Ethereum was trading at 4,392.14 level at the moment of writing, below today's high of 4,491.99. ETH/USD registered a 29.45% growth from 3,470.02 Saturday's low to 4,491.99 today's high. The crypto erased some of its losses signaling that the downside is limited and that the price could come back towards the 4,842.65 all-time high.

In the short term, a temporary correction was expected. The price action signaled that the downwards movement is over, so we could search for new long opportunities. In the last 24 hours, ETH/USD is up by 0.39% but it's still down by 3.29% in the last 7 days.

ETH/USD Under Critical Resistance!

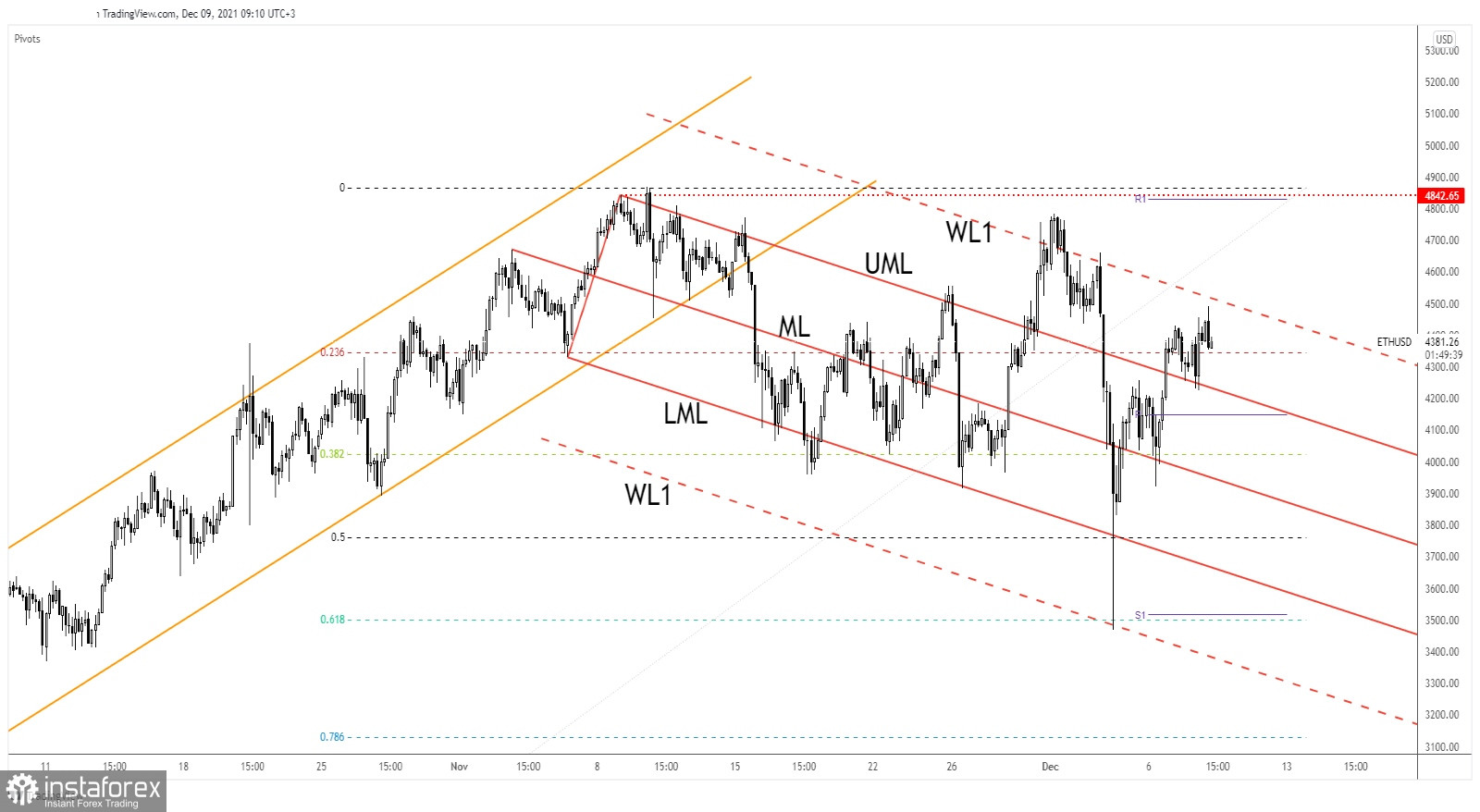

As you can see on the H4 chart, Ethereum registered a false breakdown with great separation below the 50% and 61.8% retracement levels, under the lower median line (LML), and through the warning line (WL1). Also, its failure to stabilize under the 3,958.67 signaled that the downside movement ended.

It has retested the 3,958.67 registering a new false breakdown with great separation belwo this obstacle and now is traded above teh 23.6% retarcement level. The warning line (WL1) of the descending pitchfork's stands as a dynamic resistance.

ETH/USD Outlook!

Stabilizing above the 23.6% (4,345.45) retracement level and making a valid breakout through the warning line (WL1) could announce potential upside continuation at least towards the 4,842.65 historical high.

In the short term, the pressure remains high, we cannot exclude a temporary decline. ETH/USD could come back to test and retest the upper median line (UML) trying to accumulate more bullish energy before jumping higher.