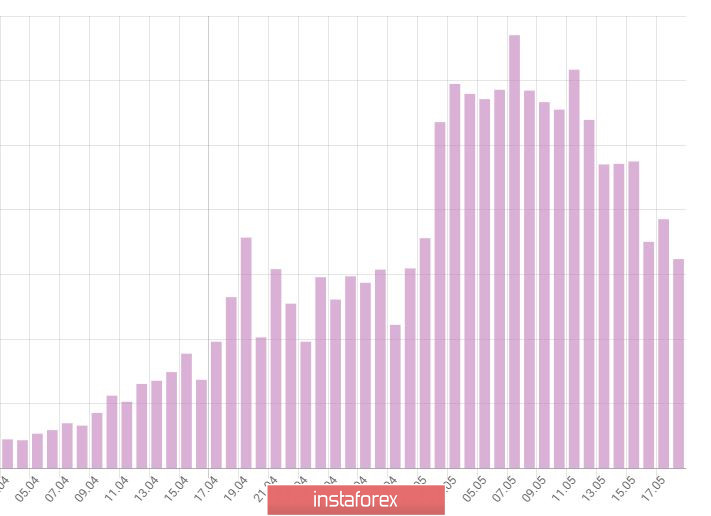

Here is the chart of new coronavirus dynamic in Moscow over the latest 24 hours. The right column displays +3,200 new cases. The total number is almost 7,000. We see a sharp decrease in the epidemic rate. It proves that the epidemic has reached its peak. The burden of medical facilities is expected to ease after June 3 when infected patients will be released. In fact, the largest number of people was admitted to hospitals in early May when the epidemic was in full swing.

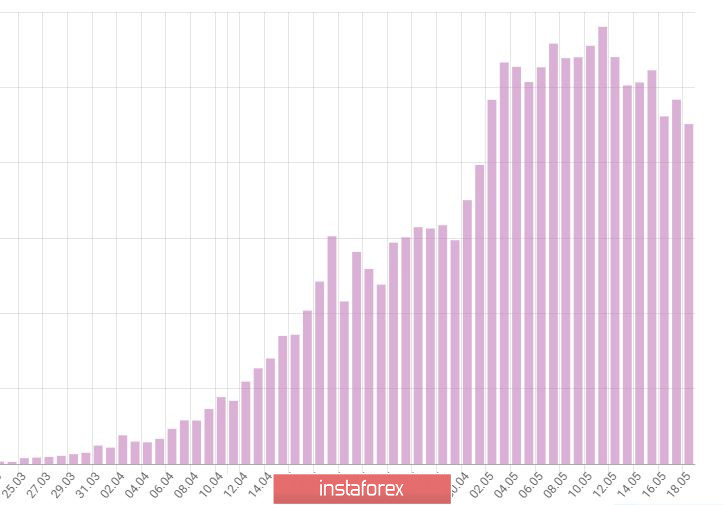

As for the rest of Russia, the situation is not so upbeat, though stable.

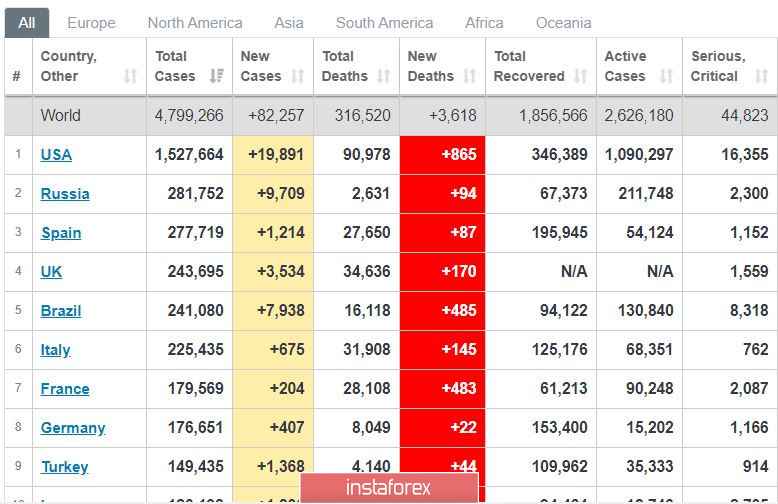

However, the unexpectedly low death toll in Russia sparked off the controversy over the recent week. To be more exact, the thing is the mortality rate which means the percentage of casualties from the number of the infected people. An average rate on the global scale is 6%. In the worst affected countries, Spain and Italy, the mortality rate is as high as 10%. In Germany, the picture is much better with a 4% rate. Remarkably, as of May 18, the mortality rate in Russia is assessed at 1%. Healthcare in Russia is hardly as efficient as in advanced Germany.

To sum up, the conclusion that the epidemic in Russia has passed its peak can be made on condition that the daily growth in new coronavirus cases has declined below +2,000 across the country and below 1,500 in Moscow per 24 hours.

You can check the death toll in various countries and the ratio of the infection cases to fatalities in the table above entitled Total Death.

The Russian ruble is trading at the strongest levels since late March against the US dollar and the euro. There are some reasons behind the ruble's resilience despite the malaise in Russia's economy. The first one is a moderate rally of oil prices (Brent crude is trading over $30 per barrel). The second one is forex interventions by the Bank of Russia.

Experts speculate that the central bank intends to protect the ruble's forex rate from falling until the referendum on amendments to Russia's Constitution. The vote is slated for June 24. However, this assumption is unofficial.

Fundamentally, I do not foresee the strong ruble. Amid its current forex rate, it would be a good idea to buy dollars and euros until the year end.