Yesterday, the market was incredibly obedient and behaved strictly in accordance with published macroeconomic data. Such strange behaviour is mainly associated with the gradual weakening of protests in the United States. Nevertheless, it is too early to say that riots and demonstrations have completely stopped. The number of night riots has been decreasing in many US cities thanks to the introduction of a curfew. Meanwhile, it is still too early to expect protests and demonstrations to stop, since at night they turn into riots, marauding acts, and clashes with the police. At the same time, despite the reduction of hotbeds of tension, the situation remains extremely alarming and ambiguous. Thus, the Pentagon stands against Donald Trump's intention of using the army to restore order. It is quite reasonable, since this is the responsibility of the police and the national guard. The army has other things to do. Bringing the army to city streets can lead to undesirable consequences and a lot of blood. After all, the army has a rather specific experience, as the tasks it faces require quite interesting methods. These same methods may surprise everyone. Nevertheless, Donald Trump continues threatening protesters. This time, the President of the United States demanded from the New York authorities to deal with protesters immediately, otherwise he would do it himself. At the same time, as if wanting to insult Donald Trump, the Los Angeles authorities announced their decision to cut police funding even though the protests in the city continue. Overall, there's never a dull moment in the US. In any case, the level of violence in cities is reducing, which, of course, is an extremely positive factor.

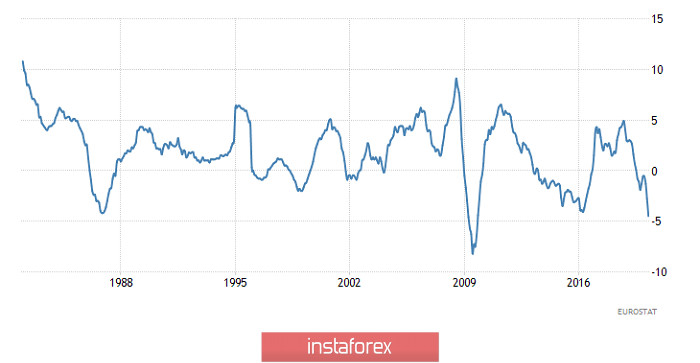

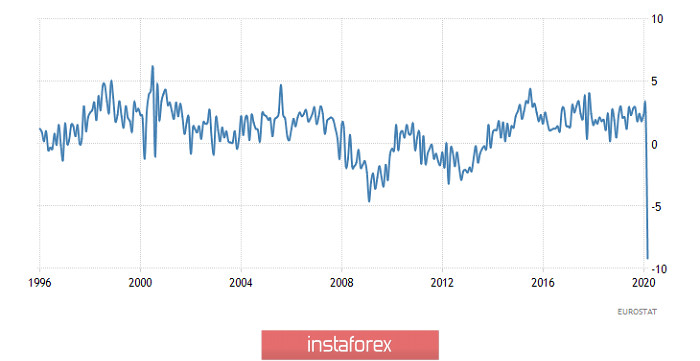

Now it's time to talk about statistics. Thus, the euro has been growing, like all previous days. This coincided with the publication of final data on business activity. The service Purchasing Managers' Index increased to 30.5 from 12.0, which allowed the composite index to rise to 31.9 from 13.6. Positive business activity results have given rise to a new optimism in European business. In addition, restrictive measures are gradually being removed and the business is getting back to normal. Even though consumer activity is expected to be significantly lower than before the epidemic, it is still much better than closed shops, restaurants, and entertainment centers. However, approximately an hour later, the euro began to decline slightly under the influence of completely different statistics. In particular, the unemployment rate rose to 7.3% from 7.1%, which turned out to be an unexpected surprise. Economists predicted that unemployment would grow to 8.1%. Apart from that, the producer price plunged to -4.5% from -2.8%, which, by the way, is significantly worse than forecasts. Thus, the risks of the euro slipping into deflation only increase. In addition, there have been countless publications that the European Central Bank has no choice but to expand stimulus measures. Mostly, we are talking about the expansion of the quantitative easing program.

