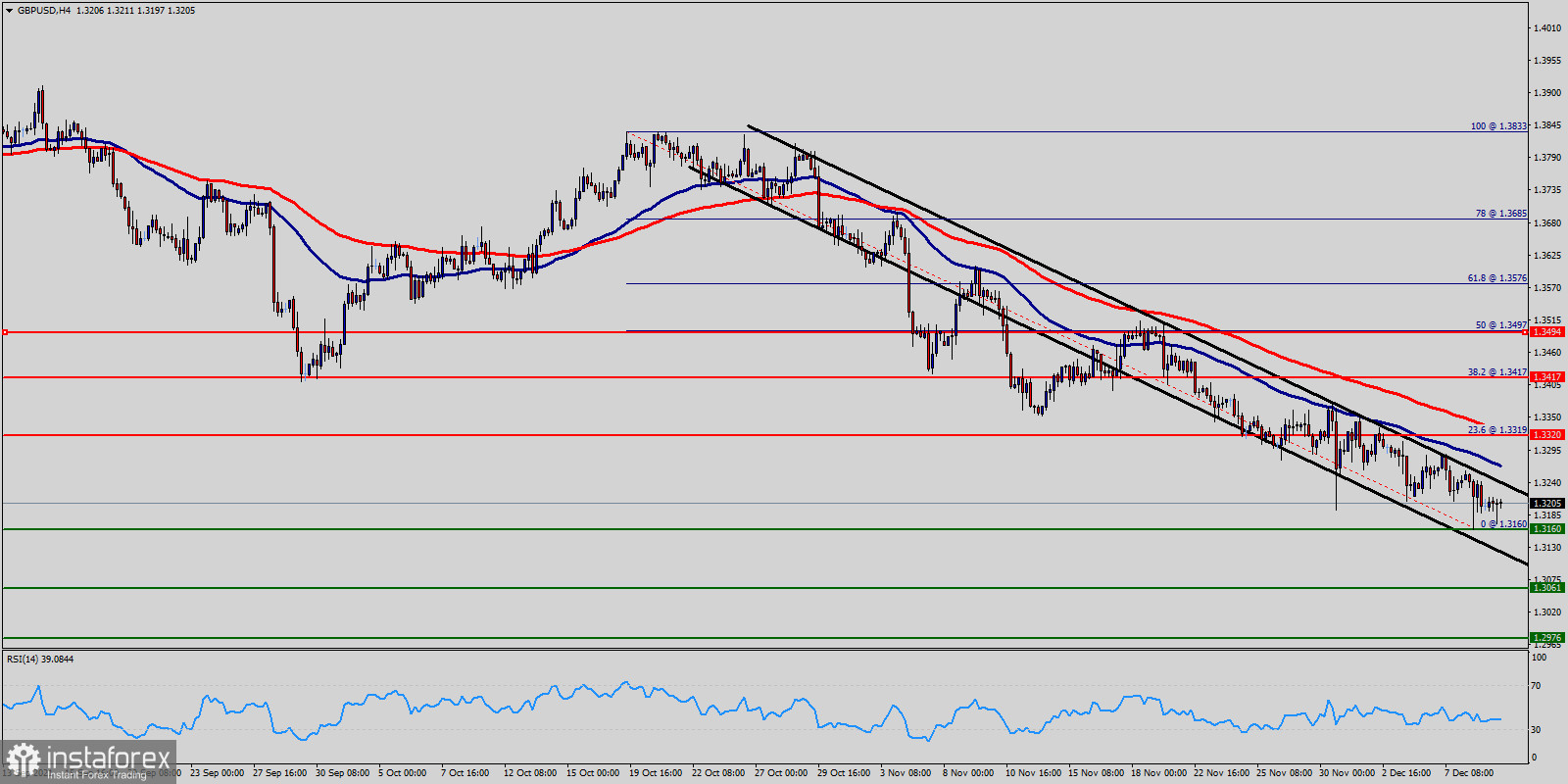

The GBP/USD pair continues to move downwards from the level of 1.3320. Yesterday, the pair dropped from the level of 1.3320 (this level of 1.3320 coincides with the R1, 23.6% of Fibonacci retracement levels - (the weekly pivot point)) to the bottom around 1.3160.

Today, the first resistance level is seen at 1.3320 followed by 1.3417, while daily support 1 is found at 1.3061. Also, the level of 1.3160 represents a weekly pivot point for that it is acting as major resistance/support this week.

Amid the previous events, the pair is still in a downtrend, because the GBP/USD pair is trading in a bearish trend from the new resistance line of 1.3160 towards the first support level at 1.3060 in order to test it.

If the pair succeeds to pass through the level of 1.3060, the market will indicate a bearish opportunity below the level of 1.3160 with thz target of 1.3060 and 1.2976 (last bearish wave).

However, if a breakout happens at the resistance level of 1.3320 , then this scenario may be invalidated.

Forecast :

If the pair fails to pass through the level of 1.3160, the market will indicate a bearish opportunity below the strong resistance level of 1.3061-1.2976.

In this regard, sell deals are recommended lower than the 1.3160 level with the first target at 1.3061.

It is possible that the pair will turn downwards continuing the development of the bearish trend to the level 1.2976.

On the other hand, stop loss has always been in consideration thus it will be useful to set it above the last double top at the level of 1.3417 (notice that the major resistance today has set at 1.3417).