As expected, EUR declined as investors sighed with relief after the Fed's policy meeting. The market was braced for tougher measures by the FOMC, in particular negative interest rates and the control over the Treasury yield curve. Meanwhile, economic data from the US signal a gradual recovery in the labor market following the shutdown. Besides, investors are absorbing information on the US draft defense budget, the swelling US public debt, and another critical attack on the Federal Reserve from Donald Trump. Let's discuss this in detail.

As I said above, an interesting point in the new defense budget draft is the section which sets out anti-China measures. Yesterday, the US Senate Armed Forces Committee gave a thumps up to the defense budget worth $740 billion. Only two committee members voted against while the rest 25 members approved the suggested figures. Nevertheless, the bill is still at the early stage. The next step is its approval by the Senate. Then, it should be agreed with the House of Representatives. Finally, the bill will have to be endorsed by Donald Trump. Interestingly, the US is due to allocate $1.4 billion to subdue China in the Asia-Pacific region. The bill suggests the program called the Pacific Moderation Initiative. The policymakers aim to assert the US interests to China's Communist Party and such interests are protection of the US rights in the Indian and the Pacific Oceans. Meanwhile, the US federal debt has beaten a new record. The US Treasury Department estimates that the debt has reached $26 trillion due to massive financial aid to fight the coronavirus-driven crisis. Notably, some think tanks voice concerns about rampant rates of growth of the public debt and budget deficit. Sooner or later, this could challenge the US dollar's status of the main world's reserve currency. Over Donald Trump's term in the office, the federal debt has ballooned by $6 trillion.

However, such appalling figures do not discourage the US Treasury Department to carry on with massive public spending. Yesterday, Steven Mnuchin stated that the White House had been considering the second round of social stimulus. The new package has been already discussed with the President who welcomed this move. This proposal should be implemented cautiously as this could be interpreted wrong by the people who are going back to work amid easing lockdown measures. More financial aid could convince them to stay home longer. Besides, Steven Mnuchin said that the national economy is unlikely to be shut during the second pandemic wave.

Yesterday, Donald Trump again slammed the central bank and Jerome Powell's economic forecast following the Fed's policy meeting and the press conference. For your reference, the Fed's leader warned about the lengthy way to the full economic recovery. Apparently, the White House has better vision based on its own more accurate data. So, the White House projects a rapid recovery in Q3 2020. Moreover, the 2021 year is going to be one of the most successful on record.

Notably, such projections of the US President have been confirmed by The Wall Street Journal. According to its latest poll, the US GDP is set to revive as early as in Q3 2020. Besides, the US labor market will shrug off the pandemic fallout sooner than later that has been proven by the recent unemployment data.

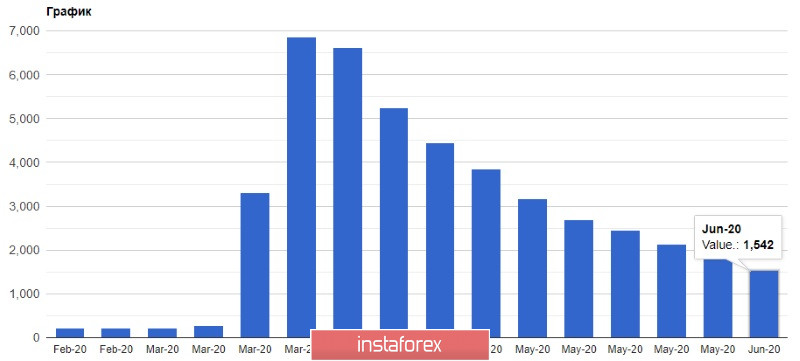

Data on unemployment claims in the US supported the US dollar. The US Labor Department reported that the number of jobless claims contracted to 20.5 million in the week ended May 30. Fewer Americans have been filing for unemployment benefits since May. So, a revival of the labor market is a good sign.

Speaking about the EU, the eurozone's economy is also easing a pace of a slowdown. Yesterday, the European Commission posted its recommendations which suggest opening all inside EU borders from June 15. The borders with the countries outside the Union could be reopened from July 1. Nevertheless, before the final decision is made, the authorities should analyze the COVID-19 state of affairs in the neighboring countries to make sure that the situation there is more or less favorable.

Here is the technical picture of EUR/USD. The breakout of support at 1.1325 is a bearish signal which means a downward correction. Still, before you rush to sell EUR, it would be better to check that bears are going to defend this level at the end of the week. If large sellers are active at around 1.1325, we can expect EUR/USD to extend the bearish bias towards support at 1.1240 and deeper towards 1.1140. Alternatively, if bulls can conquer the area of around 1.1325 tonight, buyers of risky assets will be ruling the market. The trading range will get a bit wider.

GBP/USD

The sterling is trading lower amid investors' fears about the trade talks between the UK and the EU. Another cause for concern is the second wave of the pandemic. Today, the UK GDP data for April is on investors' radars. Investors are braced for negative GDP data at the peak of the COVID-19 pandemic and restrictive measures. In case of worse-than-expected data, the sterling will extend weakness. Apart from economic contraction, traders are fretted that London has not made a trade deal with the EU yet. Meanwhile, the Brexit deadline on June 30 is just around the corner. The current trade terms with the EU remain in force until the year end. Chief Brexit EU negotiator Michel Barnier stated this week that he wouldn't allow Great Britain to pick the cherry from the post-Brexit agreement. The main EU principle is the mechanism of fair competition and strict environment requirements. If London has something against such principles, the European Parliament is able to ban this deal.

The technical chart of GBP/USD reads that the sterling has consolidated firmly at its highs of around 1.2805, having reached this week. Now the pair is trading at near 1.2580. If buyers want to take the lead, they should enable the pair to close the week above 1.2620. Otherwise, the control over the market will be taken by sellers who will try to push the price down to 1.2500 and 1.2380 next week. The key factor today will be macroeconomic data from the UK.