All attention in the first half of the day was drawn to the data on inflation in the UK, the decline of which leaves the Bank of England with even more maneuver with interest rates, maybe even with negative ones, and will also allow you to expand the QE program without any problems. The low value of the British pound and a sharp jump in the unemployment rate, as we can see, do not yet create serious inflationary pressure.

According to the forecasts of many economists, by the summer of this year, annual consumer price inflation in the UK may even touch the deflationary level and fall to zero, as the current growth rate has become the fastest since the crisis in 2009. However, such problems are more related to a sharp drop in energy prices, rather than a real decline in consumer prices. As I noted above, low inflation has only increased the talk that the Bank of England may expand its bond-buying program by 100 billion pounds at the beginning of the summer.

According to the statistics agency, the annual rate of consumer price inflation in April 2020 slowed to 0.8% from 1.5% in March, while economists expected inflation around 0.9%. Things were much better with core inflation. The report shows that it fell in April to 1.4% from 1.6% in March.

Already, inflation is 1 point below the Bank of England's target level, which is around 2.0%, and we will know very soon how the bank manager Andrew Bailey will react to this. At the very least, he needs to write a letter to the Finance Minister explaining why this happened. However, the reasons are already clear, which most likely will not cause serious problems. Returning to the topic of lowering interest rates, we can also expect similar actions from the regulator in June this year. Of course, it is not necessary to seriously think about the introduction of negative rates yet, but we should not rule out such a moment in the future. It is important to understand how the economy will respond to reduced restrictions and quarantine measures and how quickly it will recover from the coronavirus pandemic. Once again, the main driver of the fall in the consumer price index was energy prices, which is unlikely to have greatly concerned the Bank of England. How the regulator will act in the future, it will be possible to understand today after the speech of its Governor, Andrew Bailey.

As for the technical picture of the GBPUSD pair, a break in the resistance of 1.2285 may lead to a more powerful bullish impulse and update the highs of 1.2340 and 1.2430. In the event of a negative reaction of the pound to the speech of the head of the Bank of England, a break in the support of 1.2222 will lead to a larger sale in the area of the lows of 1.2170 and 1.2120.

EURUSD

The European currency remained to trade in a side-channel against the US dollar, as the euphoria from the creation of the Franco-German economic recovery fund gradually fades, and disputes and opposition to this fund only increase. And if no one disputes the 500 billion euros needed to restore the economy, it is difficult to say for sure whether this fund will be approved. The problem point is the decision to participate in the fund for the entire EU, not just the Eurozone countries.

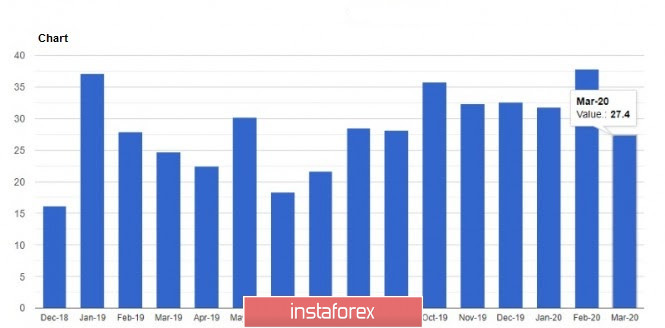

Today's data on the current account surplus of the euro area's balance of payments, which decreased in March compared to April, did not cause serious pressure on the euro. According to the data, the balance fell to 27 billion euros in March against a current account surplus of 38 billion euros in February.

As for the technical picture of the EURUSD pair, the bulls still have problems with the level of 1.0980. Only its breakout will lead to the return of the trading instrument to the highs of 1.1020 and 1.1140. The downward correction, which may begin today, will lead to an update of the minimum of 1.0890, but the longer-term goal will be the minimum of 1.0855, where buyers of risky assets will try to build the lower border of a new upward channel aimed at a larger growth of the euro.