The latest COT report (Commitments of Traders). Weekly Outlook for GBP / USD

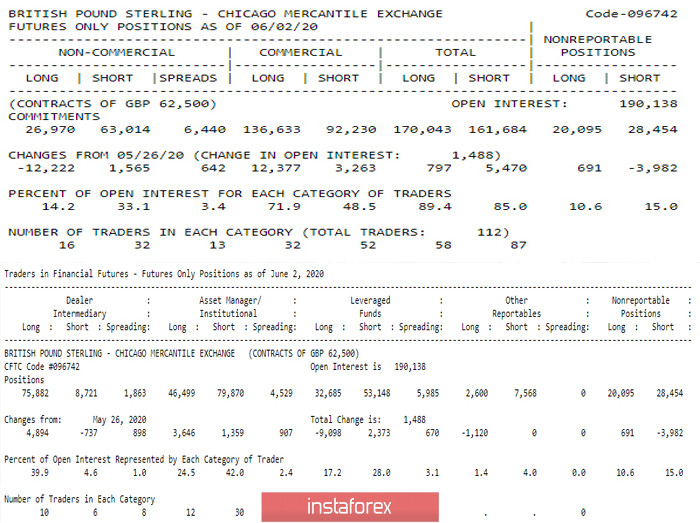

According to a new report by COT (Commitments of Traders), open interest in the British pound was increased (190.138 against 188.650) again, and the number of large players working with this currency continued to increase (112 against 107). The report shows that the two groups of players have been actively reducing positions on a large scale. These are Non Reportable Positions (- 3,982 short positions). Apparently, small traders were unable to hold short positions with active weekly growth of the pair. And Non-Commercial (-12,222 long positions). This information is more interesting. It turns out that the group responsible for trend preferences does not believe in the current growth of the pair in the long-term. We see the same picture in the financial report. Over the past reporting period, Dealer Intermediary's clients have been actively building short positions, getting rid of long positions. At the same time, the Commercials group remained committed to the Longs and increased its net long position by almost 5%. According to the results of the report, ordinary traders have something to think about.

Main conclusion

This week, players to decline will most likely seek to find a confrontation point that will limit the rise. However, the long-term prospects for traders is a bit unclear.

Technical picture

The pair performed a successful recovery last week, having met a fairly strong and wide resistance zone. These circumstances can form a daily correctional decline. The further fate of which in technical terms now depends on the strength of the resistance encountered and the strength of the possible supports expecting a pound in the region of 1.2470 - 1.2303 (daily cross + daily cloud), as well as the distribution of preferences of major market players. It should also be noted that the uncertainty and possible change in priorities now supports the emerging daily Ichimoku cloud, which has narrowed last week due to a long-term trend and is now ready to change its color, giving preference to bears.

In the lower halves, a downward correction is emerging. The key support on H1 is now located at 1.2659 (central Pivot level) and 1.2575 (weekly long-term trend). In case of a trend recovery, upward benchmarks are located today within the intraday 1.2736 - 1.2808 - 1.2885.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)