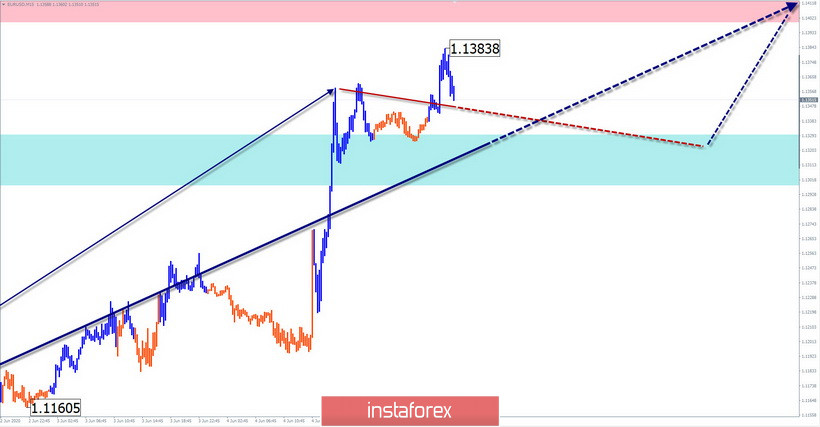

EUR/USD

Analysis:

A preliminary calculation of the upward movement of the pan-European currency that began in March allows us to wait for a rise to 118th price figures. The price is approaching the next intermediate resistance zone. Given that the final part of the wave (C) is forming, the stop is expected to be short-lived.

Forecast:

In the first half of today, there is a high probability of a short-term decline in the area of the support zone. The resumption of the upward trend can be expected in the US session or at the beginning of next week.

Potential reversal zones

Resistance:

- 1.1400/1.1430

Support:

- 1.1330/1.1300

Recommendations:

Sales of the euro today may be risky and not recommended. The best tactic is to refrain from trading until the rollback is completed with the search for buy signals in the area of settlement support.

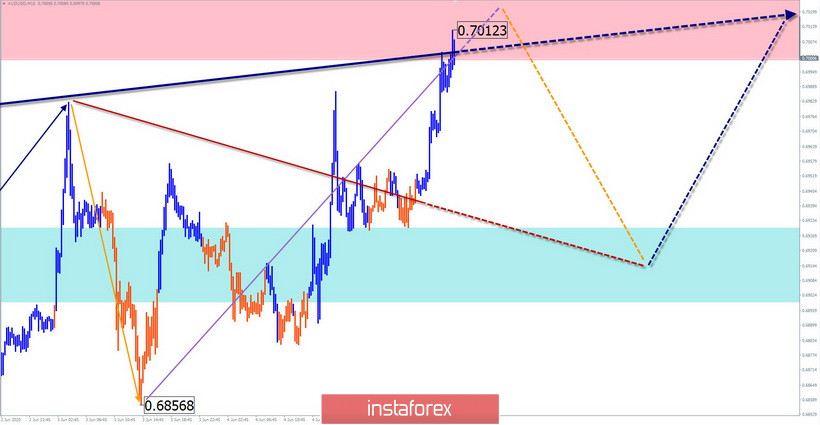

AUD/USD

Analysis:

The price of the Australian dollar since mid-March has set a new course for the pair's long-term trend. The first part (A) of the bullish trend wave of the daily scale is formed. The price has reached the lower limit of the potential reversal zone.

Forecast:

With a high probability, the price of "Aussie" today expects a move in the side plane with a descending vector. The levels of the support zone show the most likely zone of completion of the upcoming decline. You can expect a return to the main exchange rate by the end of the day.

Potential reversal zones

Resistance:

- 0.7000/0.7030

Support:

- 0.6930/0.6900

Recommendations:

Purchases on the pair's market today can be unprofitable. Within the intra-session style, short-term sales with a reduced lot are possible. A return to purchases is expected after the end of the upcoming decline.

Explanation: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements.

Note: The wave algorithm does not take into account the duration of the tool movements in time!