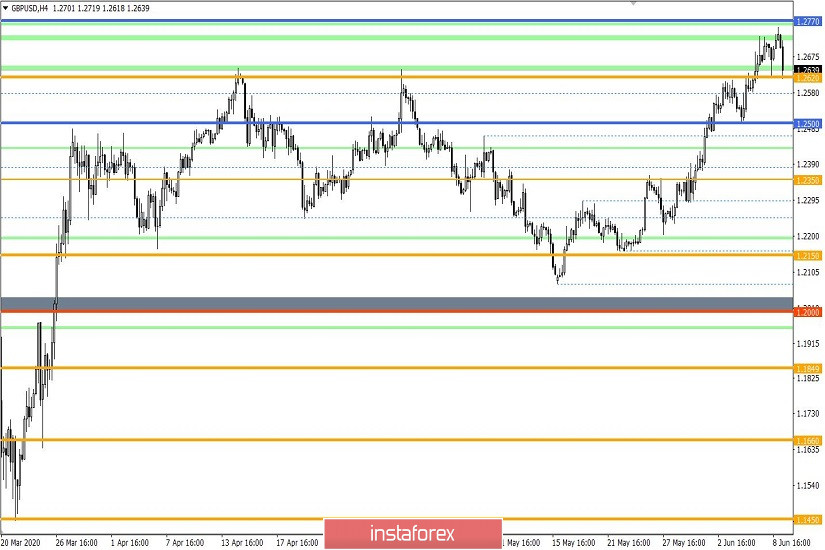

From the point of view of complex analysis, you can see the price holding above the previously passed flat formation, and now let's talk about the details.

The past trading day had an interesting dynamics, where the quote managed to return to the level of 1.2620 at first, working out the previous flat border as a support. After that, a new acceleration arose during which the quote updated its weekly maximum, confirming focusing above the previous flat formation.

Considering the scenario of upward development, it is worth noting that the level of 1.2700 is already easily breaking through the price, which means that market participants managed to occupy a new peak. Now, the key coordinates remained in the level of 1.2770, which would put an end to the difficult issue of market development.

It is worth recalling that the upward development carries in itself exclusively a change in the boundaries of oscillation from the range of 1.2150 // 1.2350 // 1.2650, by 1.2770 // 1.3000 // 1.3300. The new range does not provide for a change in the trend in the current situation with the information and news background.

It turns out that even in the case of a transition to a new range of fluctuations, long-term downward development remains relevant.

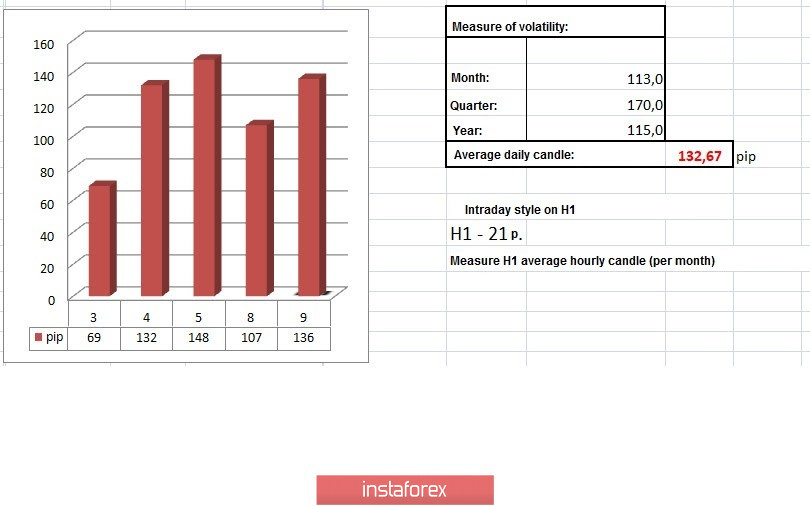

In terms of volatility, a high indicator of dynamics remains, the currency pair steadily exceeds 100 points, which indicates speculative activity.

As discussed in the previous review, traders considered the process of focusing prices above the level of 1.2620, which is what is happening in the market at the current time.

