Good day, dear traders!

At yesterday's trading, the GBP/USD currency pair returned to strengthening, thus confirming earlier assumptions about the upward direction of the instrument. However, I will start this article with the topical topic of COVID-19, and also remind you about the time of the release of statistics from the US, which may affect the price dynamics of the pound/dollar pair.

As British Prime Minister Boris Johnson said at his briefing, next week, from Monday, Britons will be allowed to visit each other. However, gatherings will be allowed only in the open air and in the number of no more than six people. Let me remind you that previously the British could only meet in parks, but from next week they will be allowed to meet on their own territory: in courtyards, gardens and other places in the air near their homes. However, according to Johnson, it is too early to completely relax, since we cannot rule out a second wave of COVID-19. By the way, in some countries, it is already viewed, however, this is a topic for a separate article. And in the United States, the death rate from coronavirus has already exceeded 100,000 people, and the United States is confidently leading in this sad indicator. I would like to note that as of this morning, more than 362,000 people have died from the COVID-19 epidemic in the world, and the number of infected people has exceeded 5 million!

As for news from the United States, the usual soloist is Donald Trump, who signed a very controversial law on social networks. The President of the United States believes that social networks have "unchecked power" and may censor any content. There is one important point to note here. This decree was signed by Trump during a period of controversy regarding voting in the upcoming presidential election. The reason for signing such a decree was the decision of Twitter to check two articles of the US President for the authenticity of the facts contained in them. Naturally, this caused resentment of Trump and his signing of the law on social networks. The head of the US Department of Justice, William Barr, also said that his department will prepare a bill on amendments to the presidential decree.

If we return to the consideration of the GBP/USD currency pair and identify the fundamental events of Friday, all of them will begin to arrive from the US at 13:30 London time. More detailed information can be found by looking at today's economic calendar.

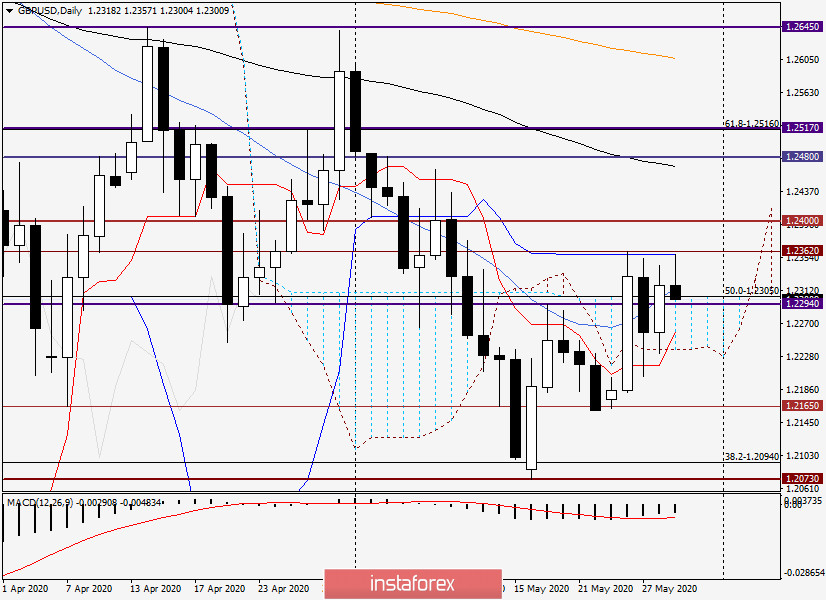

Daily

As already noted at the beginning of the article, following the results of yesterday's trading, the pair rose and ended Thursday's session by going up from the limits of the Ichimoku indicator cloud at 1.2317. However, this did not solve the problem of bulls for the pound, as the Kijun line continued to provide strong resistance and did not let the quote go higher, and the resistance of sellers at 1.2362 remains unbroken.

At the moment of writing, the GBP/USD pair is trading near 1.2310 with a slight decline. Today is an important and rather difficult day, which may indicate the further direction of the British currency. Once again, the market will close trading in May, the current week, as well as the Friday trading session.

In my personal opinion, the first priority for bulls on the pound will be to close trades above the Kijun line (blue), as well as the resistance level of sellers, which passes at 1.2362. We will talk about whether they succeeded or not on Monday, after the closing of the month, week, and today. At the moment of completion of the article, the pound/dollar is trading without pronounced dynamics.

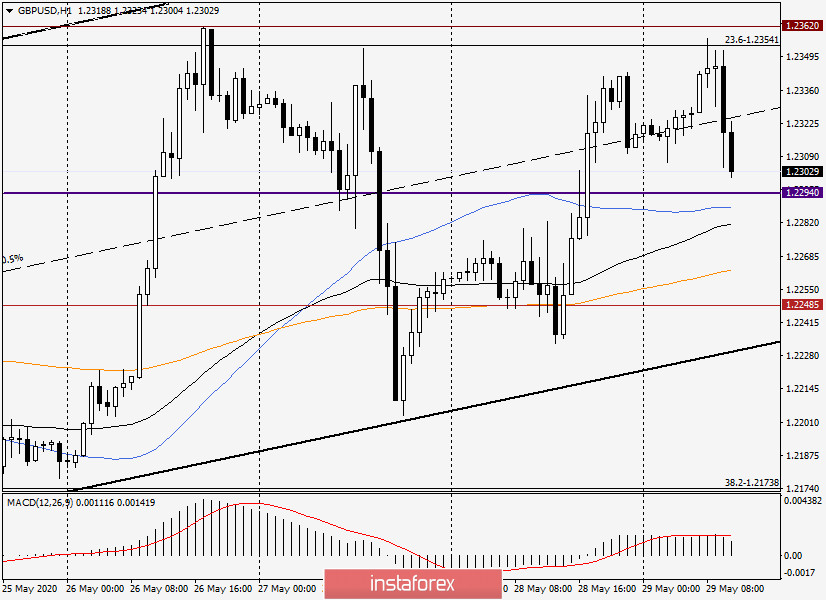

H1

After the appearance of two consecutive doji candles, the pair is currently declining and again went under the middle line of the ascending channel, which can not yet provide significant support. However, it is too early to consider the consolidation under the middle line to have taken place.

It is risky and aggressive to recommend buying the pair right now, from the current prices near 1.2317. Another option for opening long positions on the pound will be to fix it above the middle channel line, after which you can plan purchases with goals near 1.2350-1.2360 on the pullback to it.

I recommend considering purchases at more attractive prices after a short-term decline in the area of 1.2290-1.2265. In this case, it is better to set the goal a little lower, near 1.2325/30. It is better to refrain from selling in the current situation. On Monday, we will analyze the results of the closing of the month and week in more detail, and also try to develop a trading plan for GBP/USD.

Good luck with the completion of weekly trading!