Friday's Nonfarm payrolls were able to stall the decline in the dollar index. However, they did not provoke the US dollar rally. Generally speaking, such a market reaction was expected as traders react coolly to positive macroeconomic reports from the United States and very badly- to negative ones. Therefore, the American labor market data for May only increased the demand for risk assets, while the greenback again stood aside. At the same time, signs of a recovery in the US economy, which have recently become more visible, allow the US dollar index to stay afloat - that is, at the boundary between the 96th and 97th figures. On the other hand, ongoing protests in the United States are forcing investors to be wary of the US currency. Against such a contradictory fundamental background, the market has started a new trading week.

The US Nonfarm payrolls, as a rule, know how to "surprise": one of the components of a key release does not coincide with the forecast levels very often, emphasizing the ambiguity of the situation. However, this time, the figures were well-matched: all indicators came out in the green zone (except for salaries), exceeding the forecast values. If not for the latest events in the United States, dollar bulls would probably take advantage of the situation, indicating their dominance in all major currency pairs. Mike Pence, US Vice President, said that Friday's data can be regarded as the zero point of the recovery of the US economy.

After a rather optimistic report from ADP, which was published last Wednesday, traders were expecting the official figures to be in the green zone and the US labor market did not disappoint.

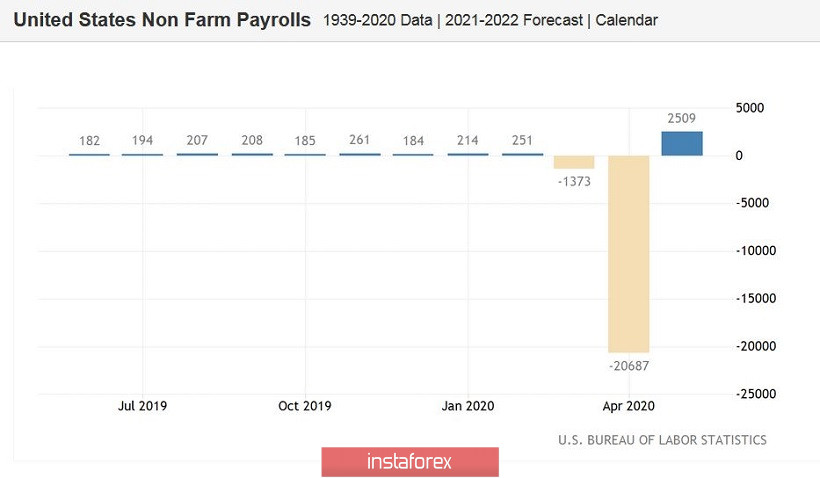

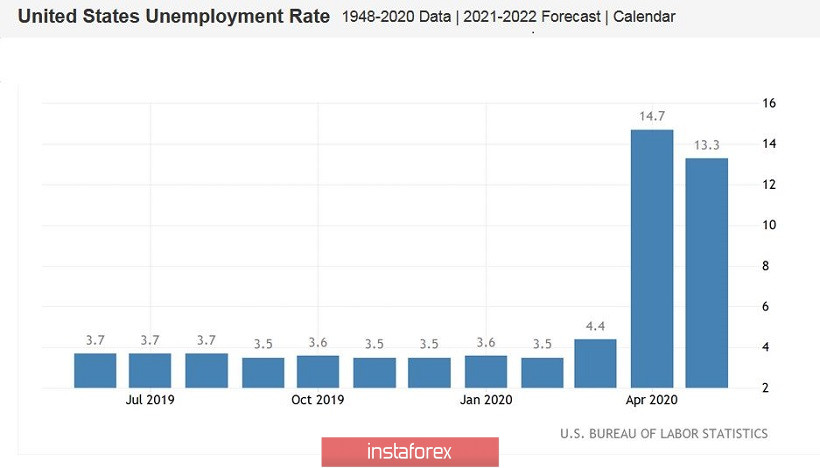

Thus, the number of people employed in the non-agricultural sector grew by 2.5 million. According to data from the ADP agency, this indicator should have decreased by about the same amount. According to the consensus forecast, the official report was to show a decline by 7.7 million. Experts did not assume that the number of employees would show positive dynamics. The increase in the number of people employed in the manufacturing sector amounted to 225 thousand after a significant reduction in April (by 440 thousand). In the private sector, this indicator has also grown sharply - by more than three million. As for the unemployment rate, it slowed down to 13.3% instead of rising to almost 20% (the general forecast was around 19.5%). Interestingly, such a significant increase in the number of employed was primarily due to the service sector - almost 2.4 million Americans had found work (or came back to their former positions) in this sector of the economy.

