4-hour timeframe

The EUR/USD pair to show signs of continued correctional movement or the completion of an upward trend on the hourly timeframe on June 10. Yesterday, bulls sharply resumed purchases of the European currency in the afternoon, but their strength was not enough to overcome the Friday high. Thus, with the current price values, a new round of correction may begin. At the same time, when the pair is near local high, it is difficult to unequivocally conclude that the upward trend is complete. However, the pair's quotes still left the upward channel, so there is still a chance. Buyers need to urgently update local highs in order to stay in the game. Otherwise, the bears can get down to business and take the pair below the critical Kijun-sen line, which is fraught with forming a new downward trend.

EUR/USD 15M

There was every chance of assuming the end of the upward trend on the 15-minute timeframe on Monday, but now both channels of the linear regression are directed upward again, so the upward trend remains in the short term.

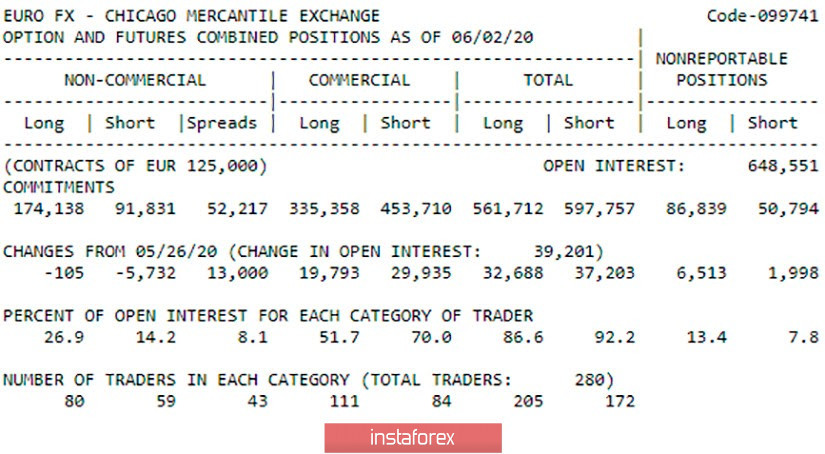

COT Report

The latest COT report showed what we did not expect to see. It turned out that professional traders did not increase purchase contracts during the reporting week, but closed contracts for sale in euros. Thus, the effect was similar. But market participants who use foreign exchange contracts for hedging risks and for operating activities frolic in full swing. New 20,000 purchase contracts and 30,000 sales contracts were opened. As you can see, there was no effect from as much as +10,000 thousand sales contracts. Therefore, the situation was terrible. Despite the fact that the total number of net sales contracts increased by about 5,000, the euro showed the strongest growth. This further leads us to the idea that the euro's growth is somewhat random and may be completed in the near future. However, the first trading days of the new week do not allow us to conclude that the upward trend is complete.

The general fundamental background for the EUR/USD pair remains neutral in the early days of the new week. There were not a large number of published statistics these days, and market participants ignored a rather important report on the eurozone GDP. Thus, traders continue to bend their line, not paying attention to the macroeconomic background. The United States will publish the inflation rate for May, which with a 95% probability will also be ignored, and late at night the US central bank meeting will be summed up and a press conference with Federal Reserve Chairman Jerome Powell will follow. The last European Central Bank meeting, culminating in the expansion of the PEPP program by 600 billion euros, was positively received by traders (or completely ignored). We can see something similar today. If Powell declares his readiness to further expand stimulus packages, this may even provide support to the dollar, although, in essence, it is a softening of monetary policy, which should pull down the dollar. However, the greenback has already fallen quite strongly against the euro. Thus, the effect of the Fed meeting can again pass through the prism of technical factors, which we recommend paying attention to first of all.

Based on the foregoing, we have two trading ideas for June 10:

1) It is possible for EUR/USD pair to grow further with targets at resistance levels of 1.1417 and 1.1542. To do this, buyers need to continue to stay above the critical Kijun-sen line, below which there has already been an attempt to gain a foothold. At the same time, the strength of the bulls is not unlimited. If the Fed does not give them unambiguous support, then the pair may again strive for a corrective movement. Therefore, we even recommend that before opening new longs, wait for overcoming the previous high or level of 1.1417. Potential Take Profit in this case is up to 140 points.

2) The second option involves consolidating the EUR/USD pair under the Kijun-sen line, which will allow sellers to try and join the game. In this case, you are advised to open sell positions with the targets of 1.1133 (support level) and 1.1064 (Senkou Span B line). Potential Take Profit range from 145 to 215 points.