At the start of trading, the US dollar index declined to the area of the 97th figure, reflecting a decrease in demand for the US currency. Donald Trump was able to only provoke a short-term surge in anti-risk sentiment at the end of last week, so the dollar lost its positions that it won on Friday during the first hours of the new trading week.

Let me remind you that just a few hours before the end of trading, the head of the White House held a press conference at which he announced the list of reciprocal steps to the address of China and the Hong Kong administration. He said that Washington will abolish all trade privileges and privileges that Hong Kong enjoyed as autonomy within China. Secondly, the States will introduce targeted sanctions against those officials of the PRC and Hong Kong who are somehow involved in "undermining the autonomy of the region." Thirdly, Washington cancels visas for Chinese students "who may pose a threat to the national security of the country." According to US media, Washington is about to expel about three thousand Chinese students, graduate students and scientists – those who are somehow connected with universities that collaborate with the Chinese army. It's about students who either studied at such universities, or came for an exchange. As the fourth item on the response list, Trump indicated that the United States will "strengthen the security of the US financial markets by identifying and blocking unscrupulous Chinese companies."

Following Friday's press conference, the dollar index slowed its decline and even tried to demonstrate a correction. However, the dollar bulls did not have enough time or arguments for further growth. The fact is that Washington's retaliatory steps were quite expected – many of them were widely discussed in the press on the eve of their announcement. In addition, given Trump's response and intriguing announcement, the market was expecting some sensation - a strong, unexpected movement. Let me remind you, the head of the White House at the beginning of last week announced that "Washington is preparing something powerful," adding that the response will include not only economic sanctions.

In fact, the States limited themselves to the expected measures, without risking to use any extraordinary methods of influence. First of all, traders were worried about the fate of the trade deal, which was concluded last fall. However, Trump did not say a word about this agreement. This fact, in fact, extinguished the anti-risk sentiment in the currency market, and the dollar came under pressure again. Weak macroeconomic reports, which were published in the USA over the previous two weeks, entered the stage again. The last speech of the head of the Federal Reserve also left a double impression. Jerome Powell reiterated the possibility of introducing a negative rate. And although he once rejected this idea, his rhetoric somewhat softened - he said that "information about the effects of negative interest rates look contradictory." Earlier, he spoke more categorically on this issue, while he expressed a "mixed attitude" to a rate below zero during his last speech. We are talking about subtle changes in verbal formulations, but some currency strategists in their reports drew attention to this nuance.

A weakening dollar is felt throughout the market. One of the main beneficiaries of this situation was the Australian dollar, which, paired with the dollar, confidently entered the 67th figure, updating the four-month price maximum. The last time the pair was at such highs in pre-crisis times, when the price hovered in a wide-range of 0.67-0.70 for several months.

It is worth noting that the Australian currency is growing not only due to the weakness of the US currency. Traders buy the AUD/USD pair in anticipation of tomorrow's meeting of the Reserve Bank of Australia, about which experts have very good suspicions. Here, you can focus on the last speech of the head of the RBA, Philip Lowe, which took place just a few days ago, on May 28. He voiced out quite optimistic arguments. In particular, he said that the "coronavirus strike" on the economy was not as strong as the Central Bank expected. For example, unemployment rates were not so weak relative to the regulator's earlier forecasts, while recovery processes have already begun.

Such rhetoric suggests that the Reserve Bank of Australia is likely to maintain a wait-and-see attitude in the coming months and will not consider options for further easing monetary policy parameters. And at the end of this year (or at the beginning of next), it may even return to the issue of raising the rate, unless the world is trapped in the second wave of pandemic. If the Australian Central Bank confirms the above expectations, the AUD/USD pair will test the nearest resistance level of 0.6850 (the lower border of the Kumo cloud on the weekly chart).

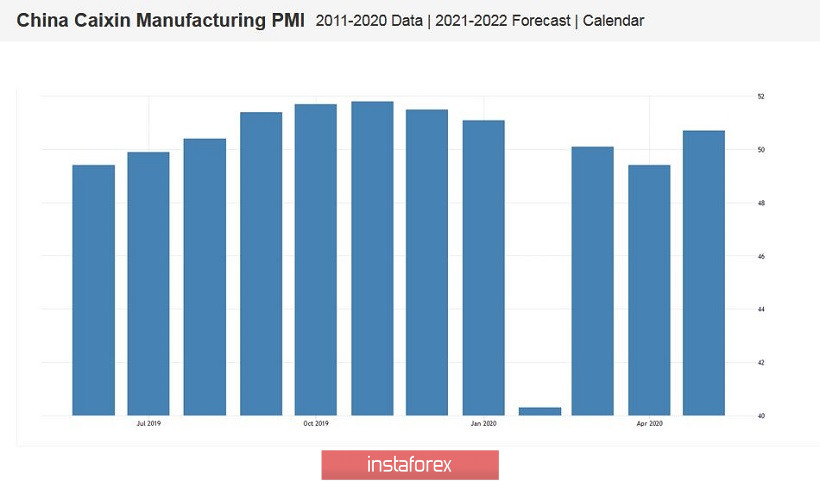

The pair was indirectly supported by the Chinese manufacturing index PMI Caixin published today, which was above the key 50-point mark (50.7) in May. China is the largest trading partner, so this fact allowed the Australian to turn on "turbo mode". It broke through more than 100 points during the Asian session.

Thus, the AUD/USD pair still retains the potential for further upward movement to the above level of 0.6850. If the Reserve Bank maintains a wait-and-see attitude and repeats the key points of Lowe's last speech, this target will be reached this week. Otherwise, the pair will be followed by a downward pullback, which must also be used to open long positions.