Recommendations for long positions on GBP/USD:

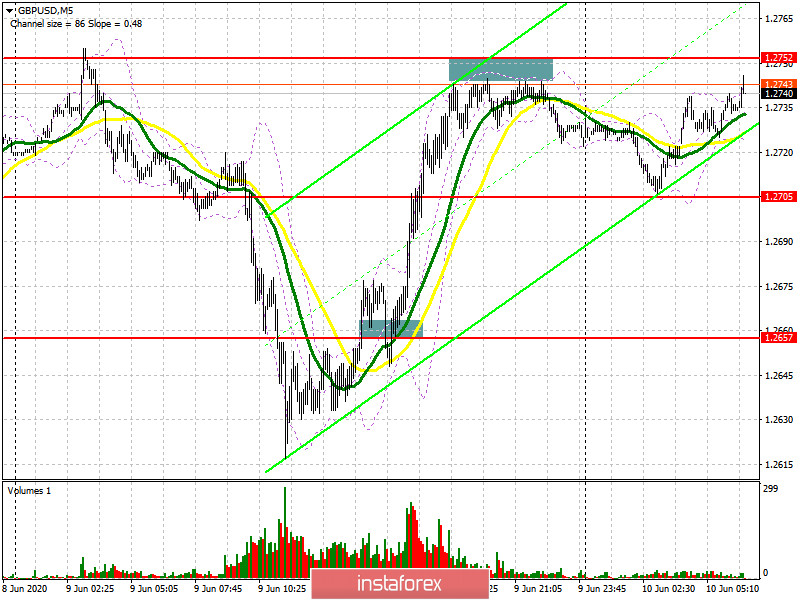

At the beginning of the European session, the pound sterling dynamic was almost the same as bulls have not changed their tactics. Yesterday, I recommended to open long positions after consolidation above the 1.2657 level. The predictions come true.

On the 5-minute chart, we can clearly see that the range is returning to the bulls' control. Another break of the upper limit proves that there are big players in the market who are betting on the continuation of the uptrend. Sellers made an attempt to act near the resistance level of 1.2752 at the end of the American session. However, the pair needed two pips to hit the resistance.

Thus, the pound sterling is still in demand even amid the frozen negotiations between the EU and the UK. The pound buyers are focused on the 1.2752 resistance level. If the price consolidates on this level, it will be a sign that the bearish trend is likely to continue. In this case, the pair may hit new highs near 1.2798 and 1.2840. I recommend to take profit at these levels.

If the pound/dollar pair drops today, buyers will bet on the support level of 1.2682. At this level, the pair may form a false break and pull back from the moving averages. If there are no active buy deals in this range, it will be better to open long positions after the hit of the 1.2622 low or open buy deals after a rebound from 1.2534. In this case, a correction of 30-40 pips within one day is the main target.

Traders should be very careful opening buy deals on the current highs as the recent COT report for June 2 showed a change in the market sentiment. During the week, short non-commercial positions increased from 61,449 to 63,014. At the same time, long non-commercial positions dropped sharply from 39,192 to 26,970. As a result, the non-commercial net position became even more negative and ended at -36,044 against -22,257, which indicates a slowdown in a short-term bullish momentum and a formation of a major downward correction is quite possible.

Recommendations for short positions on GBP/USD:

Sellers are still trying to act every time they approach large resistance levels. However, they find it difficult to move against the trend. Today, the next task for bears is to prevent bulls from hitting levels above the resistance of 1.2752, where a formation of a false break would be a clear signal for opening short positions. Thus, GBP/USD may return to the area of the middle of the flat channel of 1.2628, where there are moving averages. If the price consolidates below this range, pressure on the pair may rise. This, in turn, could lead to the demolition of bull stop orders and a sharp drop of the pound sterling to the support of 1.2622. There, it is recommended to take profit. A longer-term target for bears will be a low of 1.2534. If the pair hits this level again, there will be a break in the bull market. If the pair breaks the resistance of 1.2752, it will be better not to open short positions before the pair reaches the high of 1.2798. It is possible to open sell deals immediately after a bounce from the major resistance of 1.2840. The target is a move down by 30-40 pips by the end of the day.

I recommend traders to take a look at other analyses:

- A more detailed video review on June 10.

Indicators' signals:

Moving averages

Trading can be performed above the 30 and 50 moving averages. This points to the continuation of the upward movement.

Note that the author of the article analyses the period and prices of the moving averages on the one-hour chart.

Bollinger Bands

A break of the upper limit of the indicator near 1.2785 may lead to a new wave of the British pound's rise. If the pair drops, the lower limit around 1.2635 will act as a support level.

Definitions of the indicators:

- Moving average (a moving average that determines the current trend by smoothing out volatility and noise). Period is 50. It is marked in yellow on the chart.

- Moving average (a moving average that determines the current trend by smoothing out volatility and noise). Period is 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence is a convergence/divergence of moving averages). The fast EMA period is 12. The slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. Period is 20.

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet particular requirements.

- Long non-commercial position represents a total long open position of non-commercial traders.

- Short non-commercial position represents a total short open position of non-commercial traders.

- The total non-commercial net position is a difference between short and long positions of non-commercial traders.