Technical analysis recommendations for EUR/USD and GBP/USD on June 3

EUR / USD

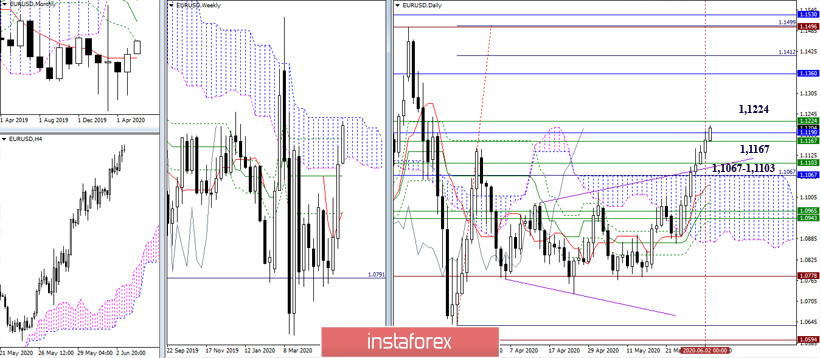

The euro continues to rise. At the moment, a cluster of resistances is being tested: 1.1167 (weekly Fibo Kijun) - 1.1190 (monthly Fibo Kijun) - 1.1224 (weekly Senkou Span B). Breaking through these levels and consolidating it securely above will allow us to consider new benchmarks. For example, such as deepening the monthly correction to the following resistance 1.1360 (Kijun) - 1.1530 (Fibo Kijun) and fulfilling the daily target for the breakdown of the daily cloud (1.1412-99). Today, significant support remains in the area of 1.1067 - 1.1103 (upper border of the daily cross + lower border of the weekly cloud and weekly Kijun + monthly Tenkan).

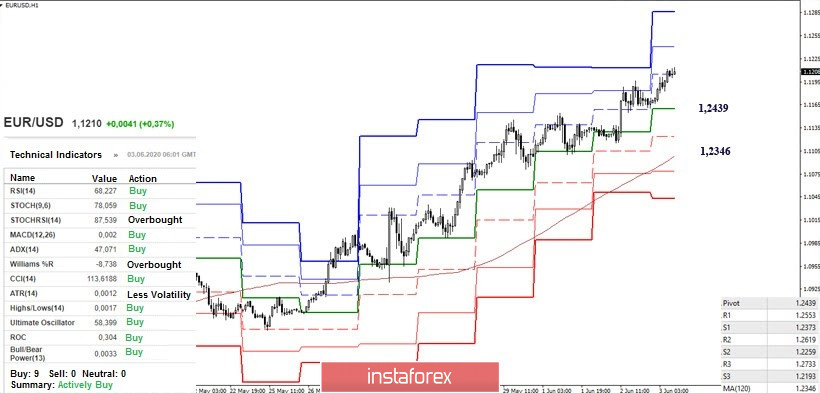

At the moment, the upward trend is in its active phase and is supported by all the analyzed technical instruments on H1. The reference points within the day and possible resistance are located today at 1.1205 (effective resistance R1) - 1.1241 (R2) - 1.1286 (R3). In this situation, the key lower support are located at 1.2439 (central Pivot level) and 1.2346 (weekly long-term trend).

GBP / USD

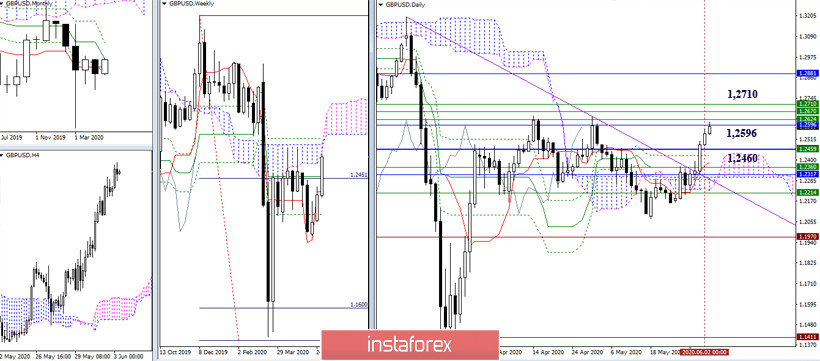

The players to increase use their past potential and continue to rise. The level of 1.2460 (weekly Tenkan + monthly Tenkan) which was broken before turned into support, and instead of a dead day cross, Ichimoku formed a golden cross, which gives preference to players to increase. At the moment, the pair has approached a fairly wide and strong resistance zone 1.2596 - 1.2710, breaking through it will help to cope not only with the accumulation of different levels of Ichimoku from the higher halves, but also go beyond the correctional declines, updating the previous maximum extremes.

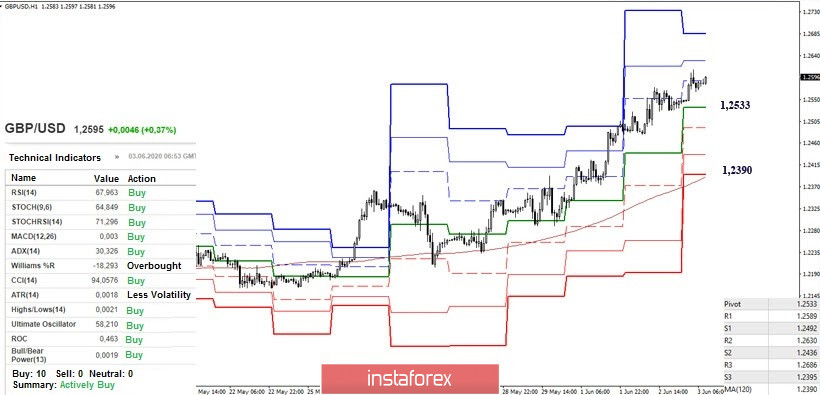

At the time of analysis, we observe a slight restriction at the first resistance of the classic Pivot levels (1.2589). The continuation of the trend will test the following intraday benchmarks 1.2630 (R2) and 1.2686 (R3). The development of a downward correction will return relevance to the support. The key ones will be 1.2533 (central Pivot level) and 1.2390 (weekly long-term trend), while the nearest support in this situation can be noted at 1.2492 (S1) - 1.2436 (S2).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)