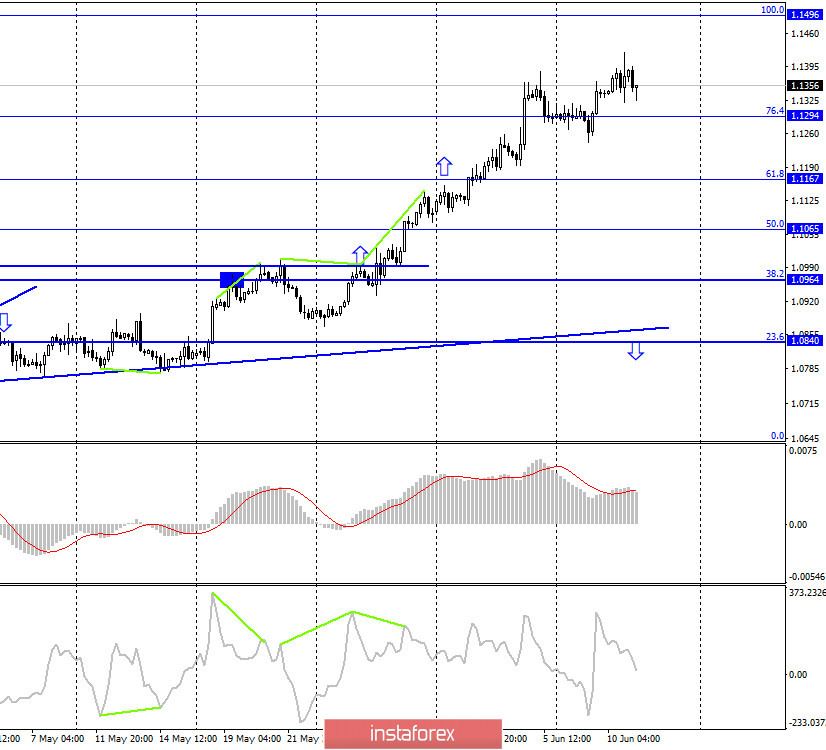

EUR/USD – 1H.

Hello, traders! The euro/dollar pair continued to grow on the hourly chart until the evening of June 10. During the day in America, inflation for May came out, which showed an even greater decline to 0.1% y/y in the main indicator and to 1.2% y/y in the base. However, traders were not particularly encouraged by this report and did not react to it in any way. Thus, only towards the end of the day, when the hour was approaching to sum up the results of the FOMC meeting, the position of the US currency began to weaken. The pair performed a reversal in favor of the US dollar and began an uncertain fall, which allowed it to eventually perform another close under the upward trend corridor. The results of the Fed meeting can be safely called passing. The Central Bank left the key rate unchanged at 0.25%. Absolutely all members of the monetary committee, headed by Jerome Powell, voted for this decision. The volume of monthly purchases of Treasury bonds also remained unchanged - $ 80 billion per month. Well, the Fed's press conference did not sound anything overly interesting. Thus, the reaction of traders was quite restrained.

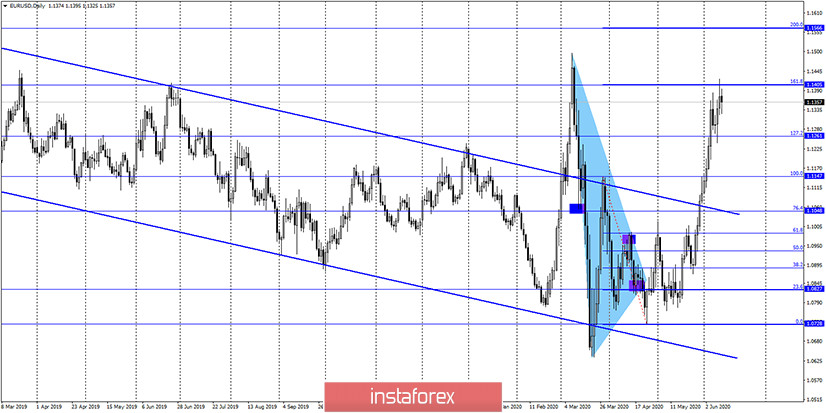

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair also tried to perform a reversal in favor of the US dollar and begin the process of falling. However, if on the hourly chart, the reversal is at least visible to the naked eye, then on the 4-hour chart, you need to look at it through a microscope. By and large, there is no downward turn on the 4-hour chart yet, and the "bullish" mood of traders was not spoiled by yesterday's passivity of the Fed. Thus, the growth process can be continued in the direction of the corrective level of 100.0% (1.1496).

