Hello, dear traders!

Well, it's time to sort out the AUD/USD currency pair, especially since the minutes of the last meeting of the Reserve Bank of Australia (RBA) was published yesterday.

There were no sensational statements or decisions in the minutes of the RBA's May meeting. It is understandable, in the context of the COVID-19 pandemic, officials of the Australian Central Bank tried to be very restrained and cautious in their comments.

The main message for market participants was the RBA's statement of commitment to the current monetary policy and the expectation of the effect of measures already taken to counteract the negative effects of COVID-19 on the Australian economy.

Bank officials' inflation expectations will still remain below 2% over the next few years. Extremely low rates will be applied for households and small and medium-sized businesses to maintain and/or revive economic activity. Purchases of government bonds can be increased if necessary. The RBA expects that the economic gradual recovery will begin at the end of this year. In the meantime, the bank assumes that GDP losses in the first half of this year will be about 10%. Here, perhaps, are all the main points of the minutes of the last meeting published by the RBA. Now it's time to move on to the technical picture, which is observed for AUD/USD. Since it is already the middle of the trading week, I will not show a weekly chart, it does not make any sense. It is worth noting that after a decline last week, the "Australian" shows quite good growth at the current five-day trading. But, as they say, it's not evening yet.

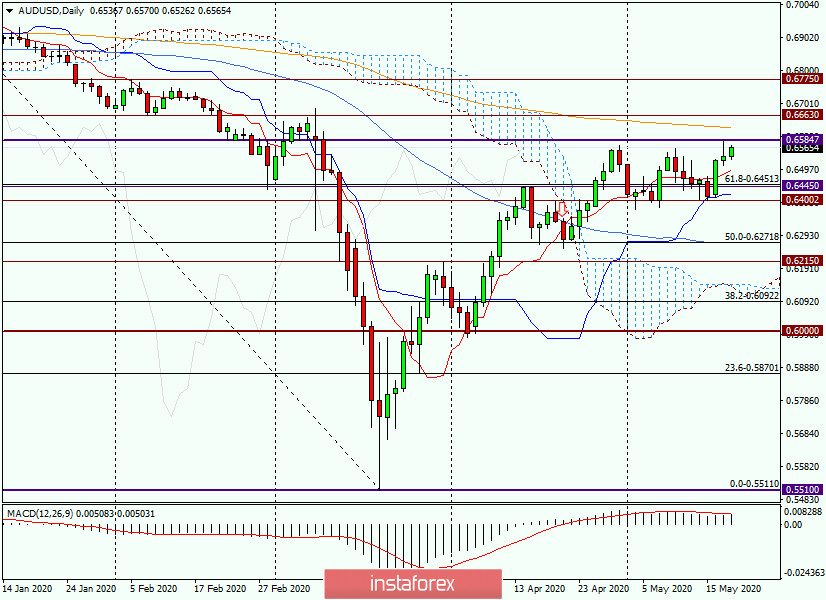

Daily

After yesterday's candle, which can be considered bearish, the pair does not think to move in a southerly direction. On the contrary, at the time of writing, the Australian dollar shows a fairly decent strengthening relative to its namesake from the US.

The primary task of the bulls on the "Aussie" will be to update yesterday's highs at 0.6585 and consolidate above this level. However, this will not remove all questions about the further upward movement of AUD/USD. The fact is that already at 0.6626, the pair will be waiting for a strong 200 exponential moving average, which is quite capable of providing significant resistance and turning the quote down. I believe that only a true breakdown of the 200 EMA will give grounds to expect a further rise in the pair. In general, we must admit that the area of 0.6600-0.6700 is quite strong and difficult to pass, so the bulls on the instrument will have to make a lot of effort to pass it. Naturally, much will depend on the attitude of investors to the US dollar. At the moment, it is far from favorable.

The bearish scenario will develop only in the case of a confident (true) breakdown of the strong technical level of 0.6400. However, do not forget about the psychological level of 0.6500, which can also affect the course of trading on AUD/USD.

According to trading ideas, I will give priority to purchases that I recommend opening after a short-term decline in the price area of 0.6505-0.6495 and (or) after breaking the resistance of 0.6585 and from the mark of 0.6600, on a rollback to these values.

In conclusion, I would like to remind you once again about the FOMC minutes, which will be published today at 19:00 (London time). This event is quite capable of changing the balance of forces in the currency market and returning increased demand to the US dollar. Otherwise, the US currency is at risk to be under even more severe selling pressure.

Good luck!