Considering the trading chart in general terms, the daily period, high activity can be seen, which has similar outlines with the dynamics of October 10, 2019. In the event of a recurrence of fluctuations, wide stagnation is expected in the near future.

The news background of the past day did not have statistics for Britain and the United States.

In terms of the general information background, we see an ambiguous picture related to the negotiations between England and Brussels on the terms of trade cooperation after Brexit. This background has a long-term effect on the pound sterling, and if we switch to the coronavirus crisis, we will get another lever of pressure on the British currency. So, British companies will need additional financial support, since debts will become an excessive burden. In turn, the rating of Boris Johnson reached a record low during the pandemic, it fell from a record high of 35 PP.

Today, in terms of the economic calendar, we have data on JOLTC open vacancies in the United States for April, which an increase of 5,000 M will be recorded.

Further development

Analyzing the current trading chart, we can see another approach to the level of 1.2620, where market participants focus on the previously passed flat formation. It is worth considering that touching the level of 1.2620 has already been done twice on the market, which suggests attempts to return the quote to the framework of the previous flat. It is worth considering that consolidating the price below the level of 1.2620 does not in any way cancel the fact that the flat is considered passed, and the fluctuation frames no longer meet the standards.

It can be assumed that price fluctuations within the range of 1.2620 / 1.2740 (1.2770) will still remain in the market, where it is worth monitoring the consolidation points relative to the borders, since in this case the mood of market participants for the coming days will be understood. In terms of local operations, you can build work on the principle of a rebound from the identified boundaries.

Based on the above information, we derive trading recommendations:

- We consider buying positions in the event of a price rebound from the level of 1.2620. The main positions are made after the price is consolidated above 1.2770.

- We consider selling positions already below 1.2620, in the direction of 1.2580 - 1.2500.

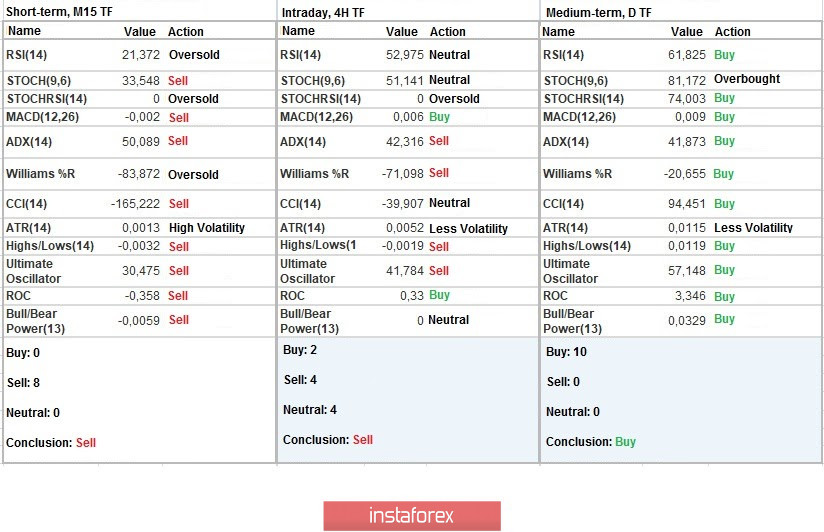

Indicator analysis

Analyzing a different sector of time frames (TF), we see that the indicators of technical instruments relative to hourly periods have changed from ascending to descending, while the daily intervals indicate a buy signal due to a steady upward movement in the period earlier.

Volatility per week / Measurement of volatility: Month; Quarter; Year

Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year.

(June 9 was built taking into account the time of publication of the article)

The volatility of the current time is 136 points, which is already higher than the average daily dynamics. It can be assumed that traders have moved to fixing long positions, where further growth in activity is not excluded.

Key levels

Resistance zones: 1.2725 *; 1.2770 **; 1.2885 *; 1.3000; 1.3170 **; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **.

Support Areas: 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411); 1.1300; 1.1000; 1.0800; 1.0500; 1.0000.

* Periodic level

** Range Level

*** Psychological level

**** The article is built on the principle of conducting a transaction, with daily adjustment