Good day, dear traders!

As expected in the GBP/USD review yesterday, the pair failed to overcome the resistance of sellers in the area of 1.2270-1.2288. A little later, we will return to a more detailed review of the charts of the pound/dollar currency pair, and for now, briefly about the macroeconomic indicators and events that have already been released and are still expected. Today, at 07:00 (London time), important macroeconomic reports on consumer prices were received from the UK. The consumer price index in the UK came out worse than experts' forecasts, which could strengthen the expectations of market participants about the introduction of negative interest rates by the Bank of England. Naturally, negative inflation indicators and rumors of a negative rate could not support the British currency. And they didn't.

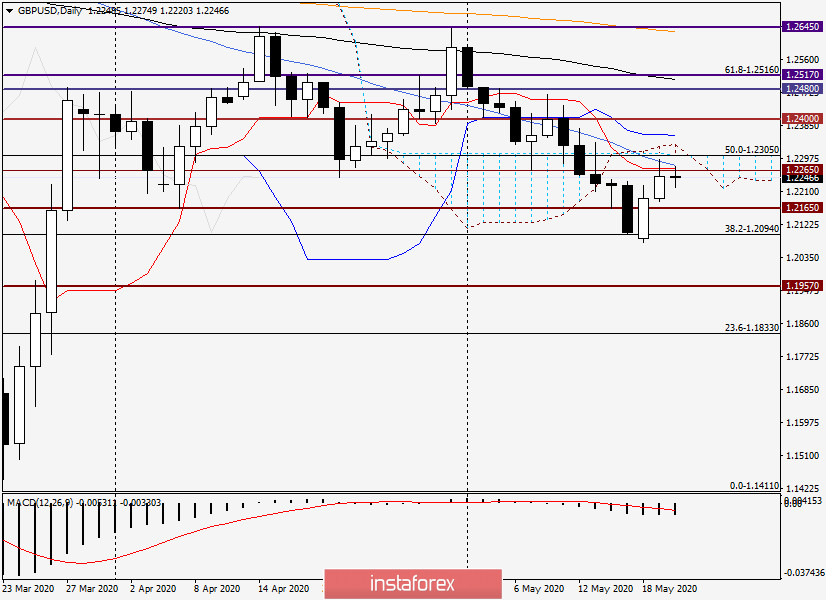

Daily

As already noted at the beginning of the article, the GBP/USD pair could not overcome the resistance in the zone of 1.2270-1.2288 and, having rolled back, finished trading on May 19 at 1.2248. As expected, the Tenkan line of the Ichimoku indicator and the 50 simple moving average became obstacles to moving the quote up.

After the release of weak inflation data in the UK, the pound came under moderate pressure, but at the moment, the pair is gradually recovering, trading near 1.2247. It seems that a significant role in this development is played by the current weakness of the US currency after very lengthy statements by the Chairman of the US Federal Reserve System (FRS) Jerome Powell. Let me remind you that the head of the Federal reserve made disappointing statements about the fall in GDP by 20-30% in the second quarter and the growth of the unemployment rate above 20%.

What we have at the moment. The nearest resistance is represented by yesterday's highs at 1.2294, in case of which the pair will have to face another strong resistance from sellers in the area of 1.2305-1.2357, where both borders of the daily Ichimoku cloud are located, and the Kijun line runs higher. Once again, I would like to express my personal opinion that only a breakdown of the Kijun and consolidation above the level of 1.2360 will open the way to higher goals. For now, the pair's bulls cannot overcome the resistance of Tenkan and 50 MA, which is located near 1.2275.

If the pair fails to pass this level up and turns in the south direction, then the bears' targets for the pound will be yesterday's lows at 1.2182, after updating which a strong technical level of 1.2165 will be tested for a breakdown. The situation on the daily timeframe is extremely uncertain, so let's see what happens in smaller time intervals.

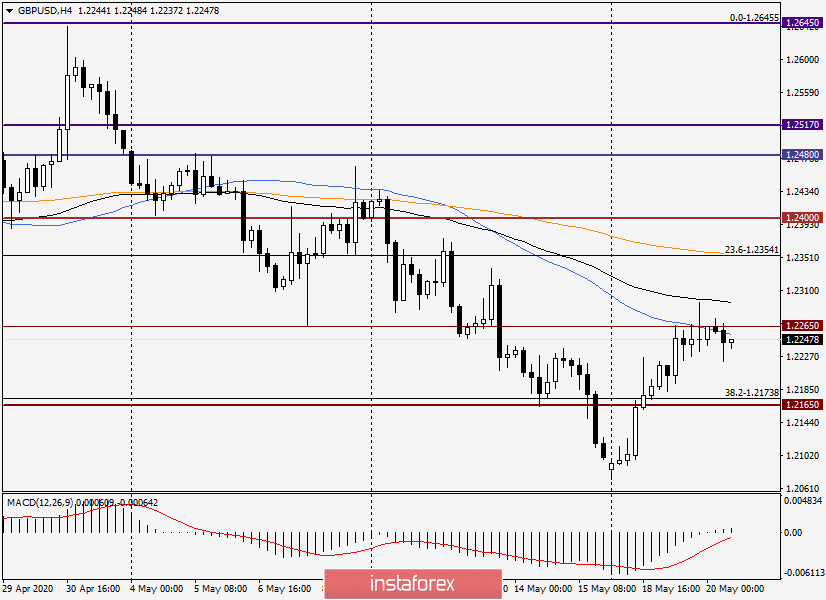

H4

At the 4-hour timeframe, the continuation of growth is hindered by 50 MA and 89 EMA, which are located in the price area of 1.2255-1.2295. I would venture to assume that only a break of 89 EMA (1.2295) and consolidation above the important level of 1.2300 will open the way to more distant goals. We follow the candle signals near the indicated moving averages, and after the appearance of bearish models, we try to sell GBP/USD with the goals of 1.2200, 1.2165, and 1.2100.

If the pair can break through the 89 exponential and gain a foothold above, it is already worth considering buying on the pullback to the 89 EMA. Opening long positions at more attractive prices is recommended to look for after a short-term decline in the price zone of 1.2200-1.2165, but in this case, it is better to see confirmation in the form of bullish models (or models) of Japanese candlesticks.

Let me remind you that today at 19:00 (London time), the minutes of the last FOMC meeting will be published, so it is a very difficult day for trading and opening new positions. I recommend entering the market only if there are clear signals.

Good luck!