EUR/USD – 1H.

Hello, traders! The euro/dollar pair performed a reversal in favor of the European currency on the hourly chart on May 15 and started new growth. However, I managed to build a new downward trend line that defines the current mood of traders as "bearish", and at the same time, the pair's quotes have only recently left the upward trend corridor. Thus, the situation is extremely complicated. The key topic in the markets now remains the topic of a possible new conflict between America and China. This topic has a lot of different aspects, so it is absolutely impossible to guess what it might end up with. There are rumors that China may abandon the first phase of the deal, which was concluded in January, citing unforeseen events (the coronavirus epidemic). There are rumors that Donald Trump is going to impose new duties and sanctions against China, its officials, and companies as a response to the spread of the coronavirus. However, any fines, sanctions, and duties will be duplicated by the second party. Thus, both economies may start to suffer from a new confrontation between the countries. And now it is clearly not the best time to put additional pressure on the economy.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair again fall to the ascending trend line and again performed a rebound from this line. Thus, the "bullish" mood of traders remains, and quotes continue to move smoothly along the trend line, which has a very weak angle of inclination. However, until the quotes are fixed below the trend line, traders can not expect a resumption of the fall of the euro/dollar pair. Thus, now there are even certain reasons to expect a new growth of the pair. There are no pending divergences in any indicator today, but the past bullish divergence worked in favor of the European currency.

EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed a new consolidation under the corrective level of 23.6% (1.0840), which is not a strong level at this time. Thus, according to this close, the fall of quotes can be continued in the direction of the lower line of the descending corridor, but this signal is weak and the 4-hour chart does not confirm it.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to count on some growth in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and a new, possibly long fall.

Overview of fundamentals:

On May 15, America released reports on GDP in Germany and the European Union for the first quarter. Official figures showed that both indicators declined by 2.3% y/y and 3.2% respectively. These figures are hardly good or bad in the context of a pandemic and a global crisis. In America, especially, the numbers were no better. Retail trade declined in volume in April by 16.4%, and industrial production - by 11.2%.

News calendar for the United States and the European Union:

On May 18, the calendars of economic events in America and the European Union are empty, so the information background is empty today.

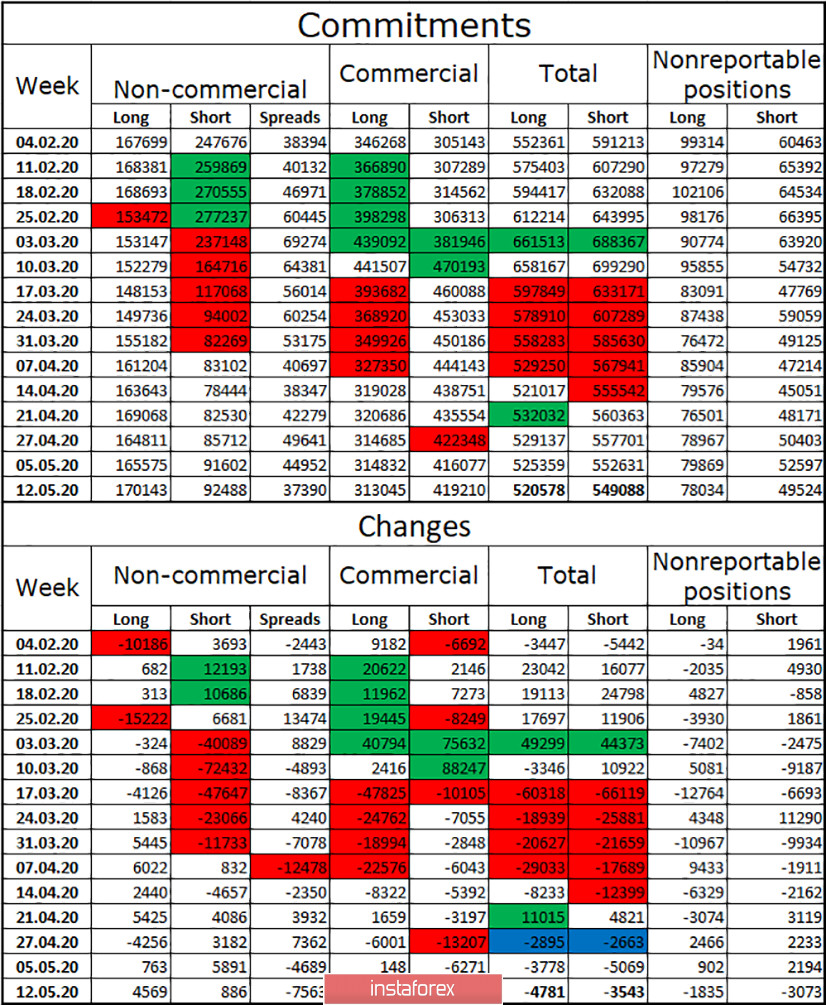

COT (Commitments of Traders) report:

The latest COT report, released on Friday, again showed minimal changes. In the reporting week of May 12, the total number of contracts for purchase and sale among major market players decreased by 4,781 and 3,543, respectively. Thus, the activity of professional market participants is reduced. In principle, this is clearly visible on the steam schedule itself, especially on the 4-hour schedule. In recent weeks, the pair has been trading in a very narrow side corridor. At the same time, large traders (speculators) began to build up long positions, but the "Commercial" group, on the contrary, got rid of purchase contracts. Based on this, we can conclude that speculators are beginning to change their mood to "bullish". More contracts focused on their hands are also purchase contracts. So, I would say that the COT report gives the euro currency a perfect chance of growth in the coming weeks. But the graphical analysis is also powerful and closing the pair's quotes below the trend line will work in favor of the US currency.

Forecast for EUR/USD and recommendations for traders:

I suggest that new sales of the euro currency be made after the pair closes under the upward trend line on the 4-hour chart with the goal of 1.0638. I still do not recommend buying a pair, even in the case of a break from the trend line (which has already been several).

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.