Crypto Industry News:

According to local media reports, the Indian government will not be asking for a total ban on cryptocurrencies, but will instead regulate the sector.

On November 23, the media reported that the Indian government is considering a bill proposing the creation of an official digital currency, while imposing a ban on all "private" cryptocurrencies.

The news triggered a panic sell-off on the local cryptocurrency exchange the next day. The unclear wording of the law and the lack of explanations from the government led many observers to share the prospects for cryptocurrencies in India.

Indian news service NDTV said it had obtained details of a cabinet memo circulating in the government regarding the proposed cryptocurrency law. It turned out that the note made suggestions for regulating cryptocurrencies as crypto assets, and the Securities and Exchange Council of India (SEBI) oversees the regulation of local crypto exchanges.

Investors will be given a certain amount of time to declare their cryptocurrency holdings and transfer them to SEBI-regulated exchanges, suggesting that private wallets may be banned. This, he added, was part of the government's insistence on preventing money laundering and terrorist financing. The government will halt its plans for the Central Bank's Digital Currency (CBDC) with the Reserve Bank of India (RBI) while its focus is on the cryptocurrency sector. It will not allow any crypto assets to be recognized as currency or legal tender.

Technical Market Outlook

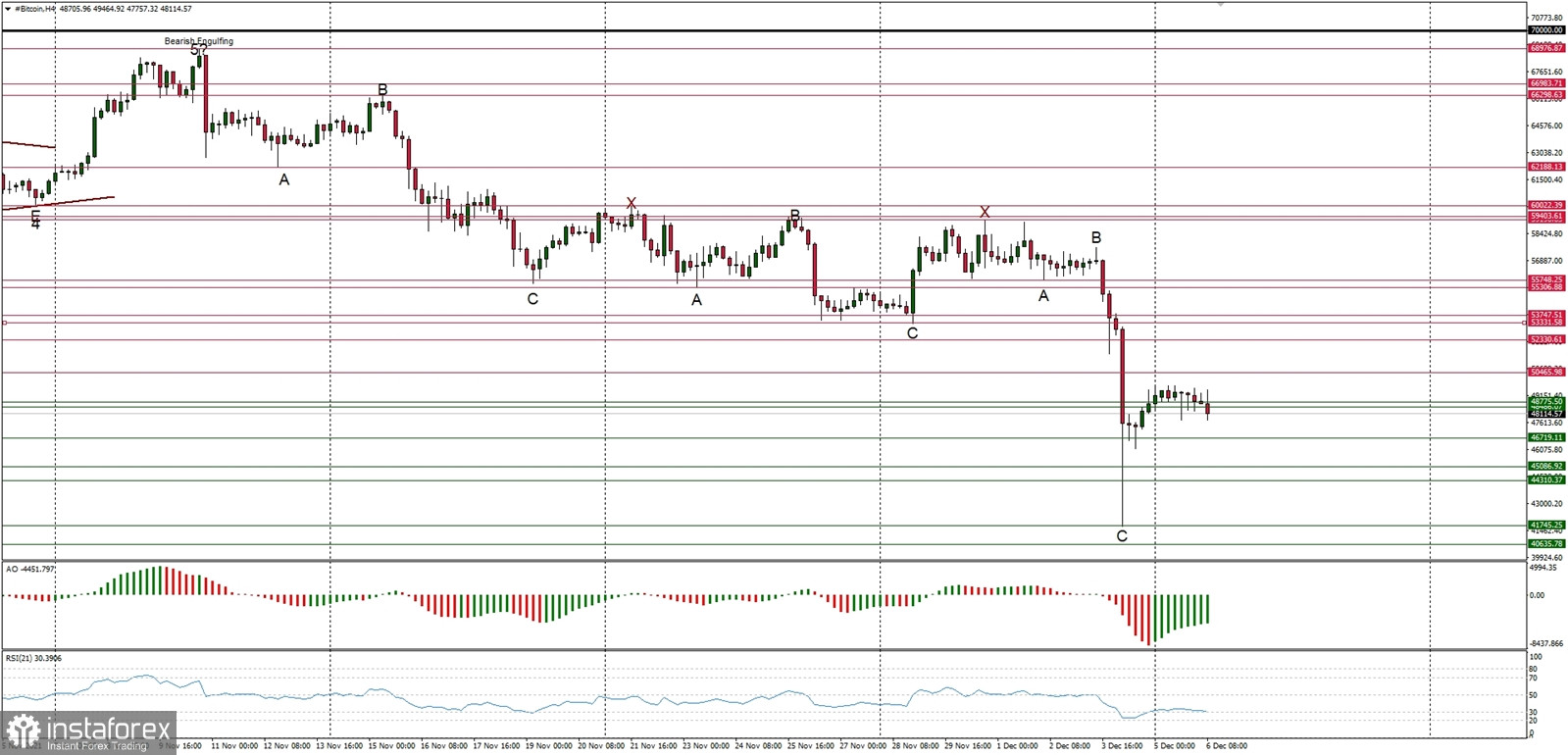

The vicious sell-off on the BTC/USD had been terminated at the level of $41,678, so the bears had manage to push the price almost towards the $40k level. The immediate bounce from this level has hit the level of $49,702 at its best and now the market is consolidating in a narrow range. The next technical resistance is located at $50,456 and $52,333. The immediate technical support is seen at $46,719. Despite the recent complex and time consuming corrective decline in form of ABCxABCxABC pattern, the larger time frame trend remains up.

Weekly Pivot Points:

WR3 - $75,308

WR2 - $67,229

WR1 - $57,614

Weekly Pivot - $49,717

WS1 - $40,054

WS2 - $31,972

WS3 - $22,000

Trading Outlook:

The ABCxABCxABC complex corrective cycle might be terminated at the level of $41,678 and the market is ready to continue the up trend. According to the long-term charts the bulls are still in control of the Bitcoin market and the next long term target for Bitcoin is seen at the level of $70,000. This scenario is valid as long as the level of $39,474 is clearly broken on the daily time frame chart (daily candle close below $39,000 would be considered as a long-term trend change due to the lower low placement).