The latest COT report (Commitments of Traders). Weekly prospects for EUR/USD

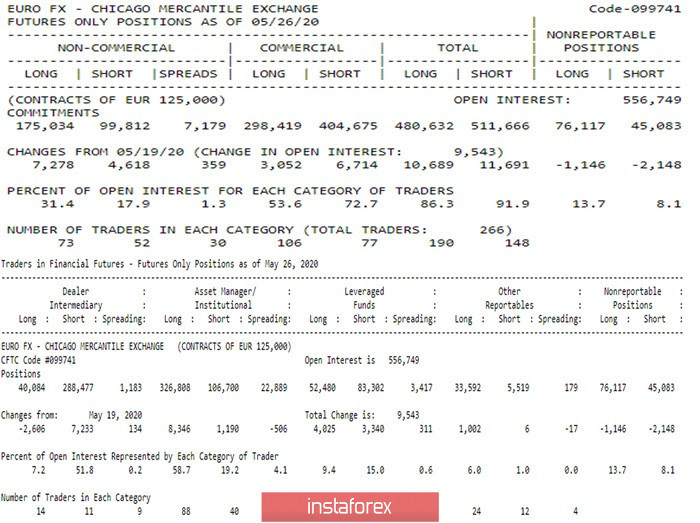

According to the results of the new COT report (Commitments of Traders dated 05/26/20.), It can be seen that interest in the euro remained at the same high level and even slightly increased (556.749 against 547.206-266 against 263). All accountable market participants increased their positions, but at the same time maintained the status quo, leaving approximate equality in general areas (long 86.3% - short 91.9%). Major players responsible for maintaining the current trend preference continue to support players to increase. At the time of reporting, they had long contracts at 175.034 (31.4%), and short ones at 99.812 (17.9%). This is confirmed by an in-depth financial report, where key groups of large players also prefer the bullish direction, having a good advantage over bears. Nevertheless, one cannot fail to notice that the preponderance of forces is not so significant, and the largest group, associated with the real sector of the economy (Commercials), continues to actively build up its short positions (6,714 against 3,052) and has more bearish interest (404,675 against 298,419).

Main conclusion

Rising players retain the advantage of big money, but even if the daily trend in the near future continues to uphold bullish preferences, it most likely will not do without deep bearish corrections.

Last week was quite indicative. Support for bulls by large players allowed them not only to develop an advantage on the daily chart, but also optimistically close last week and the month of May. The trend is set, and it is likely to be developed. The Ichimoku indicator marked the birth of a new bullish cloud on the daily chart. Players to increase their moods in the near future will seek to form a target for a breakout of the current cloud, above which they are now (1.1066). Furthermore, their task will be to eliminate the weekly dead cross (1.1167) and testing the upper border of the weekly cloud (1.1225). In this case, an upward correction relative to the current bearish trend will develop on the monthly chart. Downward players can prove themselves by restraining the fast breakout of the daily cloud and achieve the next corrective decline, the reference points of which will be the levels reached 1.0935-65 (weekly Tenkan + Fibo Kijun + daily cross) and 1.0878 (lower border of the daily cloud + day Fibo Kijun). With a decrease below, a change in the current balance of forces may be outlined and a new assessment of the situation will be required.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)