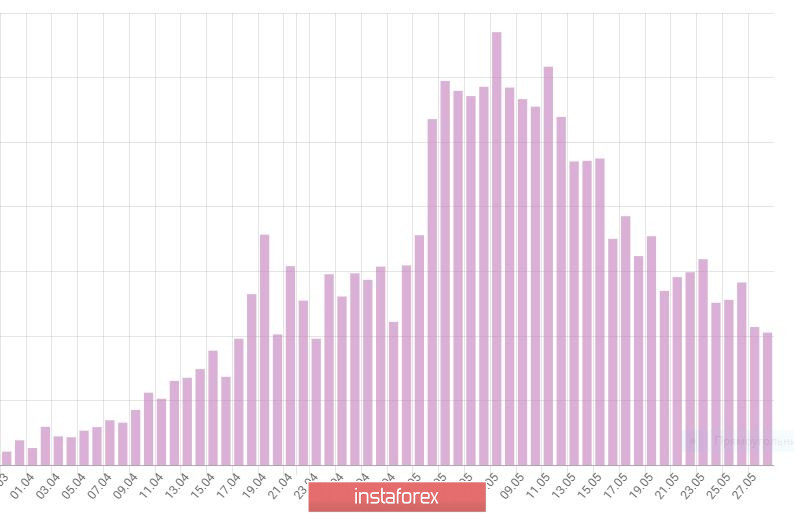

As we can see on the chart, in Moscow, the daily rise in the number of new cases slashed to 2,000 people a day. The number of cured people exceeds 3,000. That is why the city's authorities have deiced to soften the lockdown measures from June 1 st. It means that non-food stores and a part of the service sector will reopen. People will be able to go for a walk three days a week and to do sport until 9 a.m. Moreover, there is no need to request a pass to leave homes. The regime will be in force until June 14th.

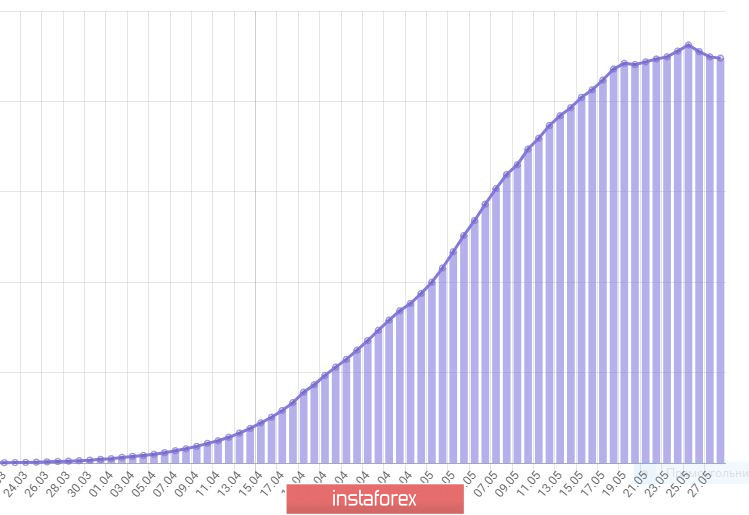

This is a chart of all active virus cases in Russia. We can see that the situation is stabilizing somehow. However, we should take into account that the chart also reflects a decline in Moscow. Thus, in other regions there still a rise in the number of active cases. That is why Russia's president asked Sobyanin to send doctors and resources to a number of regions, including Dagestan, Voronezh, and Pskov region.

In my opinion, restrictive measures in these regions were not enough to contain the virus spread. Moreover, these regions have weak healthcare infrastructure. At the same time, in Saint Petersburg, the number of active virus cases totals 10 thousand that is ten times less than in Moscow.

Let's take a look at the Russian ruble. The currency hit the record highs against the US dollar and the euro. The ruble is expected to held such positions until a new wave of weak oil prices and a slump in the US market. Nevertheless, it is inevitable.

However, it is a good idea to buy the euro and the US dollar for the rubles at the moment.

Dynamic of the EUR/USD pair depends on the US labor market data that is due for release on Thursday.

Buy positions can be opened from 1.0855, if the pair drops to 1.0870.