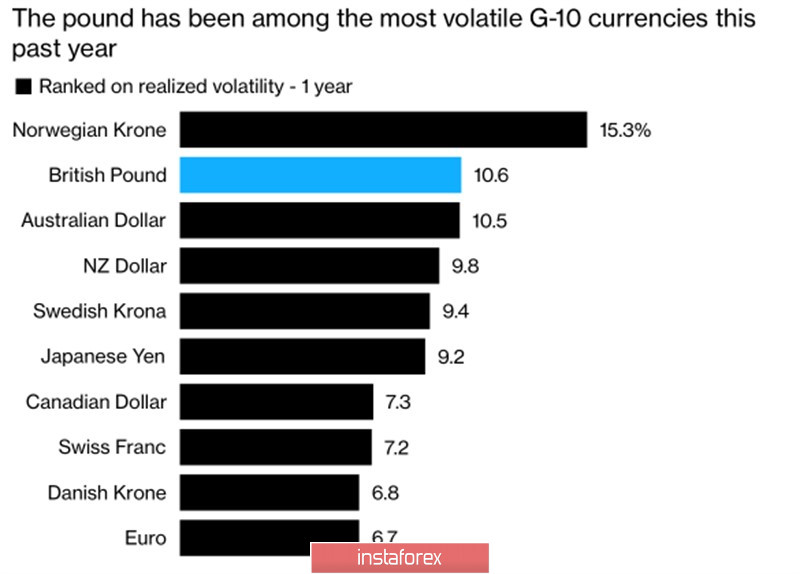

As soon as the Brexit bear began to wake up from its winter hibernation, the British pound once again felt like an outcast on Forex. In 2019, due to the unfavorable political landscape, the volatility of sterling was comparable to the volatility of the quotes of monetary units of developing countries, which scared off foreign investors and created problems for London with raising capital to patch holes in the current account. In February-April, due to the pandemic, Brexit was forgotten, but in May, the "bears" for GBP/USD armed themselves with a good old trump card. And not just them.

G10 currency volatility in 2019

The on-line conference mode complicates negotiations that already looked difficult. David Frost, representing Britain, claims that the main obstacles to a deal are a number of new and unbalanced EU requirements for a so-called equal playing field. The European Union's chief negotiator, Michel Barnier, said that Brussels would not bargain for European values in the interests of the British economy.

London does not understand why the EU does not want the same terms of a trade deal as with Canada, although the answer actually lies on the surface: never before has it come to the same large economy. And so close. The European Union is afraid of competition, and the case may end with the exit of the Foggy Albion from its composition without any agreement. As a result, there will be new tariffs that will drag Britain's GDP to the bottom. The same GDP is likely to decline as deep as it did three centuries ago in the second quarter.

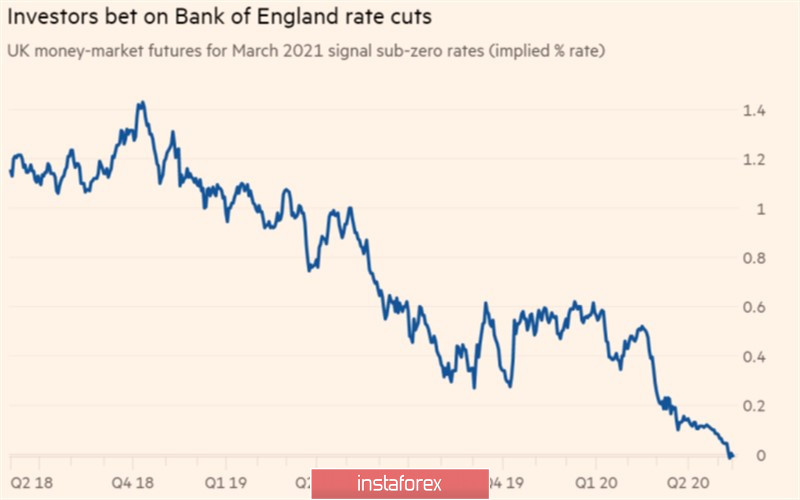

Resuscitation of Brexit-related risks is not the only problem for the pound. Contrary to Andrew Bailey's loud statement that the Bank of England does not plan to reduce the repo rate below zero, the money market is beginning to lay the probability of such a scenario. The BoE's monetary policy easing may occur in March 2021.

The dynamics of the expected values of the repo rate

If Britain goes to reduce import duties on American agricultural products, as Donald Trump insists, breaks off relations with the EU without a trade Treaty and is extremely slow to get out of social isolation (which is quite likely in the conditions of the largest number of deaths from COVID-19 in Europe), its economy can go on the path of W-shaped recovery. This will force the Bank of England to cut rates into negative territory.

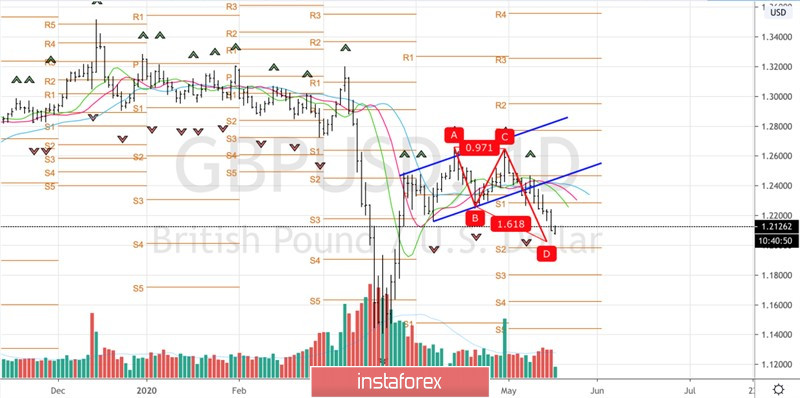

The week to May 22 is notable for sterling not only for Brexit negotiations and trade between Britain and the US but also for a busy economic calendar. Data on business activity and the labor market of the Foggy Albion will help clarify the situation. In contrast to the European purchasing managers' indices, from which Bloomberg experts expect a slow recovery, the British PMI may collapse even deeper. This circumstance allows you to hold and increase the open GBP/USD shorts on breakouts of the levels of 1.235 and 1.229. The initial targets are a 161.8% target on the AB=CD pattern and a pivot level near 1.1975.

GBP/USD, the daily chart