Producer prices in Europe:

The pound remained steady yesterday and no serious activity was observed. However, business activity indices rose in the UK. Thus, business activity in the service sector grew to 29.0 from 13.4. The composite index advanced to 30.0 from 13.8. The reasons for the growth are exactly the same as in the euro area. However, these reasons are now universal for the whole world. The pound is relatively stable due to some uncertainty regarding negotiations between London and Brussels on the trading agreement. The parties still cannot reach a compromise. Moreover, representatives of the European Union are constantly repeating one and the same thing - London wants too much. The next round of negotiations will take place today. Moreover, Boris Johnson is going to take part in negotiations in the middle of June. Thus, London is still busy developing its strategy. Indeed, the position of Brussels has not changed for several years.

Composite business activity index in the UK:

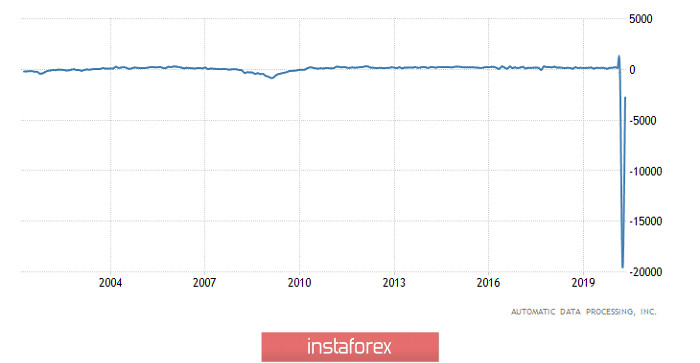

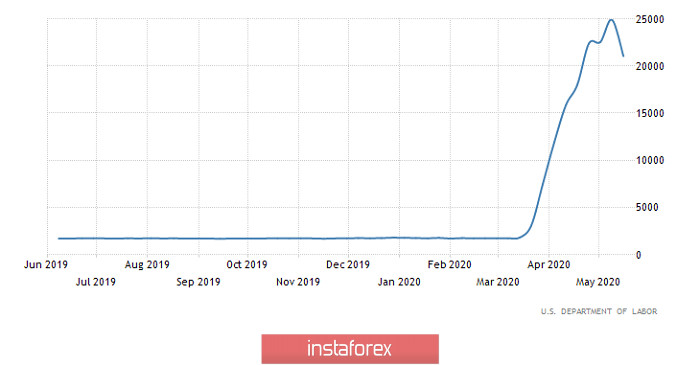

The publication of statistics in the United States was marked by a clear weakening of the greenback. However, the data came out significantly better than forecast. As in Europe, the US business is getting back to normal, which has been reflected in business activity indices. Thus, the Purchasing Managers' Index in the service sector grew to 37.5 from 26.7. The composite index rose to 37.0 from 27.0. Interestingly, the ADP jobs report showed that employment in the US decreased by 2,760,000 compared to predicted 9,600,000. Moreover, the previous data were revised for the better. Thus, in April, employment plummeted by 19,557,000 instead of 20,236,000 indicating that the catastrophe might not be as terrible as it seemed and that the US economy had a chance to recover quickly from this crisis. In addition, factory orders dropped by 13.0%, which was slightly better than the expected 16.0%. Nonetheless, this is still an extremely deep economic downturn. The only thing is that it may turn out to be not so deep and not so prolonged as anticipated.

ADP Employment Change in the United States:

Both the pound and the euro started to actively lose their positions in the morning amid the upcoming meeting of the Board of the European Central Bank. In addition, the revision of the situation in the US labor market has put both currencies under additional pressure. Thus, the pound today is expected to ignore its own macroeconomic statistics even though the rate of decline in car sales should slow down to -83.0% from -97.3% and the business activity in the construction sector should grow to 32.0 from 8.2.

