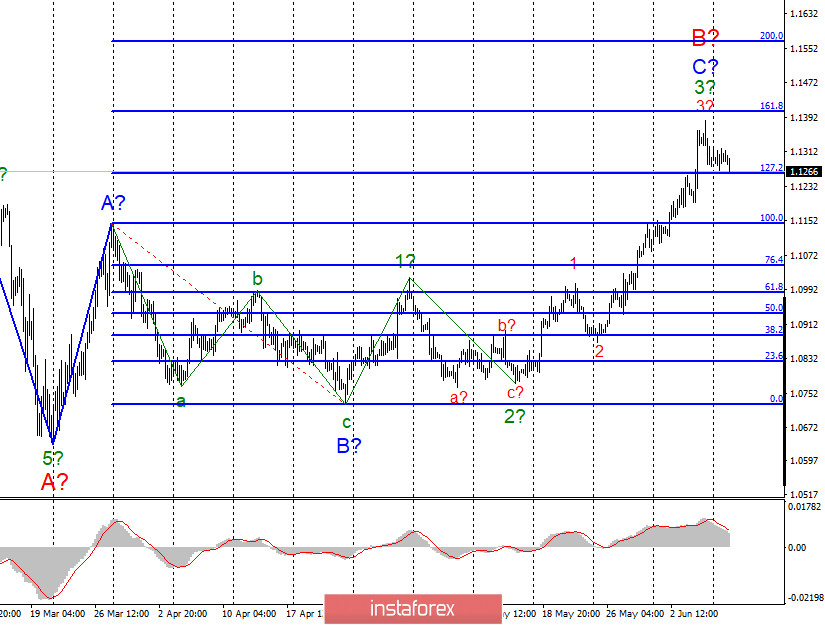

EUR / USD

On June 8, the EUR / USD pair lost only a few basis points. Thus, the current wave marking has not undergone any changes. Presumably, construction supposed wave 3 is completed in 3 to C to B. If this becomes true, then the pair will continue to build correctional wave 4, after the completion of which we can expect the resumption of the increase in the instrument. The current wave marking allows a stronger increase since the construction of wave 5 in C in B is still expected.

Fundamental component:

On Monday, there were very few interesting events and news in the world. There were no economic reports worthy of attention at all. Even the speech of the Chairman of the ECB Christine Lagarde did not have anything fundamentally new to report. Thus, the markets decided not to force events ahead of several important events this week. For example, before the Fed meeting, which will be held tomorrow, June 10. Also this morning, an important report on GDP in the eurozone was released, which showed a smaller reduction in the main indicator of the economy. The fall was only 3.1% y / y and 3.6% q / q. However, after almost two weeks of high demand for the euro, markets seem to have begun to cut purchases, ignoring GDP.

The US inflation report is also expected tomorrow, but I think that under current conditions it will have even less impact on the foreign exchange market than EU GDP. And also one of the most important events of this week is the Eurogroup meeting, scheduled for Thursday. Let me remind you that the latest attempts by the European Union to agree on a new package of assistance to the European economy have ended in nothing. The Nordic countries refuse to donate to the southern countries most affected by the crisis, and the EU government cannot find more suitable solutions to this problem. Another proposal is to form a fund by attracting contributions from all EU countries and further distribution among all those in need. The budget of the fund is 750 billion euros.

General conclusions and recommendations:

The Euro-Dollar pair is supposedly continuing to build the upward wave C in B. Thus, I recommend buying the instrument with targets located near the calculated marks 1.1406 and 1.1570, which equates to 161.8% and 200.0% Fibonacci for each new signal up by the MACD indicator. At present, the instrument is at the stage of building correctional wave 4.

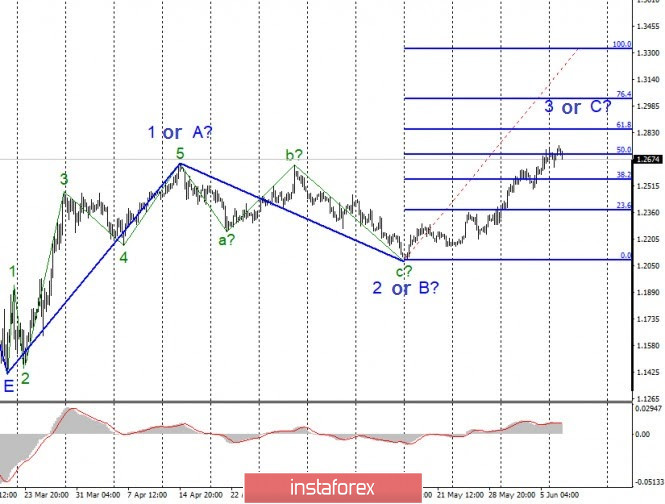

GBP / USD

On June 8, the GBP / USD pair gained another 55 basis points. Thus, the construction of the alleged wave 3 or C of the upward trend section continues. An unsuccessful attempt to break the level of 50.0% Fibonacci instrument indicates readiness to construct a corrective wave composed of 3 or C. Current wave size 3 or C is only 50% of the wave 1 or A. Thus, it is expected that the quotes of the instrument will continue to increase.

Fundamental component:

In the UK, nothing interesting happens at the start of a new week. And throughout this week, the picture will hardly change. However, on Friday, there will be some really important reports that cannot be ignored by the markets. Until this day, markets will only analyze news from the US. Due to the empty news background, demand for the euro and the pound decreased, which can be used by the dollar to win back part of the losses in recent days.

General conclusions and recommendations:

The Pound / Dollar tool supposedly continues to build a rising wave. Thus, purchases remain valid with targets located near the estimated levels of 1.2844 and 1.3030, which corresponds to 61.8% and 76.4% Fibonacci. A successful attempt to break the 1.2698 mark (50.0% Fibonacci) will indicate that markets are ready for new purchases.