GBP/USD

Analysis:

Since March 18, the chart of the British pound has changed the trend of the daily scale. The structure of the wave shows a zigzag (A-B-C). The last part started on May 18. By now, the price is approaching the lower limit of the preliminary target zone. Since yesterday, a pullback has been developing on the chart.

Forecast:

During the European trading session, the price decline is expected to continue until it is fully completed. A short-term puncture of the lower support border is not excluded. Then it is expected to reverse and re-ascend to the resistance area.

Potential reversal zones

Resistance:

- 1.2590/1.2620

Support:

- 1.2500/1.2470

Recommendations:

Selling the pound in the market today can be risky. It is better to reduce the lot in these transactions or refrain from trading. We recommend tracking purchase signals in the area of settlement support.

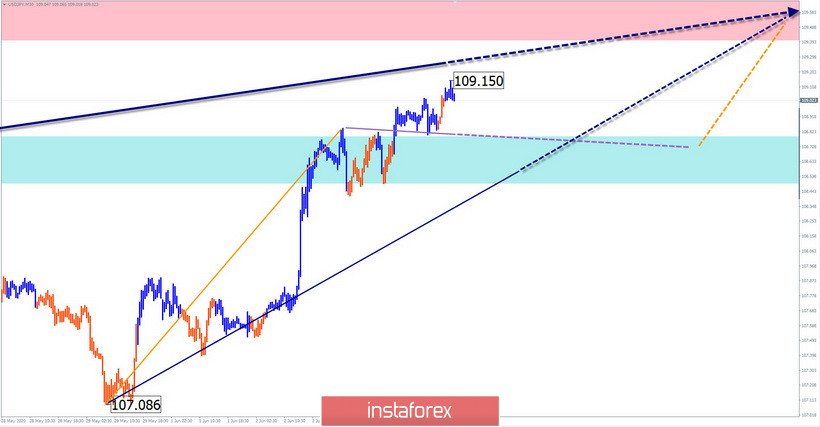

USD/JPY

Analysis:

In the dominant upward wave since March, the direction of the short-term trend is set by the bullish section from May 6. At the beginning of this week, the price pushed through strong resistance and moved close to the lower border of the preliminary target zone.

Forecast:

In the first half of the day, a short-term pullback is not excluded. A break below support is unlikely. The resumption of the bullish rate can be expected by the end of the day or tomorrow.

Potential reversal zones

Resistance:

- 109.40/109.70

Support:

- 108.80/108.50

Recommendations:

There are no conditions for selling the yen today. In the area of calculated support, it is recommended to track reversal signals for entering long positions.

USD/CHF

Analysis:

In the past 2 months, the direction of the price movement of the Swiss franc was set by a corrective wave in the form of a horizontal triangle. Its last section from May 7 is nearing its logical conclusion.

Forecast:

Today, the general downward mood of the price movement is expected. In the first half of the day, a short-term rise to the resistance zone is possible. The active phase of the decline can be expected in the US session.

Potential reversal zones

Resistance:

- 0.9640/0.9670

Support:

- 0.9570/0.9540

Recommendations:

Purchases on the pair's market may be risky and are not recommended. Within the framework of intraday, sales are possible today. It is better to reduce the lot.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of arrows shows the formed structure, and the dotted ones show the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!