EUR/USD – Daily.

On the daily chart, the euro/dollar pair performed an increase to the corrective level of 161.8% (1.1405) and rebounded from it. Thus, traders can now expect a slight fall in the direction of the Fibo level of 127.2% (1.1261).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). Given the growth of the euro currency in recent days, this goal can be "taken" in the next week.

Overview of fundamentals:

On June 10, there were no interesting news or economic reports in the European Union. In America, the inflation report was released (weak) and the results of the Fed meeting (passive) became known. In general, traders continue to remain "bullish".

News calendar for the United States and the European Union:

US - number of primary and secondary applications for unemployment benefits (12:30 GMT).

On June 11, the news calendar in the United States and the European Union is almost empty. The report on applications for unemployment benefits is no longer as important as it used to be. Thus, there will be no background information on Thursday.

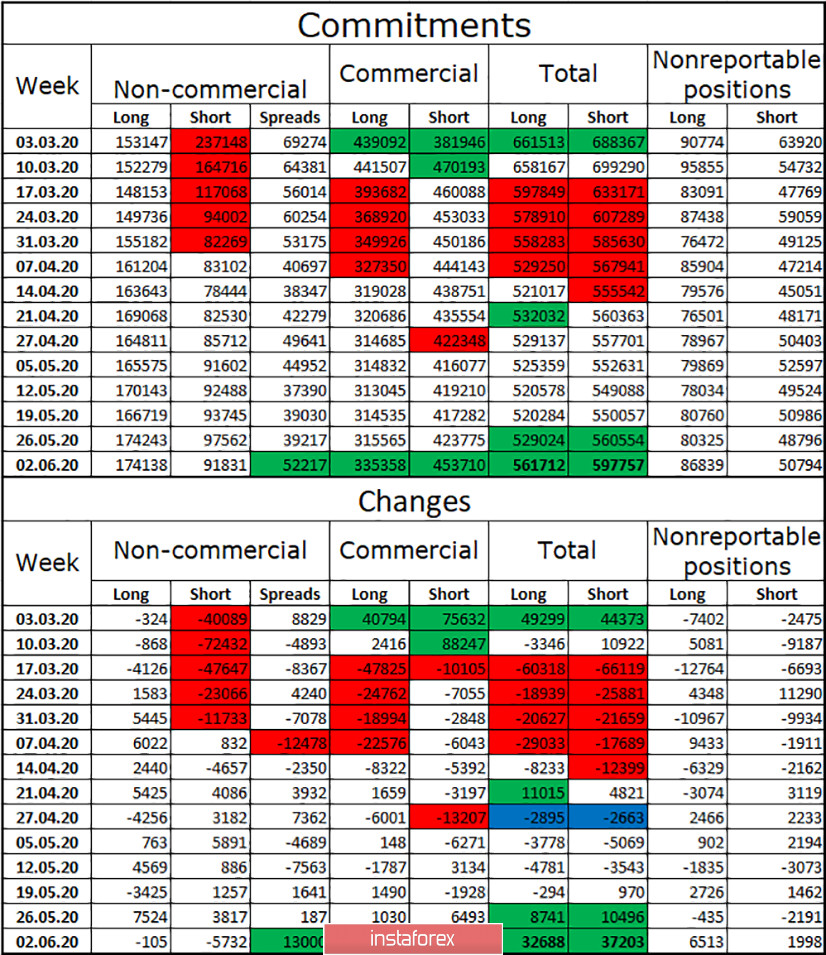

COT (Commitments of Traders) report:

Over the past week, the European currency has shown very strong growth, so traders reasonably expected a high increase in the number of long positions in general and in the "Non-commercial" group. However, in practice, it turned out the opposite. According to the new COT report, a group of speculators strenuously got rid of short-contracts during the reporting week, which led to the same effect as the build-up of long-contracts. Thus, the difference between the number of long and short contracts in the hands of major speculators for the reporting week has increased, which is perfectly compared with what is happening in the currency market. I also note the increased activity of major players, as the total number of open contracts increased in 1 week by as much as 70 thousand. This week, the situation does not change at all and the euro currency is still in demand.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goal of 1.1261, as the rebound from the level of 161.8% on the daily chart was performed. I recommend opening new purchases of the pair with the goal of 1.1566 if it is fixed above the correction level of 161.8% on the daily chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to provide current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.