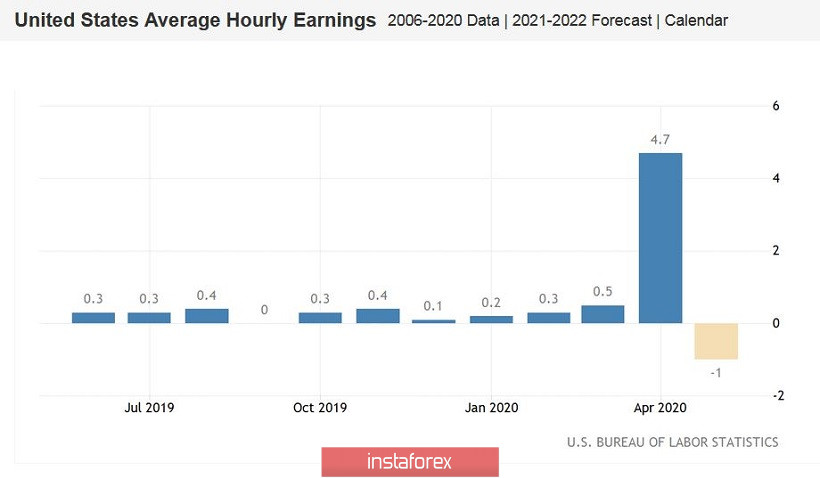

Meanwhile, the average hourly wage in April showed a distorted picture - the reading increased abnormally due to the disproportionate loss of work by low-paid workers and their lower wages (and not due to general growth in wages). However, in May, the release showed the true picture: the indicator crashed into the negative area to -1% on a monthly basis.

Overall, Nonfarm payrolls for May left a good impression. In good times the above release would have provided strong support for the dollar. However, to the disappointment of dollar bulls, the greenback has recently been in high demand only with outbursts of anti-risk sentiment. The recovery of the US labor market was interpreted by traders in the context of the general process of global economic recovery. The total risk appetite did not fade therefore in the key dollar pairs the greenback showed short-term and very indistinct growth.

It should also be noted that theUS dollar is still under pressure from recent events in the United States. Last weekend, one of the largest and most massive rallies since the start of the demonstrations took place. For example, in Washington, tens of thousands of people marched. Thousands of protests were also held in New York, Los Angeles, Chicago, San Francisco and other major cities of the country. The ongoing unrest does not add appeal to the greenback in the eyes of investors.

Thus, the US dollar could not turn the tide on the market against the backdrop of really strong Nonfarm payrolls. The growth of the greenback was short-lived. Soon, traders will turn thor attention to other fundamental factors, such as US inflation (Wednesday, June 10) and the June meeting of the Fed (on the same day).

Among all the dollar pairs, it is important to pay attention to USD/JPY. Here, the fundamental factors work in a slightly different way, since both currencies are safe haven assets. In this case, the downtrend should be considered as an opportunity for long positions. The yen remains a weak asset amid rising risk sentiment in the market and especially after today's release of data on the economic growth in Japan. Today, the final assessment for the first quarter was published, and it was revised downward. According to updated data, Japan's GDP decreased by 2.2% instead of initially forecast 2.1%.

All this suggests that the USD/JPY pair shows only a correctional decline. On the daily chart, the price is still located on the upper line of the Bollinger Bands indicator, above the Kumo cloud, and above all the lines of the Ichimoku indicator. The purpose of the upward movement is the 110.00 mark, which at the moment is the main level of resistance.