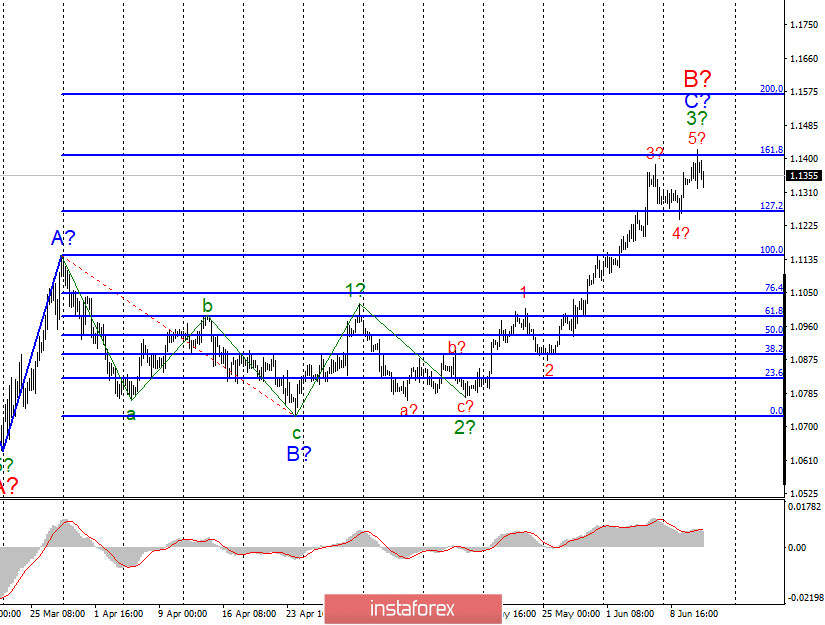

EUR/USD

On June 10, the euro/dollar pair gained about 30 basis points. At the end of the day, it hit the 161.8% Fibonacci level. However, the price failed to break the mentioned level and pulled back from the reached highs. Thus, we have all reasons to say that formation of waves 5 and 3 or C and B could be completed soon. If it is true, the quote will go on falling within the waves of 4, C, B. As soon as the formation is completed, the price may resume the upward trend.

Fundamental factors:

On Wednesday, there was a flow of news and events. Some of them were expected, others became as a surprise. Market participants almost ignored the US inflation data. However, the report showed another drop. Traders were focused on the Fed's meeting and Jerome Powell's speech. The results of both events are rather controversial. The US Fed decided to maintain the key rate and the QE program unchanged. However, the regulator has significantly lowered GDP forecasts for 2020-2022 as well as forecasts for inflation and unemployment rate. In fact, the worst predictions were made for 2020. However, the Fed's forecasts for 2020 are considered to be the most accurate. Besides, they reflect the current economic condition.

Nobody knows what will happen in 2021 and 2022. There are uncertainties about the US-China relations, the US president, etc. Thus, predictions for these two years are really groundless. In case of a trading war with Beijing, all forecasts will be revised several times. Jerome Powell's rhetoric has neither awakened interest. Markets again heard that the coronavirus crisis is an unprecedented event in the history of the US. It creates strong risks for the economy, so the regulator does not plan to raise the key rate until the end of 2022 or until employment levels and inflation allow it to do so.

General conclusions and recommendations:

The euro/dollar pair is likely to continue forming the upward waves C and B. Thus, I recommend to open buy deals with the targets at 1.1406 and 1.1507 that corresponds to the 161.8% and 200.0% Fibonacci levels. At the moment, the pair may be forming correctional waves 4,C,B. Thus, the pair could drop for some time.

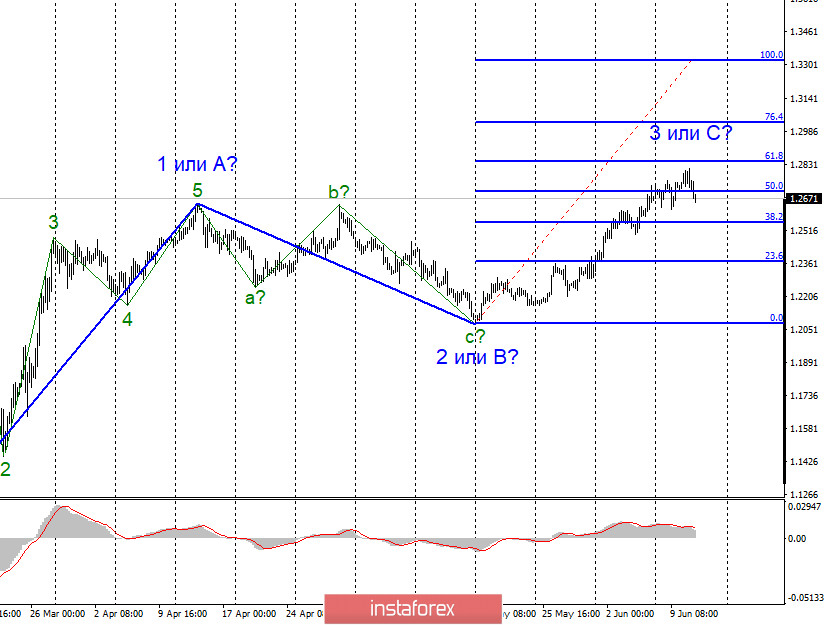

GBP/USD

The GBP / USD pair gained only 15 basis points on June 10. Thus, the current wave markup has not suffered any significant changes. Today, the instrument has started a stronger decline and has lost about 60 points. The pair continues forming the expected wave 3 or C of the uptrend with targets located around 61.8% and 76.4% Fibonacci levels. The entire wave 3 or C ccould be quite long, especially if the British pound rises on the news background. At the moment, wave 3 or C is not completed.

Fundamental factors:

Nothing interesting has happened in the UK this week. Only tomorrow, markets will see several economic reports. At the moment, the British pound is completely dependent on demand for the US dollar. Yesterday, quotes began to move away from the reached highs. Thus, demand for the British pound may decrease slightly. At the same time, there is no news in the US today. In other words, the pound sterling may resume climbing.

General conclusions and recommendations:

The pound/dollar pair is forming an upward wave. Thus, buy positions could be opened with the targets located near the levels of 1.2844 and 1.3030 that corresponds to the 61.8% and 76.4% Fibonacci levels. I recommend go on buying after every "up" signal from MACD.