Good day, dear traders!

As it became known, the British Central Bank is considering the possibility of introducing negative interest rates. This was announced yesterday by the head of the Bank of England, Andrew Bailey. I would like to note that this measure will be applied for the first time in the entire three-hundred-year history of the British Central Bank. However, this issue is being carefully analyzed on the example of other world Central Banks that already use negative interest rates. Let me remind you that one of the main tasks of the English regulator is to achieve the target inflation rate of 2%.

But yesterday's publication of the minutes of the last meeting of the Federal Open Market Committee (FOMC) of the US Federal Reserve did not bring any surprises and was ignored by participants in the currency market. According to the April minutes, the US Central Bank did not discuss the possibility of introducing negative interest rates, which are so advocated by US President Donald Trump. At the same time, the Fed forecasts that the exit from the crisis will not be quick and the US economy will recover at a slower pace from the consequences of COVID-19 than previously expected.

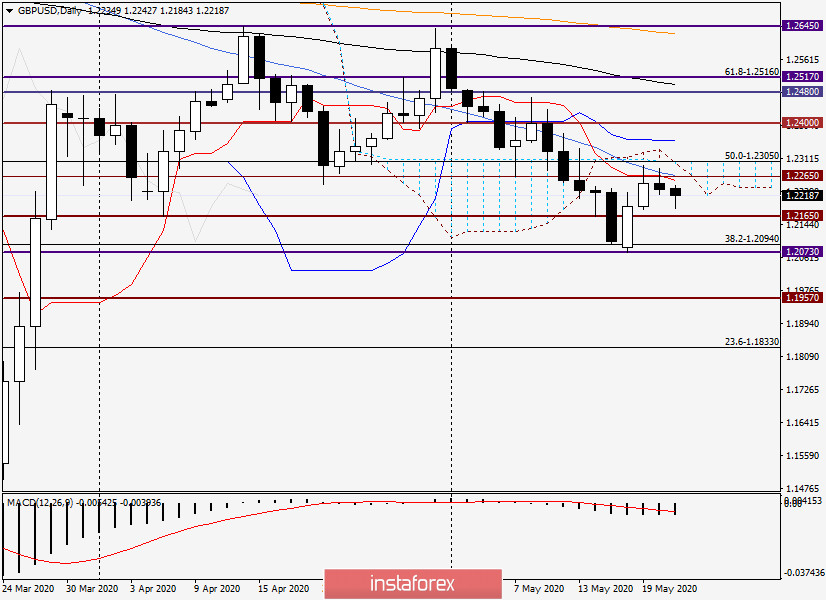

Well, let's look at the charts of the GBP/USD currency pair and see if there have been any changes. Let's start with the daily timeframe.

Daily

The final candle of yesterday's trading once again clearly indicated that the bulls for the pound can not overcome the strong resistance zone of 1.2270-1.2288, which was mentioned in previous reviews of this currency pair. The maximum values at 1.2286 are all that the players were able to achieve yesterday for an increase, after which the course turned in the south direction. More precisely, there was a rebound, which resulted in the formation of a Doji candle, which can be considered a reversal with good reason.

In my personal opinion, the candle for May 20 is a signal for the subsequent decline of the British currency. If so, the next targets at the bottom will be 1.2165, 1.2100, and 1.2073. At the same time, the breakdown of the last level will leave no doubt about the bearish sentiment for GBP/USD. The situation for the bulls can only be corrected by an alternate breakdown of the levels of 1.2305 and 1.2357. However, judging by the technical picture on the daily chart, such a scenario is unlikely. The main option of the price movement looks like a decrease in the pair to the levels indicated above. This means that you should look for points of sale in smaller time intervals.

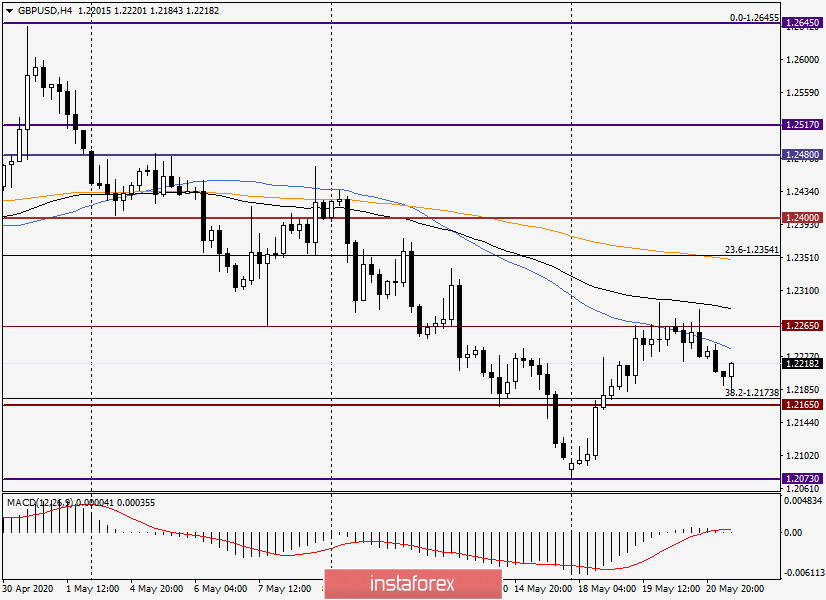

H4

On this chart, the pair is trading under all the moving averages used (50 MA, 89 EMA, and 200 EMA), each of which can provide decent resistance and turn the price down. I believe that only overcoming the 200 exponential, which is at 1.2348, and fixing above it will cancel the descending scenario and reanimate the ascending option. In the meantime, I recommend considering opening short positions on GBP/USD after rising to the price zone of 1.2236-1.2286. As usual, the confirmation signal for opening short positions will be one or more bearish reversal candles.

Do not forget that today at 13:30 (London time) data on initial applications for unemployment benefits will be published in the United States, and later there will be a speech by the head of the Federal Reserve Jerome Powell. I fully assume that these events may have an impact on the course of trading in GBP/USD.

Good luck!