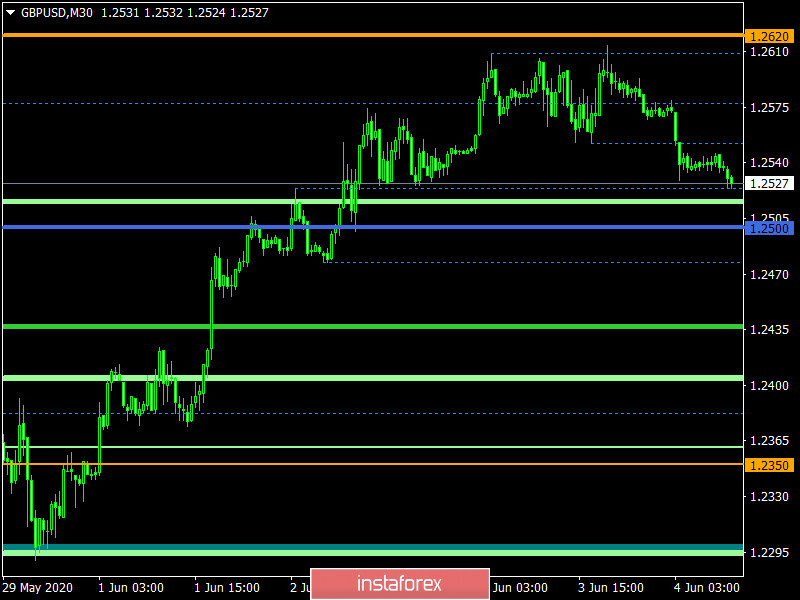

Construction business activity index in the UK:

Clearly, the main event of today is the meeting of the Board of the European Central Bank. Before that, the data on retail sales will be published, which can reflect the exact situation the European regulator is in. The fact is that the decline in retail sales should accelerate from -9.2% to -24.0%. It turns out that sales are drastically declining. At the same time, the risk of Europe slipping into deflation is increasing. In such a situation, there is practically nothing else to do but to fill the economy with money in order to somehow revive it. And that's what everyone expects from Christine Lagarde. No one doubts that the European Central Bank will expand its quantitative easing program. The only question is the scale. There is practically no doubt that this may lead to depreciation of the euro, which will drag the pound along with it.

Retail Sales in Europe:

The press conference of Christine Lagardewill begin at the same time with the publication of jobless claims in the United States. Therefore, only a few will pay attention to the US statistics. Nevertheless, the situation in the labor market, although terrible, is still not as scary as expected. In particular, the initial applications are expected to reach 1,790,000 against 2,123,000 last week. The number of repeated applications should decrease to 20,690,000. However, these are still huge numbers. In addition, the assertion that the situation is not so terrible and that the labor market will recover quite quickly is quite controversial. The fact is that if people lose their jobs en masse, then sooner or later there will simply be no one to dismiss. Thus, according to the elementary laws of mathematics, the number of applications for benefits should be reduced. Moreover, everyone who needs the unemployment benefit has already applied. It regards both the first time and the repeated jobless claims.

Repeated jobless claims in the United States:

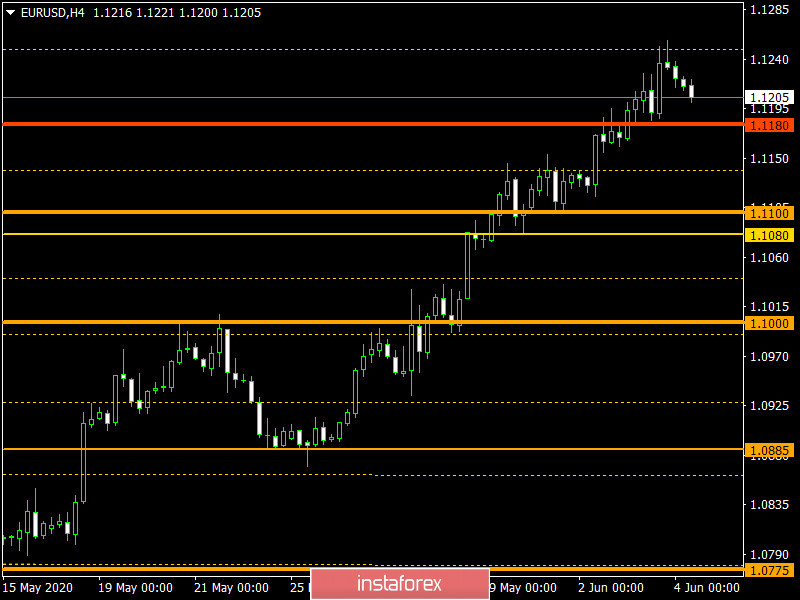

During the intensive upward movement, the euro-dollar pair reached a variable value of 1.1250, where it slowed down and entered a pullback stage. It can be assumed that, against the background, the pullback may change into a correction, thereby returning the quotes to the 1.1100/1.1150 area.

The GBP/USD pair has slowed down within the important price level of 1.2620, where signs of a technical rebound are recorded relative to the current fluctuation. We can assume the preservation of a given movement in the direction of 1.2500. A more significant decrease can be expected in case of price fixing lower than 1.2470. Otherwise, we may encounter a closed fluctuation between the values of 1.2500/1.2620.