Euro bulls tried to return to the market after the Fed press conference, but their efforts failed, so the bears had a chance to pull the market to their side. Measures to control the yield curve and leading indicators, which market participants were so afraid of, were not announced, so the pressure on the US dollar was slightly eased.

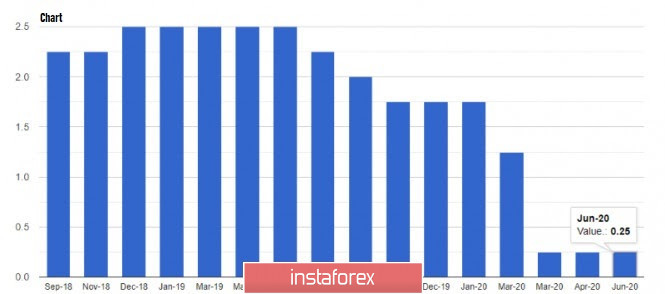

The Fed is keeping interest rates between 0.00% and 0.25%, and discount rates at 0.25% The reason for which is that the coronavirus pandemic will continue to exert strong pressure on economic growth, inflation, and employment in the short term, which creates significant risks for the economy in the medium term.

The central bank also announced its plans to adhere to the current pace of purchases of treasury bonds in the amount of $ 80 billion per month. This suggests that the regulator does not only fear the excessive acceleration of the economy which could lead to an overheating, but also fulfills its promises to reduce purchases of debt obligations when economic activity starts ro recover. Thus, according to the data, since the Fed acquired Treasury bonds worth $ 22.5 billion last week, it will acquire Treasury bonds for only $ 20 billion this week.

The FOMC forecast the rate of federal funds to average 0.1% at the end of 2022, and return to the target of about 2.5% on a longer term. The Fed does not see any rate hikes until 2023.

As for estimates and prospects for the economy, the Fed expects the US GDP to shrink by 6.5% in 2020, and then grow by 5% in 2021. Unemployment remains a big problem for the regulator, which is projected to be at 9.3% this year, but decrease to 6.5% in 2021 and to 5.5% in 2022.

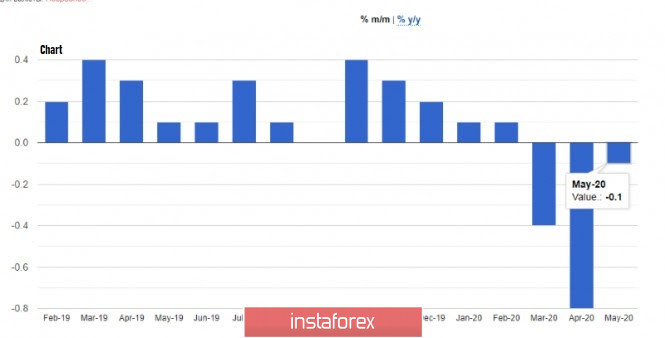

With regards to inflation, things are a little worse than expected. The report published yesterday revealed that consumer prices in the US dropped further in May, after falling sharply in April. Although food prices have risen due to increased demand from consumers, other categories of goods still have fallen sharply in price. Thus, according to a report by the US Department of Labor, CPI in May 2020 fell to 0.1%, after falling at 0.8% in April. As for core inflation, which does not take into account volatile categories, the indicator also recorded a drop of about 0.1%, after falling by 0.4% in April.

Such figures supported the forecasts of the Federal Reserve System, which expects inflation to be at the level of 0.8% in 2020, and then grow to 1.6% in 2021.

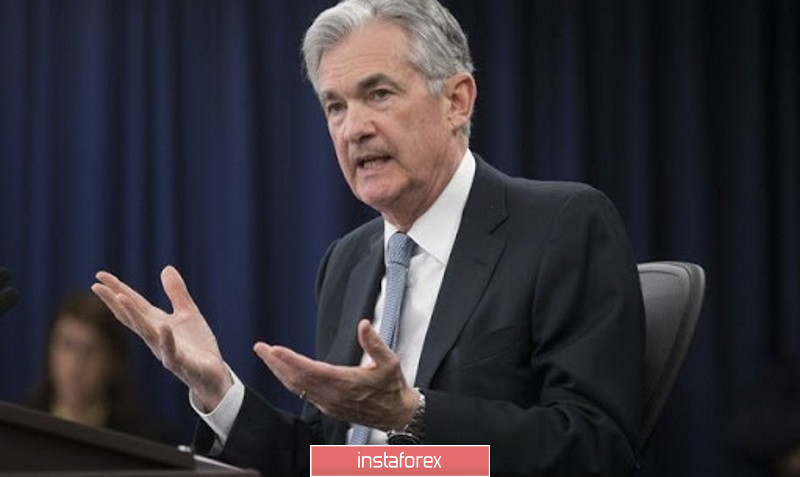

Fed Chairman Jerome Powell also discussed during the press conference the effects of the coronavirus pandemic, such as great damage and uncertainty about the future. According to him, unemployment remains the highest by historical standards, and inflation decreased far below the target level of the Fed, which creates additional problems. As for the assessment and the extent of the recession, Powell did not answer the question precisely, saying that everything will depend on whether the virus and the second wave of the pandemic can be controlled. Nevertheless, the Fed intends to use the full range of tools to support the economy, and in order to maintain smooth functioning of the markets, purchases of treasury and mortgage-backed securities will remain at their previous levels in the coming months.

As for the euro, it did not receive a strong support since the Fed did not discuss measures that would control the yield curve.

The Fed did not diverge from the planned route but did not force events further, taking a certain expectant position, which could lead to a slight strengthening of the US dollar against risky assets until good news appeared on the state of the world economy.

As for macroeconomic statistics on the Eurozone economy, the attention was drawn yesterday on the report on industrial production in France which showed a sharp decrease. According to data, industrial production in April fell immediately by 20.1% compared with March, while economists expected a reduction of 18.6%.

The OECD report, which also came out yesterday, did not significantly affect the markets, even though it indicated figures for a serious contraction in the global economy. According to the data, global GDP is expected to fall by 6% in 2020 and recover by 5.2% in 2021. But in the case of a second wave of the pandemic, the economy can sag by more than 7.6% in 2020, and growth in 2021 will not exceed 2.8%. As for the estimated prospects of the leading economies of the world, economists expect the US economy to fall by 7.3% in 2020, and then recover by only 4.1% in 2021. In China, the economy could contract by 2.6% in 2020.

As for the current technical picture of the EUR / USD pair, the continuation of the bullish mood will depend on the resistance level of 1.1400, a breakout from which will allow the bulls to push the quotes to highs of 1.1460 and 1.1520. Meanwhile, the bears will attempt to break break below the local low of 1.1325 today, the success of which will allow the quotes to reach the support level of 1.1245 and 1.1140.