The Federal Open Market Committee (FOMC) meeting contributed to the weakening of the British pound as well as other currencies. In addition, the pound is now brought under pressure amid poor macroeconomic data in the United Kingdom. The economic situation in the UK is alarming. Restriction measures aimed at curbing the spread of the coronavirus in the UK are gradually being lifted. At the same time, another problem remains unsolved - Brexit. London and Brussels are to sing a trade agreement by December 31. Otherwise, the United Kingdom will be deprived access to the European market. Meanwhile, the parties are negotiating the deal. The negotiations on this issue have been going on for many years. However, the parties are still unable to come to a mutual agreement. Only the final deadline for the UK to withdraw from the European Union has been constantly delayed. This time, there will be no delay. However, there are doubts that at least some kind of trade agreement will be signed, as the UK's demands remain high. Moreover, Brussels is unlikely to agree on compromise. Interestingly, the position of the European Union on the issue, unlike the United Kingdom, has not changed in any way since the Brexit referendum. And all this can lead to the situation where British companies will be forced to simply leave the European market next year. Under current conditions, this is likely to severely hit the British economy. Therefore, it is clear that the prospects for the pound look extremely vague.

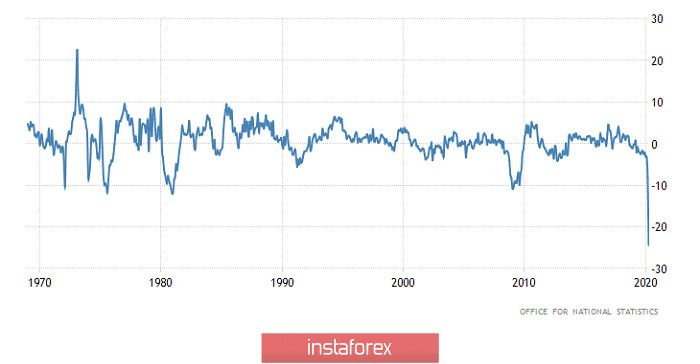

Now, let's get to macroeconomic data in the UK. Thus, industrial production in the country plummeted to -24.4% from -8.2%. This is the sharpest fall since the end of 1960s. For example, industrial production in the UK contracted the most in December 1980. Back then, it plunged to -12.0%. At the same time? The decline in industrial production had been accelerating for almost a year. This time, it fell rapidly and unexpectedly. This indicates that the current crisis is not only severe, but also that problems have been brewing in the economy for a long time. In other words, the British economy has serious structural problems that have turned into a kind of a card-castle. Same events take place in the European Union and in the United States.

Industrial production in the United Kingdom:

Today, the next round of talks between London and Brussels is going to take place. Given the experience of previous years, it is unlikely that the pound will rise. Quite the opposite, in fact. Brussels is expected to once again declare that its position has not changed. London, in its turn, may accept the proposed conditions. Otherwise, there will be no trade agreement. London is likely to once again declare that this time the UK has offered mutually beneficial conditions and that the European Union stubbornly refuses to accept the terms. Such a scenario has been played out many times.

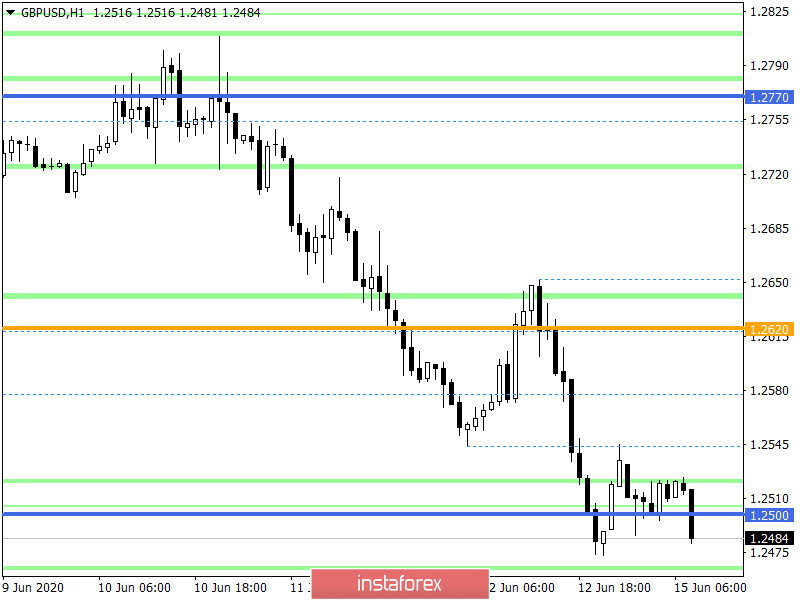

In terms of technical analysis, we see an intense downward movement from the range level of 1.2770, where the quotes have previously come against the background of an inertial move. Currently, the recovery of the US dollar against the British pound is approximately 50%, relative to the total value of inertia. The mark of 1.2500 became an intermediate level in the recovery process. Along this level an alternating stagnation of 1.2475/1.2545 was formed, which plays the role of a local regrouping of trade forces.

Interestingly, if we take a look at the trading chart in the daily time frame, we can see the first corrective move in 18 trading days, which means that there is still the prospect of further recovery.

It can be assumed that if the price consolidates below the level of 1.2470, the quotes will decline to 2420-1.2350. This is the area where a rebound is likely to occur.

Trading signals are the following:

- It is better to open Short positions below the level of 1.2470 with the target at 1.2420-1.2350.

- If the price consolidates above 1.2550, it is preferable to consider Long positions with the target at 1.2620.

From the point of view of the comprehensive indicator analysis, we can see that the signal of the technical tools at the hourly intervals have changed from upward to downward due to the existing recovery process. The buying signal at the daily interval is on the verge of turning neutral.