Hello, dear colleagues!

At yesterday's trading, the euro bulls intended to continue moving the quote up, however, their attempts were doomed to failure. The strong technical level of 1.1380 played a role. Having risen to 1.1383, the upward momentum dried up and the pair turned to decline. In fairness, it should be noted that the downward trend is certainly not impressive. Yes, the bears tried to take advantage of the situation, however, they did not succeed.

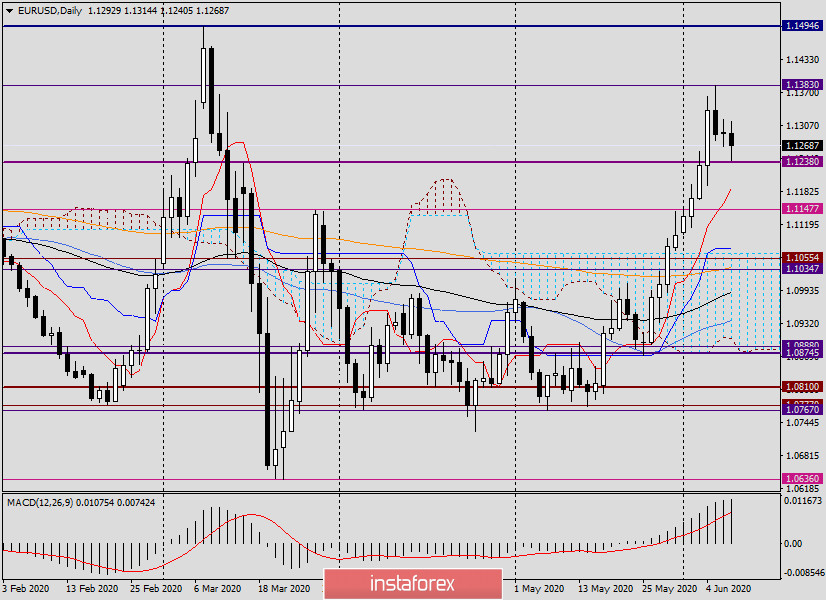

Daily

As a result, a doji candle with equidistant shadows without a body appeared on the daily chart. The opening price is virtually identical to the closing price on June 8. In general, a typical Monday, when the market is swaying and preparing for something. The question is why? Like a May thunderstorm, data on the US labor market for the last spring month thundered out. Once again, it is worth recognizing that, given the negative impact of COVID-19 on economic activity, the most important indicators for unemployment and employment in non-agricultural sectors of the American economy came out better than experts' expectations, while Nonfarm Payrolls were much stronger than forecast values. However, the market again showed indifference to the most important statistics from the US, and the dollar rose by only 30 points.

Yesterday's speech by ECB President Christine Lagarde was mainly devoted to the decline in economic activity in the Eurozone due to COVID-19. The measures taken by the ECB will ensure that there will be no significant increase in interest rates for the private sector.

The ECB measures that are being taken under COVID-19 will be temporary and targeted. And traditionally, all the leaders of the ECB mentioned its mandate. Christine Lagarde also did this. To be honest, Lagarde did not say anything new or particularly interesting, so let's return to the technical picture of the main currency pair of the Forex market.

In order for euro bulls to consolidate their current superiority over their opponents, they need to pass a strong technical level of 1.1200 and secure trades above this mark. To return to bearish sentiment, you need to lower the EUR/USD exchange rate below the level of 1.1100. Exactly under 1.1100, this is not a typo. In my strictly personal opinion, the 11th figure will determine the prospects for medium-term, and maybe long-term price movement in the euro/dollar. As can be clearly seen on the daily chart, the market does not want to decline in principle. After each small corrective pullback, there is immediately a demand for the single currency, which means strong buyers.

In my opinion, despite the good non-farms, the US dollar is not in favor at the moment. At a time when the global economy is somewhat stabilizing after the coronavirus pandemic, investors have become more risk-averse. It is not for nothing that the New Zealand dollar has become the leader of growth against the US dollar.

The main trading recommendation for EUR/USD is to buy after corrective pullbacks to strong technical levels and the appearance of bullish candle analysis models. At the time of completion of this article, this recommendation is confirmed. The strong technical level of 1.238, which was built a long time ago, kept the quote from further decline and turned it up. A very good example. If today's candle remains about the same, we will prepare for purchases near 1.1275 and 1.1250. I will write more precisely about this in tomorrow's article on EUR/USD. And don't forget that tomorrow there will be an extended Fed meeting with updated economic forecasts and a press conference by Jerome Powell. I believe that volatility in the currency market will increase significantly. More details about this and other events will be published in tomorrow's article.

Good luck!