To open long positions on GBPUSD, you need:

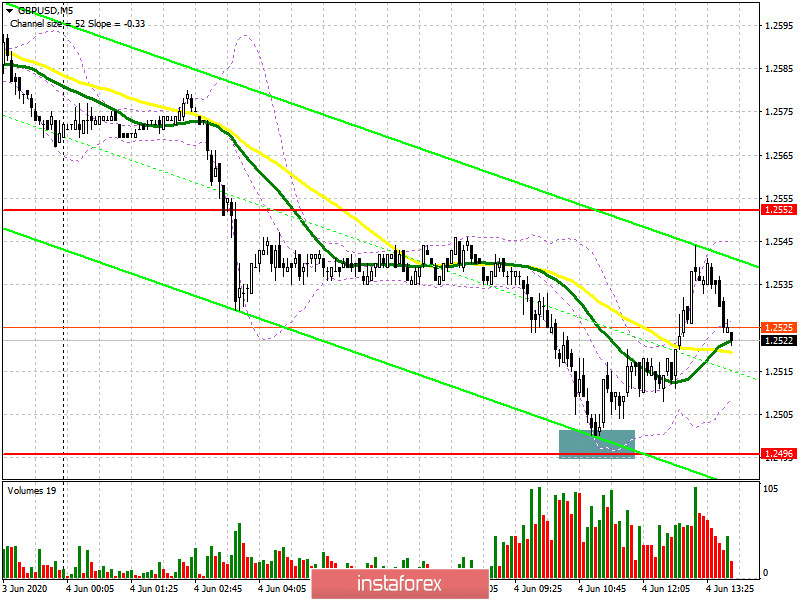

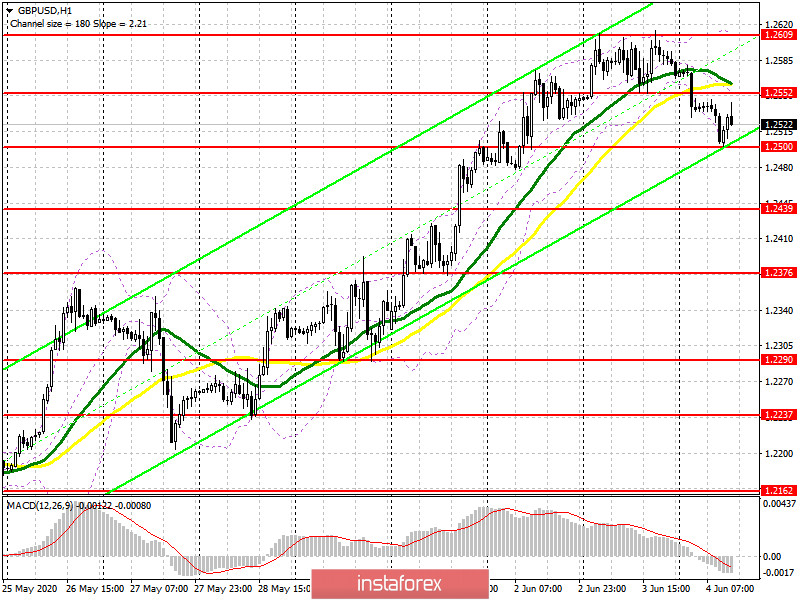

In the first half of the day, I paid attention to the support level of 1.2496 and recommended opening long positions from it if a false breakout is formed. If you look at the 5-minute chart, you can see how the pair fell just short of the indicated level, which did not allow us to form a more accurate signal to buy the pound. Those who entered long positions now have to hope for a breakout and consolidation above the resistance of 1.2552, which plays a very important role in the current technical picture. Only in this scenario can we expect the pair to continue strengthening. It is important to note that GBP/USD has fallen below the moving averages, which does not add optimism to market participants. Fixing at 1.2555 will be a good signal to buy with a view to re-growth to the resistance of 1.2609 and its breakdown, which will lead the pound to new highs in the area of 1.2647 and 1.2686, where I recommend fixing the profits. If the pressure on GBP/USD returns in the second half of the day, it is best to postpone purchases until the next false breakout is formed in the support area of 1.2500 or open long positions immediately for a rebound from the minimum of 1.2439 in the calculation of correction of 30-35 points within the day.

To open short positions on GBPUSD, you need:

For sellers of the pound, nothing has changed yet. They still need to achieve the formation of a false breakout in the resistance area of 1.25555 and a rebound from the moving averages, which will be an ideal signal to open short positions in the pair. However, while trading is below the level of 1.2555, the pressure on the pound will also remain, which may lead to a repeated decline to the support area of 1.2500, which could not be broken below the first time. The longer-term goal of the bears remains at least 1.2439, where I recommend fixing the profits. The test of this level may become a turning point in the current upward trend from May 25 this year. If the bulls manage to take the market under their control, it is best to consider short positions only after a false breakout in the resistance area of 1.2609 or slightly higher: from the highs of 1.2647 and 1.2686. However, a test of these levels will lead to no more than a downward correction of 25-30 points within the day.

Signals of indicators:

Moving averages

Trading is conducted below the 30 and 50 daily averages, which now act as a resistance and can limit the upward potential of the pair.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

A break in the lower border of the indicator around 1.2500 will increase the pressure on the pound. Growth may be limited by the upper level of the indicator around 1.2605.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20