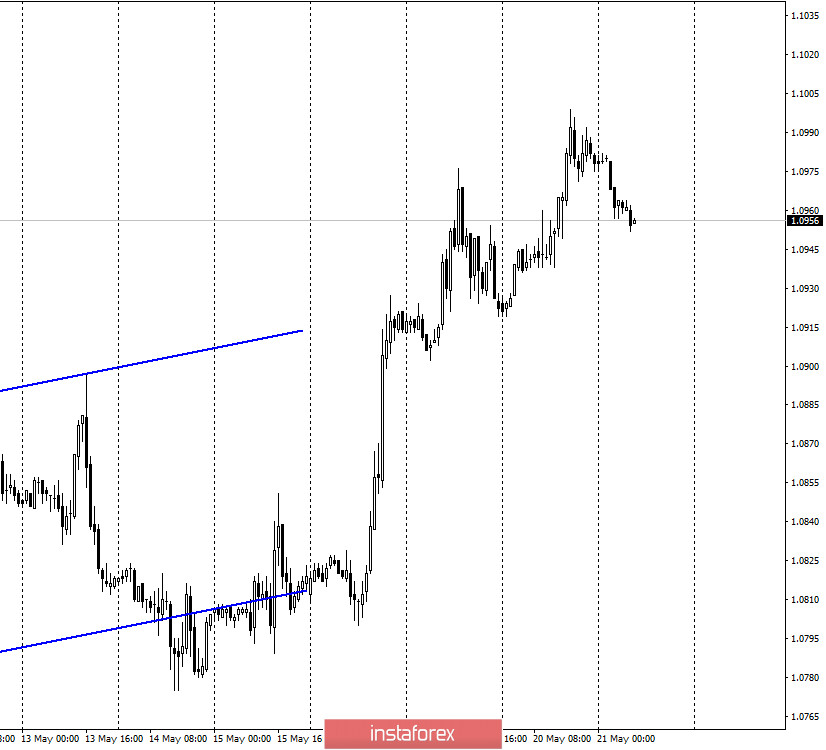

EUR/USD – 1H.

Hello, traders! On May 20, the euro/dollar pair resumed the growth on the hourly chart, but by the end of the day, a reversal was made in favor of the US currency and a weak process of falling quotes began. Thus, the overall mood of traders remains "bullish", but there are still signs of a possible reversal in favor of the US dollar on all charts. At a time when the central banks and the ministries of finance of the United States and the European Union are trying their best to save their sinking economies, US President Donald Trump continues to engage in his own PR and work on his political ratings. In the midst of the epidemic, Donald Trump decides to launch legal proceedings against the previous President, Barack Obama, and his main rival in future elections, Joe Biden. Trump accuses Obama of allegedly running a 2016 campaign to prevent him from coming to power. Joe Biden "also knew everything". However, the US President did not provide any evidence, which immediately caused an influx of criticism for trying to distract the attention of Americans from pressing problems and their own mistakes.

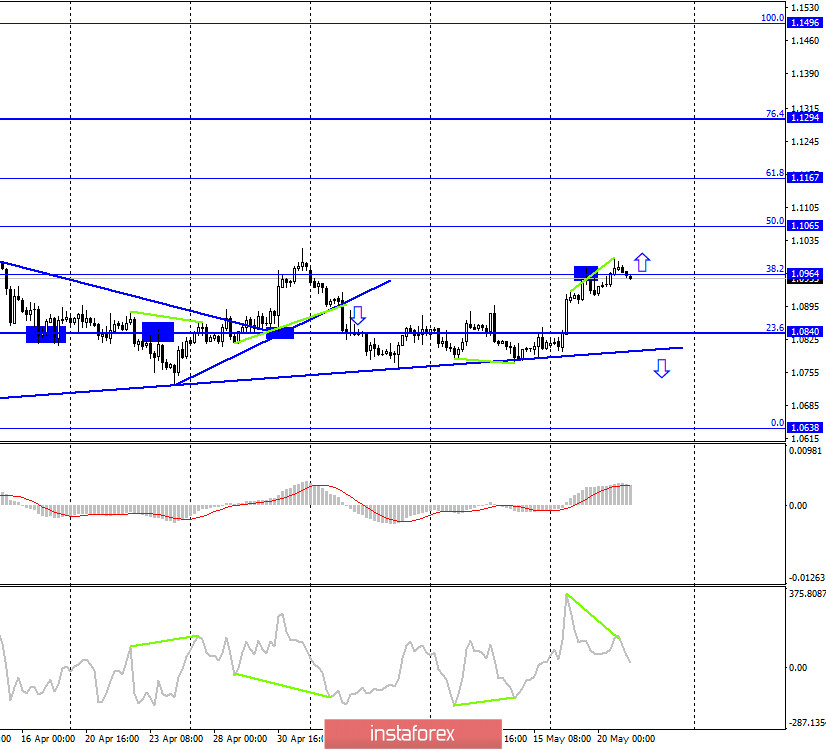

EUR/USD – 4H.

As seen on the 4-hour chart, the quotes of the euro/dollar pair performed a consolidation above the corrective level of 38.2% (1.0964), which allowed traders to expect further growth. However, the formation of a bearish divergence in the CCI indicator worked in favor of the US dollar and the beginning of a fall in the direction of the Fibo level of 23.6% (1.0840), as well as an upward trend line. Thus, the process of falling may continue today. Bull traders stopped almost at the previous high, which, in turn, almost coincides with the post-current high.

EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed an increase to the Fibo level of 38.2% (1.0965). The rejection of quotes from this level will work in favor of the US currency and the beginning of a fall in the direction of the corrective level of 23.6% (1.0840). And fixing above will increase the chances of continued growth.

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair continues to trade near the bottom line of the "narrowing triangle". The rebound of quotes from this line still allows us to expect some growth in the long term in the direction of the level of 1.1600 (the upper line of the "triangle"). Closing the pair under the "triangle" will work in favor of the US currency and a new, possibly long fall.

Overview of fundamentals:

On May 20, the European Union released a report on inflation, which showed its noticeable decline from the already low 0.4% y/y to 0.3% y/y. The Fed's minutes, which became known late at night, mostly contained talking points about a long period of low rates, "until the economy starts to grow steadily".

News calendar for the United States and the European Union:

EU - index of business activity in the manufacturing sector (10:00 GMT).

EU - index of business activity in the service sector (10:00 GMT).

US - number of initial and repeated applications for unemployment benefits (14:30 GMT).

US - index of business activity in the manufacturing sector (15:45 GMT).

US - PMI for services (15:45 GMT).

US - Federal Reserve Board of Governors Chairman Jerome Powell will deliver a speech (20:30 GMT).

On May 21, Europe is scheduled to report on business activity for May, in America - a report on applications for unemployment benefits and a speech by the Fed Chairman.

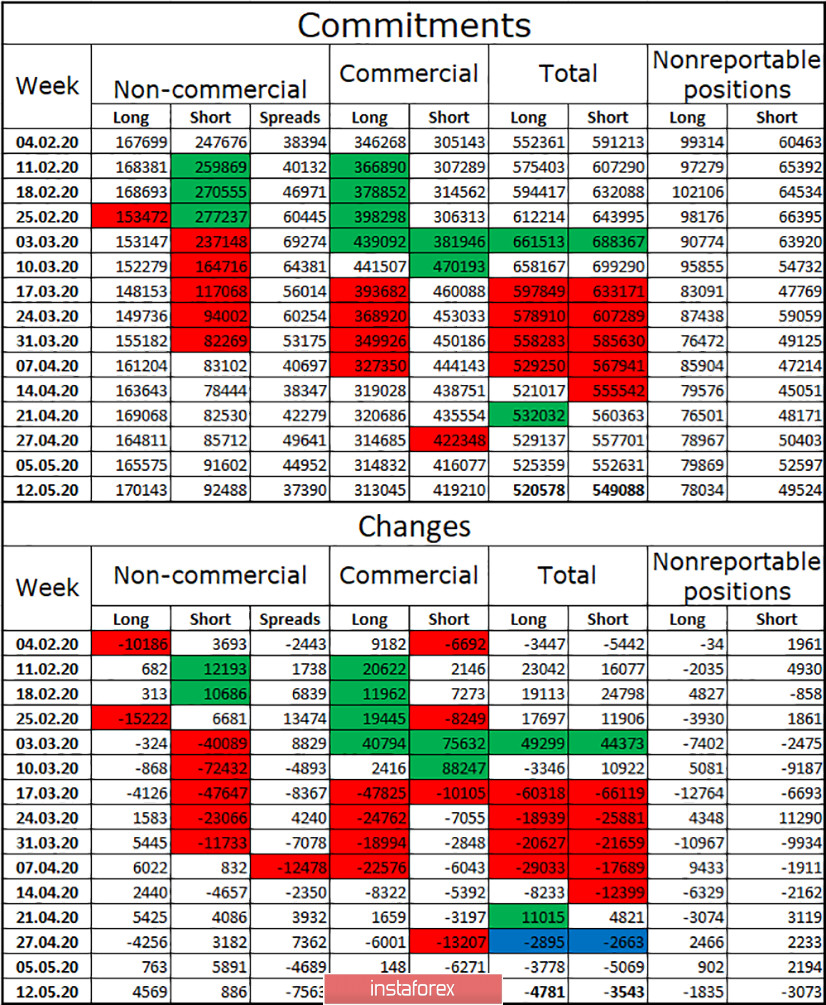

COT (Commitments of Traders) report:

The latest COT report again showed minimal changes. In the reporting week of May 12, the total number of contracts for purchase and sale among major market players decreased by 4,781 and 3,543, respectively. Thus, the activity of professional market participants is reduced. In principle, this is clearly visible on the steam schedule itself, especially on the 4-hour schedule. In recent weeks, the pair has been trading in a very narrow side corridor. At the same time, large traders (speculators) began to build up long positions, but the "Commercial" group, on the contrary, got rid of purchase contracts. Based on this, we can conclude that speculators are beginning to change their mood to "bullish" and this hypothesis is confirmed by trading this week, where the euro currency shows a tendency to grow. Thus, I would say that the COT report gives the euro a very good chance of growth in the coming weeks. But fixing the pair's quotes below the trend line will work in favor of the US currency.

Forecast for EUR/USD and recommendations for traders:

I suggest that new sales of the euro currency be made after the pair closes under the upward trend line on the 4-hour chart with the goal of 1.0638. I do not recommend buying the pair now since bearish divergence is in favor of a new fall.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.