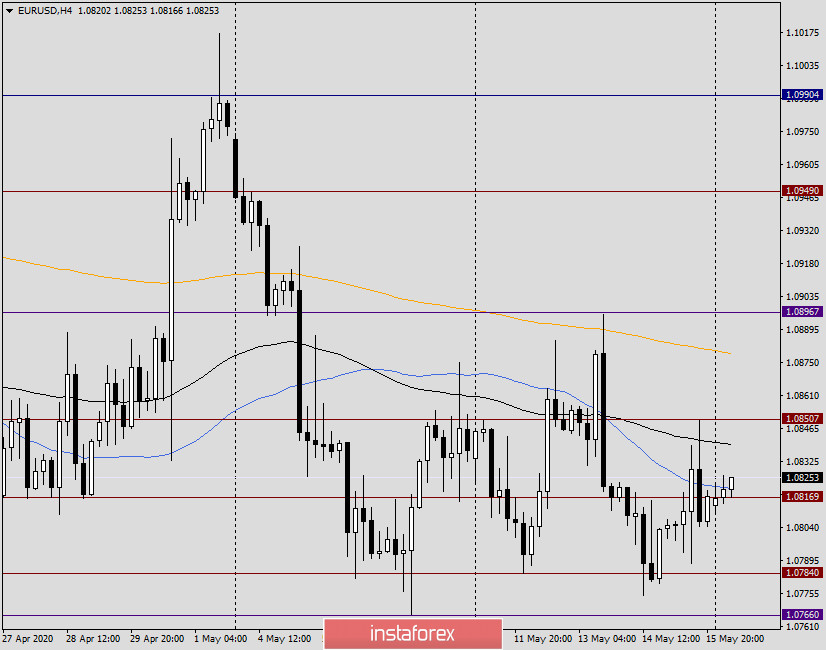

H4

Since there is nothing interesting happening on the daily chart and the situation remains virtually unchanged, we will move to younger time intervals in order to find points for opening positions there.

On the four-hour chart, the nearest resistance is represented by the 89 exponential moving average, which passes at the level of 1.0840. Slightly higher, at 1.0850, are the highs of the US session on May 15. The further resistance area is 1.0870-1.1000, where in addition to a few peaks, there is also a 200 exponent.

However, at the moment of completion of this article, the pair is trying to overcome the 50 simple moving average, and only the successful completion of this mission will open the way to higher goals outlined above.

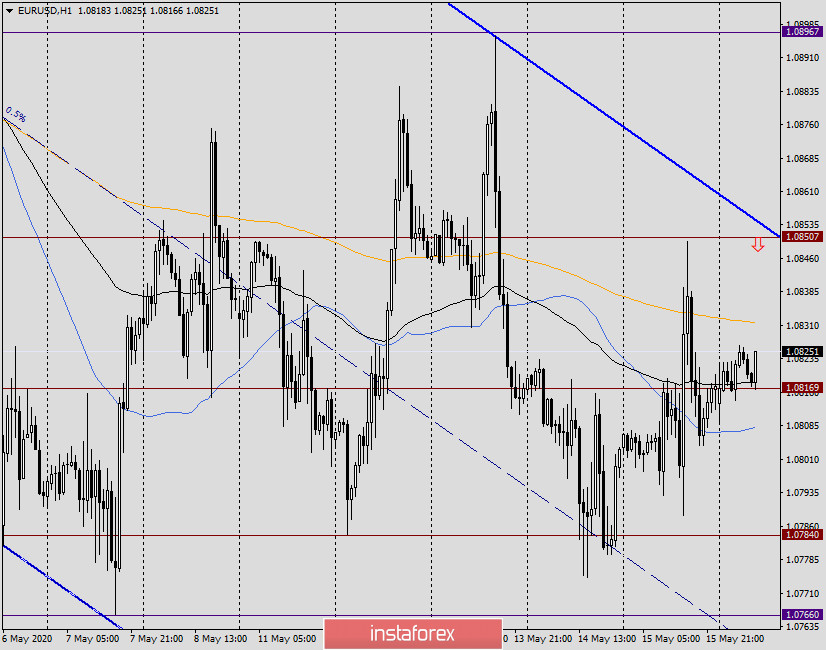

H1

I built a descending channel with parameters on the hourly chart: 1.1058-1.0996 (resistance line) and 1.0782 (support line). Since the upper limit of this channel intersects with the 1.0850 resistance line, I believe that sales from this mark are technically quite justified and are the main trading idea for the euro/dollar today.

If the level of 1.0850 and the upper border of the channel are broken and the price is fixed higher, on the pullback to the area of 1.0850, it is already worth considering purchases, the confirmation signal for the opening of which will be bullish models of candle analysis.

There are no important or significant events planned for today in the economic calendar. In future reviews of the main currency pair, we will definitely note them.

I wish you successful trading!