Hello, dear colleagues!

Yesterday's trading on the main currency pair was quite volatile, although within expectations. We will talk about this in more detail in the technical part of the article, but for now, briefly about the external background and the fundamental component.

At the end of the session on May 19, the main currency pair of the Forex market slightly strengthened. Support for the single European currency continued to be provided by the agreement between Berlin and Paris on the creation of a fund to help countries most affected by the COVID-19 epidemic. Let me remind you that this fund will amount to 500 billion euros.

The euro was also supported by the index of business sentiment from the ZEW Institute for Germany and the Eurozone. Both indicators were better than the forecast values, which improved investor sentiment and added optimism.

But data from the United States on new home mortgages came out worse than expected, while building permits exceeded forecasts. I do not think that the listed statistics from Europe and the US were the key moment in strengthening the EUR/USD, but nevertheless.

Today is an important day for the market. At 19:00 (London time), the minutes of the last meeting of the US Federal Open Market Committee (FOMC) will be published. Previously, the FOMC protocols had a significant impact on market movements, especially in dollar pairs, but recently, the market cannot be said to have reacted so violently to such important events. Investors are much more concerned about measures to support leading economies, as well as the prospects of creating a vaccine against a new type of coronavirus infection. Given such market sentiment, it is difficult to expect that the data on consumer prices in the Eurozone which will be published at 10:00 (London time) will have a significant impact on the price dynamics of the euro/dollar, but this indicator itself is important and significant, so it's worth paying attention to it.

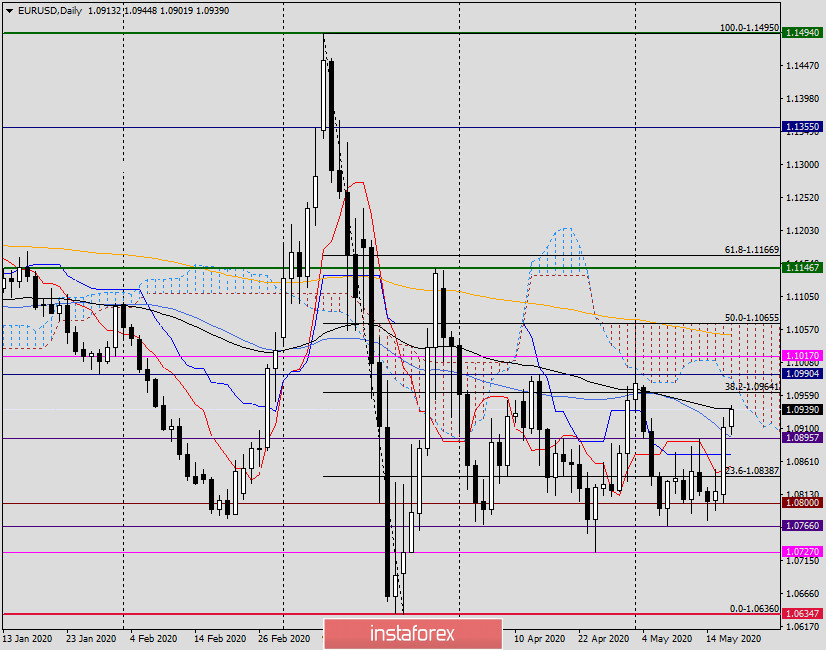

Daily

Yesterday's candle with a very long upper shadow can be considered a reversal model. After reaching the level of 1.0975, there was a strong rebound in the price down, which was facilitated by the strong technical mark itself and the 89 exponential moving average, which passes at the level of 1.0940.

By the way, at the moment of writing this article, the euro bulls are again making attempts to raise the quote and testing for a break of 89 EMA.

If the 89 exponential passes, the next resistance at 1.0962 may create the lower border of the Ichimoku indicator cloud. However, it will be possible to count on a further upward scenario only after the breakout of the sellers' resistance at 1.0975 and the closing of daily trading above this mark. Now it is difficult to guess how today's trading will end, especially since the FOMC minutes will be published in the evening. But whether the market will react to them or ignore them is the main question.

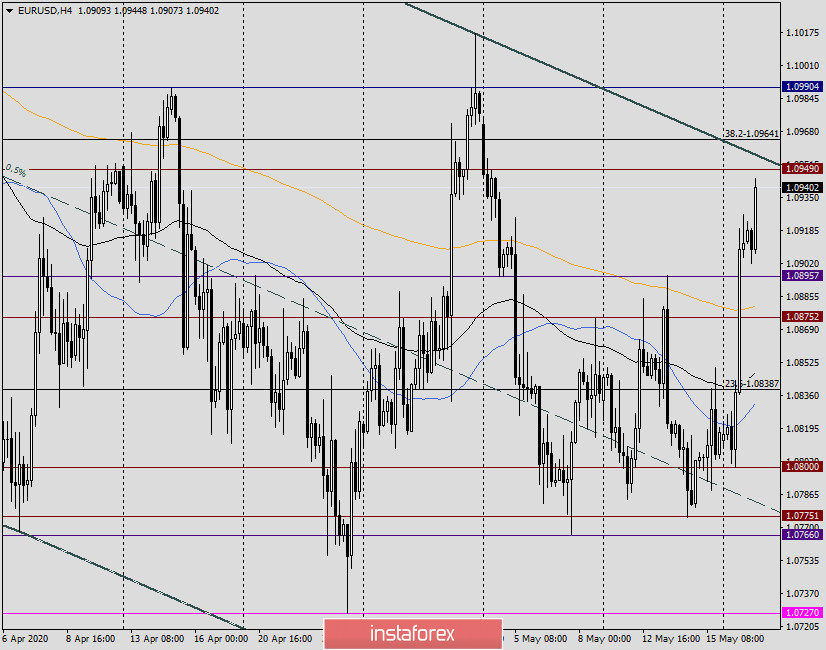

H4

As expected in yesterday's article on EUR/USD, the pair tried to go up from the downward channel, but these attempts were not successful. Today, at the moment of the article's completion, the euro/dollar is again approaching the upper border of the channel and will try to test its strength once again. To avoid wasting your time, I will immediately go to the trading recommendations.

Given the uncertain and difficult situation on the market, yesterday it was suggested to open positions after the appearance of confirmation signals. Such a signal for the opening of sales was allocated to the candle of the varieties of doji. Today, I recommend that you follow the same plan, that is, wait for the necessary signals to open positions.

For sales, these are bearish candles under yesterday's highs of 1.0975 or under the next resistance level of 1.1017. It is better to plan purchases after a true breakdown of the upper border of the channel and the resistance level of 1.0975, on a pullback to the price zone of 1.0980-1.0960. In both cases, I do not recommend setting large goals. Once again, I emphasize the frequent change in market sentiment, so it is better to take your 20-40 points and close positions. Moreover, it is not known what will be the reaction of investors to the Fed protocols

Good luck!