Trump's statements on Friday did not shake the markets, as many expected more serious decisions regarding China. Nevertheless, the relations between the two countries continue to deteriorate, which will certainly lead to the weakening of risky assets, especially if the parties fail to compromise in the near future. So far, neither China nor the US have exchanged courtesies.

On Friday, Donald Trump accused China of not keeping its word regarding the autonomy of Hong Kong. According to him, the Chinese government continues to violate its promises, which is a tragedy. Trump also mentioned the refusal of Chinese authorities to report to the World Health Organization, claiming that Beijing has complete control over it, which led to the announcement of the US on its complete breakdown of relations with WHO. Such occurrences led the US with a number of measures against China, among which is the restriction of access of Chinese citizens posing a threat to security to the United States. A number of special privileges previously granted to Hong Kong will also be revoked. Many were disappointed, as they expected a more serious blow such as sanctions, etc. However, such decisions will not lead to anything good in the future,

Meanwhile, several important macroeconomic reports were published last Friday. One is the continued slowdown of consumer prices in the eurozone, which may gradually lead to deflationary risks. The decline is mainly due to the collapse of energy prices, which now has started to recover. Thus, according to official data, consumer prices in the eurozone rose by only 0.1% in May, compared to the same period last year. Inflation was much slower than its previous figures of 0.3% in April and 1.4% in January. Energy prices also have dropped by 12% in May, compared to the same period last year. Core inflation, which does not take energy prices into account, slowed to 0.9% in May, from 1.1% in January.

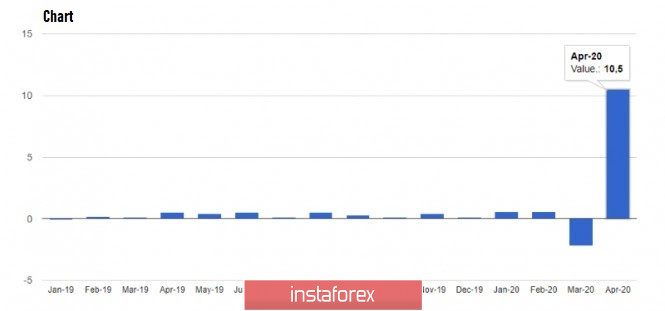

In the afternoon, data on consumer spending in the US was published, which revealed a sharp decline in the index due to quarantine measures and restrictions related to coronavirus. According to the report published by the Department of Commerce, expenditures fell immediately by 13.6% in April compared with the previous month, which is much worse than economists' forecasts. Personal incomes, on the contrary, rose, but the reason for this is the increase in social payments under the federal program to stimulate the economy. The report states that personal income went up by 10.5%.

Meanwhile, weak data on Chicago PMI did not affect the US dollar, as traders already expected such figures. According to the MNI Indicators, the Chicago business barometer fell from 35.4 points in April to 32.3 points in May, while economists had expected the index to be 40 points in May. Surveys also show that about 27% of companies predict that the coronavirus will continue to influence their plans for six months.

Another important report was the assessment of Americans on the US economy, which helped the US dollar partially win back Friday's losses against the euro and the pound. According to the University of Michigan, the final consumer sentiment index rose from 71.8 points to 72.3 points over the past month. Economists had expected the index to reach 74.0 points. The positivity in the index was greatly affected by the measures taken by authorities, such as the compensation payments and increase in unemployment benefits. Anyhow, the index of expectations fell to 65.9 points in May, while the index of current conditions rose to 82.3 points.

The slight increase of activity in the area of Kansas City Fed also did not greatly affect traders last Friday. According to the data published by Kansas City Fed, the composite index for the services sector rose from -58 points in April to -21 points in May.

Meanwhile, the speech of Fed Chairman Jerome Powell once again repeated the statements previously delivered over the past two weeks. According to Powell, although the Fed is independent, there are limits beyond which no one will cross. He emphasized the ability of the Fed to lend, but it cannot give money free of charge. The most difficult program, in his opinion, was to start implementing programs to support small businesses, which will start today, June 1.

As for inflation, Powell still does not see problems with it, as the current increase in the balance does not carry risks for inflation and financial stability in general. When asked about negative interest rates, he replied that such actions are not appropriate for the United States, as the US financial infrastructure as a whole is incompatible with it.

As for the technical picture of the EUR/USD pair, the bulls will most likely fail to breakout of the resistance level 1.1140, which was formed last Friday. The success of it though will resume the bullish mood in risky assets, which will lead to a test of new highs 1.1230 and 1.1340. However, if the demand for the pair begins to gradually decrease, a downward correction to the support level 1.1085 will occur, which will then lead to the test of 1.0990.