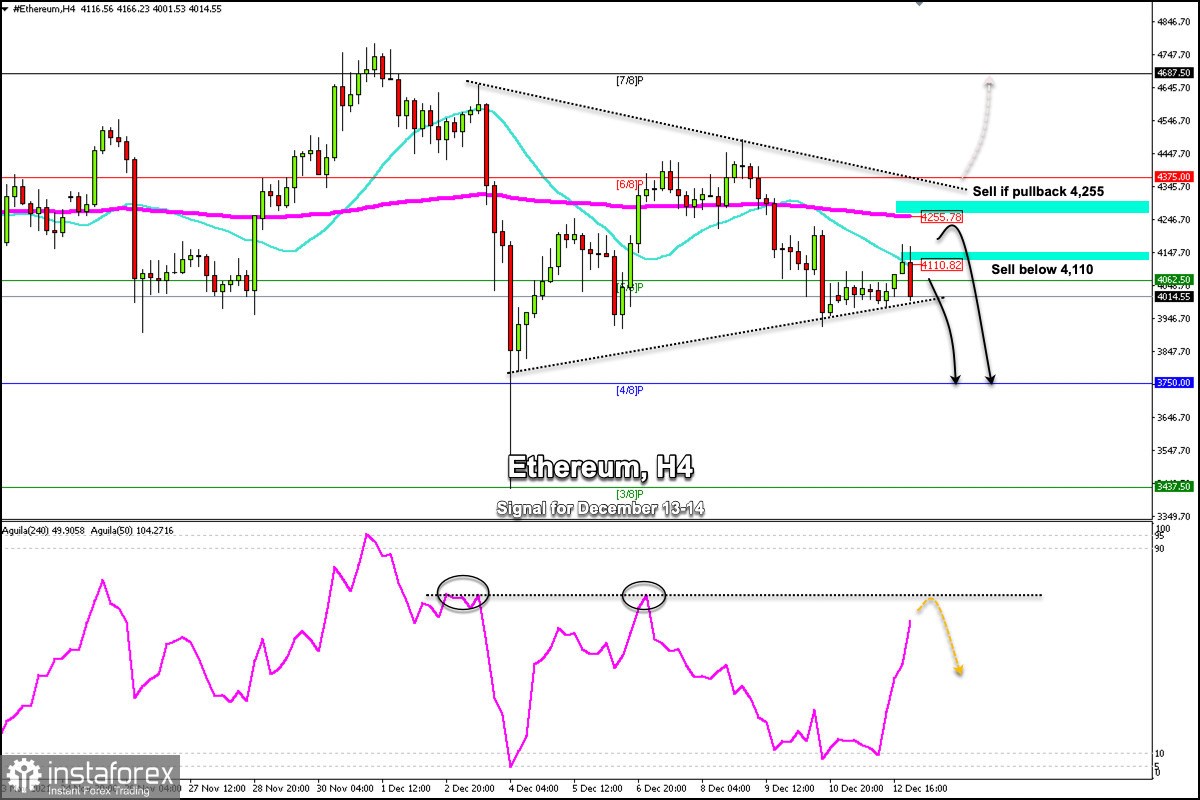

Ethereum (ETH) is trading below the 21 SMA and below the 200 EMA. As it is below these moving averages, the short-term outlook remains negative and with an immediate target at 4 / 8 moray around 3,750.

The 4-hour chart shows that the price rebounded from Friday's low of 3,922. Having faced strong resistance at the 21-period simple moving average, it is now retracing and could extend the weakness of ether towards 4/8 of Murray in the next few hours.

If bulls break above the 200 EMA located at 4,255, then the rally could reignite for a test at 4,687 (7/8). For this, there must be a confirmation above 6/8 of Murray (4,375) either with a strong break or a consolidation of the price.

On the contrary, if a pullback occurs towards the 200 EMA or towards the top of the downtrend channel and fails to consolidate above this level, then it will be an opportunity to sell ether as targets at the psychological level of 4,000 and up to 3,750.

However, the eagle indicator remains below the resistance line suggesting that the downward bias is likely to remain intact for the next few days.

Therefore, ETH sellers will push until it reaches the key support at 3,750, then a bearish breakout of a symmetrical triangle formed since early December could be confirmed.

Additionally, a decisive break below 3,750, could fall to 3/8 of a Murray located at 3,437 and if bearish force prevails to the psychological level of 3,000.

Support and Resistance Levels for December 13 - 14, 2021

Resistance (3) 4,375

Resistance (2) 4,276

Resistance (1) 4,173

----------------------------

Support (1) 3,903

Support (2) 3,858

Support (3) 3,750

***********************************************************

A trading tip for ETH on December 13 - 14, 2021

Sell below 4,110 (21 SMA) with take profit at 3,750 (4/8) and 3,437 (3/8), stop loss above 4,276.