Tensions between China and the United States do not yet have a significant impact on global financial markets. Of course, investors are still keeping in mind the increasing confrontation, but all their attention is focused on the exit of countries from quarantine and waiting for the creation of a vaccine for the COVID-19 pandemic.

Despite the continued caution, financial markets are increasingly beginning to take into account precisely the economic prospects of countries affected by the pandemic in particular and the world economy as a whole. But observing everything that is happening, one can already say with some optimism that the worst is over. The recovery of economically developed countries will increase the demand for risky assets. The gradual opening of transport links between countries, including flights, will lead to a noticeable revival of world trade, which will be a favorable incentive for the normalization of the situation in the world.

As we previously thought, the summer period will be a turning point when the topic of coronavirus will first recede into the background, and then disappear altogether from the news feeds, giving way to reports on the global economic growth rate, as well as the confrontation between Washington and Beijing.

The US dollar continues to gradually lose ground to a basket of major currencies in the currency market. The main reason is the easing of tension around the situation with coronavirus and the growth of economic activity in economically developed countries. The ICE dollar index is below the key mark of 100 points this week and is already testing a local minimum of 98.40 points from March 30. Significant pressure on the index is exerted by the appreciation of the single European currency, which, finally, has received support in the wake of clear measures to help the European economy. The decision of France and Germany to create a fund to help countries affected by the pandemic was precisely the trigger that allowed the single currency to grow against the currencies of competitors, and paired with the dollar, it broke out of the range that it has been in since late March.

The change in market sentiment, the gradual withdrawal of the coronavirus topic, and so far, the absence of very serious problems in the confrontation between Washington and Beijing will continue to exert widespread pressure on the US dollar. The preservation of this scenario will lead to radical changes in market mood in June and will cause a global decline in the dollar.

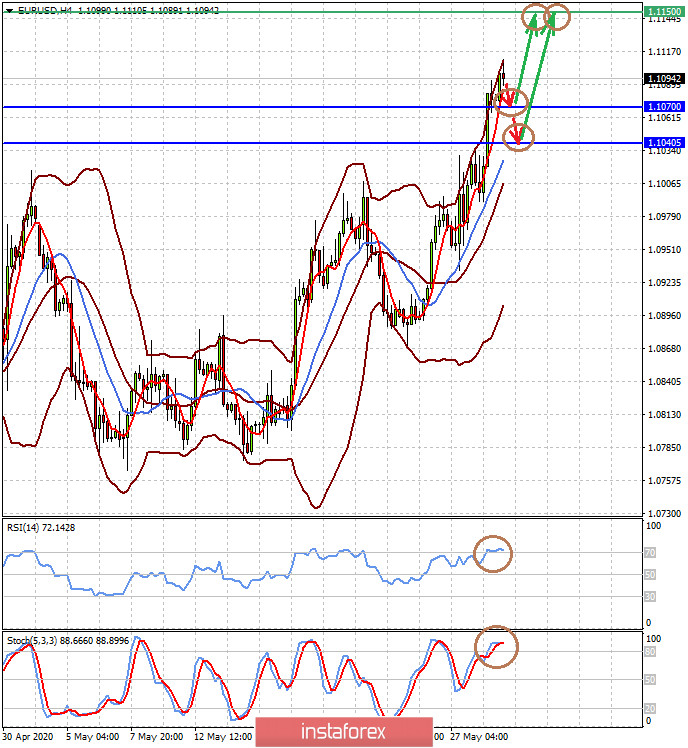

Forecast of the day:

EUR/USD is trading above a strong resistance level of 1.1070. The pair may adjust to the level of 1.1070. If it persists, growth should resume to 1.1150. At the same time, a decline below this level to 1.1040 after a small correction can also stimulate the pair's growth to 1.1150.