The US dollar received a significant support for almost all major currencies last week amid widespread profit taking in equity markets.

The week ended with a continued weakening of the US dollar against the backdrop of a continuing rally in equity markets, which, however, was somewhat restrained by the expectation of the final decision of the Fed on monetary policy. Investors were interested in how long the regulator will follow the current unprecedentedly soft monetary rate. They were also worried about the bank's forecasts for this year and for the coming years. A cautious look was associated with the uncertainty that, in the wake of the implementation of the V-shaped scenario of America's recovery from the crisis, the Federal Reserve would decide to lower a number of incentive programs with the prospect of a significant reduction.

However, the situation was mixed. The communique issued by the bank, as well as the subsequent statement by J. Powell, showed that, on the one hand, the regulator will support the economy for an extremely long time, but on the other hand, it believes that it will recover very slowly, which in fact has become the reason for profit taking in the stock markets and increased demand for defensive assets - US Treasuries and other government bonds of economically strong countries. Also, turmoil in the markets was facilitated by data on the number of applications for unemployment benefits in the US, which unexpectedly turned out to be lower than forecasts, showing slightly lower growth than expected. And the values of production inflation added significantly more to the consensus forecast.

Despite such a turn of events and economic data, the dollar began to receive support by the end of the week along with the yen and the Swiss franc. In turn, stock markets declined last Thursday and Friday, fostering demand for safe haven currencies. However, it should be recognized that there was a rebound on Friday. Here, the question arises: will there be a reversal in the markets with the continuation of the June rally or not?

In our opinion, a generally positive view on the development of the situation in the US economy in particular and in the world as a whole will continue to support the demand for risky assets, which means that the dollar will be under pressure again, although local pullbacks are possible. This week, market's attention will be focused on key events: the discussion of the EU recovery fund, Brexit negotiations between Britain and the European Union, the publication of business activity indexes in both the manufacturing sector and the services sector, and RBNZ's meeting on monetary policy, US GDP for the first quarter and the speech of J. Powell before the Senate Banking Committee.

To sum everything up, it can be noted that despite the existing fears of the probability of a second wave of the coronavirus pandemic, the growth of investors' restrained attitude towards the pace of recovery of the American, European and other significant economies in the world, the growth of stock markets will continue to persist.In these conditions, the us dollar will also remain under pressure, significantly weakening in the currency market.

Forecast of the day:

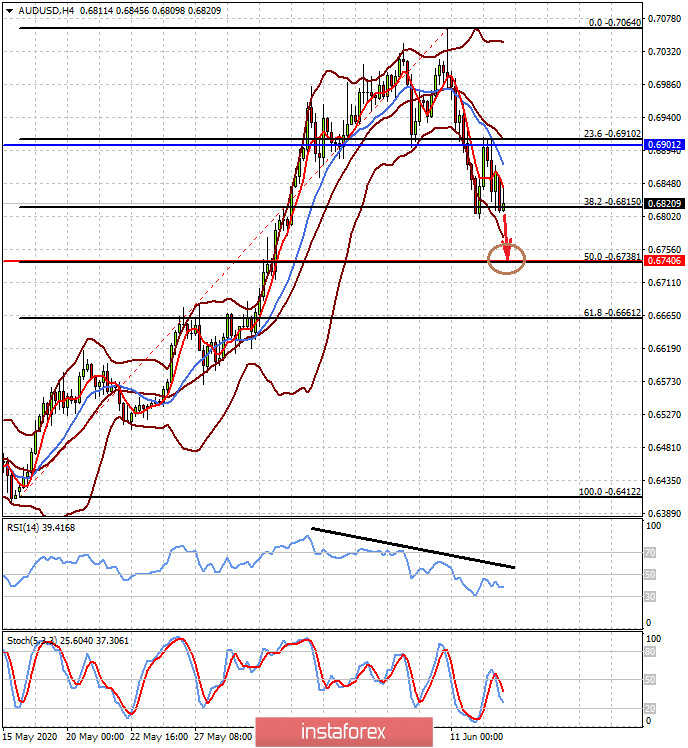

The AUD/USD pair remains under pressure in the wake of a new report of an outbreak of coronavirus infection in a market in Beijing. An increase in fears may lead to the continuation of the correctional decline in the pair to 0.6740, but only after breaking through the level of 0.6800.

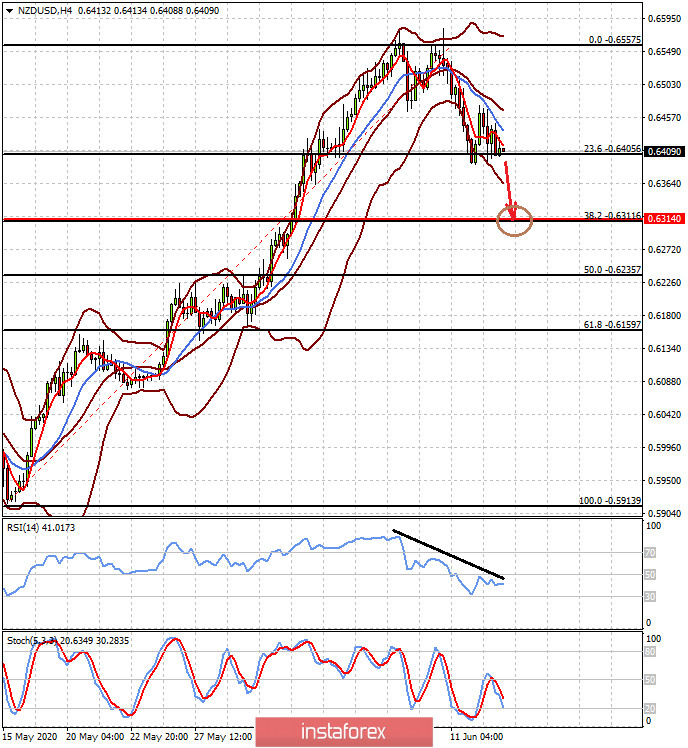

The NZD/USD pair is trading near the level of 0.6410. A decline below the level of 0.6400 should be seen as an invitation to short sell the pair with a target of 0.6315.