EUR/USD 1H

The EUR/USD pair continued its upward movement on the hourly timeframe on June 4, when everything seemed to be in favor of starting a downward correction. However, as we have already mentioned in fundamental articles, a rather strong and recoilless trend has now taken shape and it is completely inexpedient to guess the point of its possible completion. Thus, over the past day, the euro's quotes overcame the resistance level of 1.1312, and also went beyond the rising channel, which indicates an even greater strengthening of the trend. The last target of buyers for this week is the resistance level of 1.1478, and the beginning of the correction can still be identified by consolidating the price below the rising channel and/or the Kijun-sen line. Up to this point, the bulls will continue to hold the market in their hands.

EUR/USD 15M

The picture does not change at all on the 15-minute timeframe. The same two linear regression channels that are directed upwards are at your disposal, which indicate the absence of any signs of starting a correctional movement.

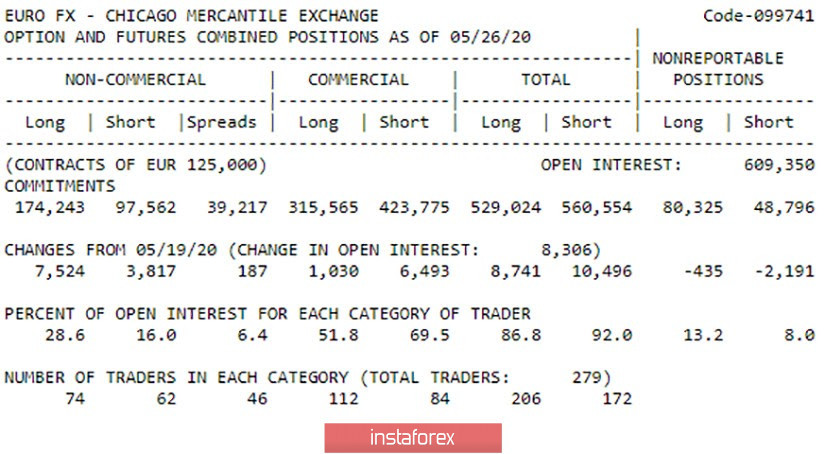

COT Report

The latest COT report showed that professional traders unexpectedly started buying the euro during the reporting week. Suddenly - because, from our point of view, the fundamental background was not in favor of the euro. However, throughout the current week, the fundamental background was already in favor of the euro due to mass rallies and protests in the United States. Large traders found reason to open new 7524 purchase contracts last week. For the reporting week, only 3817 sales contracts were opened, if we take into account the most important group of traders, the professional players who work in the market with the goal of making a profit due to exchange rate differences. This information is already enough to understand that the mood of large traders for the reporting week has changed to bullish. The entire current week also remains with buyers, so in the new COT report we can see an even greater increase in purchase contracts among professional traders.

The general fundamental background for the EUR/USD pair remains neutral if we only take into account economic news. Yesterday, the results of the ECB meeting showed that the regulator expects serious deterioration in the economy compared to its own expectations in March. The PEPP program was immediately expanded to 600 billion euros and its terms were extended. As we have already mentioned, this does not mean that a total of 1.35 trillion euros will be enough to cope with the consequences of the pandemic and the crisis. In the same way, if not the fact that the total losses of the European economy in 2020 will amount to 8.7%, and not more. Thus, these figures were supposed to force traders to refuse buying the euro yesterday. However, either the macroeconomic background was again ignored, or traders considered that a +600 billion aid to the eurozone economy is good, however, the single currency has risen in price again. The United States also retains a negative background. Statistics from across the ocean continue to come weak and at times disastrous, which in principle is not surprising for times of crisis. Rallies and protests continue. The situation between China and the US continues to heat up. Thus, the main thing is that all this does not end in an explosion. Too many processes now can end completely unpredictably. Well, US President Donald Trump continues to lose support at this time, which significantly reduces his chances in November 2020.

Based on the foregoing, we have two trading ideas for June 5:

1) It is possible for quotes to grow further with the goal of the resistance level for the 4-hour chart at 1.1478. However, for this, the bulls just need to continue to stay within the rising channel and protect the level of 1.1312, which is left behind. Stop Loss levels can still be placed below the channel and gradually transferred to the top. Potential Take Profit in this case is 130 points.

2) The second option involves consolidating the EUR/USD pair under the ascending channel, which will allow sellers to finally join the game and begin to trade down. However, we recommend that you wait until the consolidation below the Kijun-sen line and only after that open sell positions with targets 1.1147 (March 27 high) and 1.1011 (Senkou Span B line). Overcoming each of the barriers will keep sales open. Potential Take Profit range from 60 to 190 points.