Good day, dear traders!

Despite the easing of the quarantine, the UK government has decided to tighten the rules for entering the United Kingdom. Those who arrive will necessarily have to pass two weeks of self-isolation. This decision may hit the tourist business hard, but to exclude imported risks of COVID-19, this measure is quite justified, especially since many virologists expect a second wave of coronavirus. By this time, the UK is preparing to train special service dogs that will recognize infected COVID-19 by smell, and each virus has its special one.

Meanwhile, at the end of last week, British Prime Minister Boris Johnson came under pressure. Johnson was asked to resign his chief adviser, who allegedly violated the quarantine rules by going to his parents. This happened at the end of March and surfaced for some reason almost two months later. It is not important, as everywhere, there are political squabbles.

This week, no important and significant macroeconomic indicators will be received from the UK, so the fundamental background for the GBP/USD currency pair will be made up of statistics from the US. If we talk about today's day, there are no macroeconomic indicators that can affect the price dynamics of GBP/USD, and therefore we are moving to the technical picture, which we will start with a weekly timeframe.

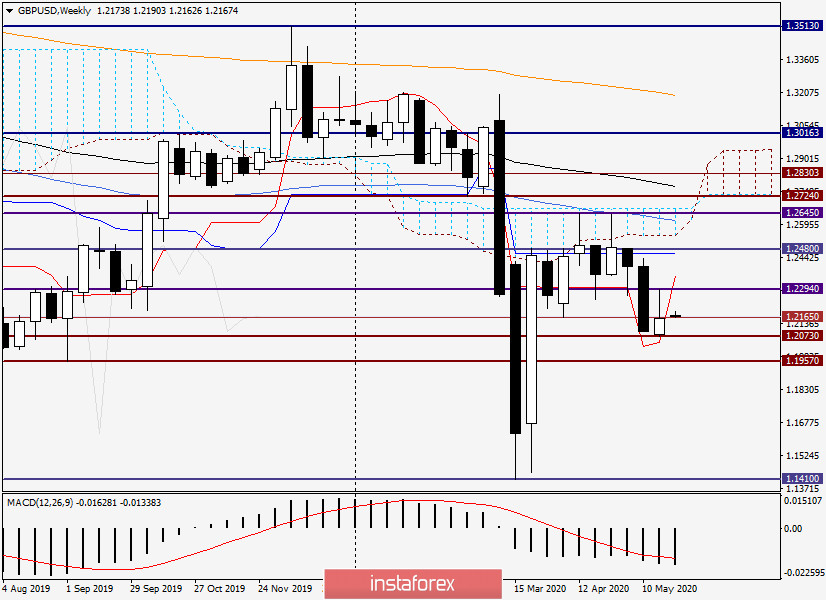

Weekly

Following the results of trading on May 18-22, the pound/dollar currency pair strengthened and ended the week at 1.2160, while the maximum values of the last five days were shown at 1.2294.

The long upper shadow of the last candle indicates significant problems for the pound bulls and their failure to further move the course in the north direction. In previous reviews of this currency pair, the price zone of 1.2300-1.2310 was repeatedly mentioned, which limited the growth of the instrument in the past week's trading.

Another notable and important moment from a technical point of view was the closing of the last week's trading under the level of 1.2165. Moreover, this is the second consecutive trading week that closes under this level of support, increasing the chances of its true breakdown. If we sum up on the weekly chart, then updating the previous highs, breaking through the resistance at 1.2294, and closing the session above the important level of 1.2300 will return the pair to the prospects of bullish mood and further strengthening. If the support is broken at 1.2073 (the lows of last week), I assume a bearish trend, the goals of which will be the psychological level of 1.1000 and support at 1.1957.

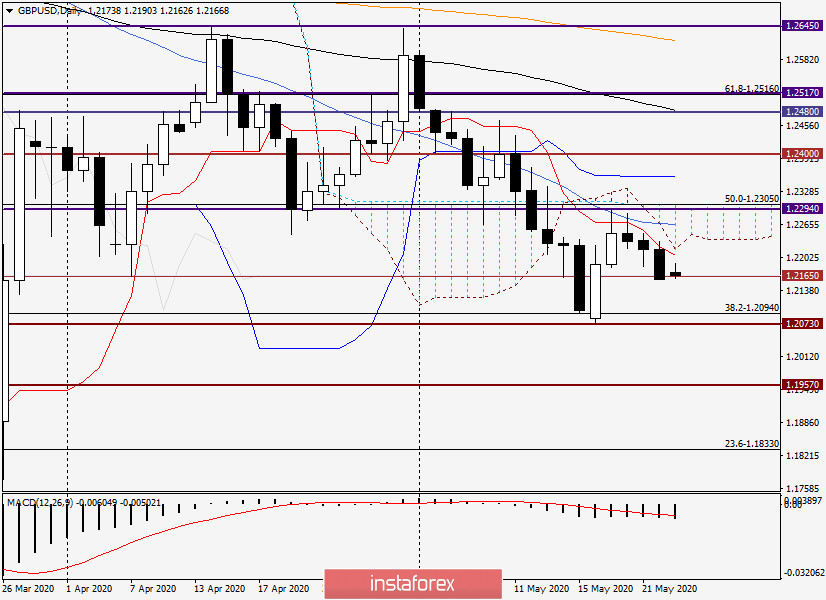

Daily

After the opening of today's trading, the US currency is moderately strengthening against the pound. Investors are still worried about a new round of tension between the US and China over the national security law in Hong Kong, which was criticized by US President Donald Trump. In this regard, the market is experiencing an increased demand for safe assets, one of which is the US dollar.

Technically, Friday's close below the support level of 1.2165 should find its confirmation in the course of trading in the next two days. If the breakout of this level turns out to be true, you can plan to open short positions on the British currency on the rollback to it. If the pair returns above 1.2165, the breakdown of this support will have to be considered false and prepare for attempts to further strengthen the quote. However, in the area of 1.2205-1.2217, the pound/dollar may meet strong resistance in the form of the Tenkan line and the lower border of the Ichimoku indicator cloud, after which a reversal to resume the downward dynamics is not excluded.

Conclusions and trading recommendations for GBP/USD:

According to the technical picture on the weekly and daily charts, as well as in the author's personal opinion, the descending scenario looks the most relevant. I recommend looking for points to sell the pair when it rises to the area of 1.2200-1.2217, as well as after a short-term growth to the levels of 1.2228 and 1.2263.

If the expected rollbacks do not occur, those who want to try to sell GBP/USD at the breakdown of support at 1.2160 or after the breakdown, on a rollback to this level. There are no fundamental reasons or technical signals for purchases at the moment.

Good luck!