Latest COT report (Commitments of Traders). Weekly prospects for EUR/USD

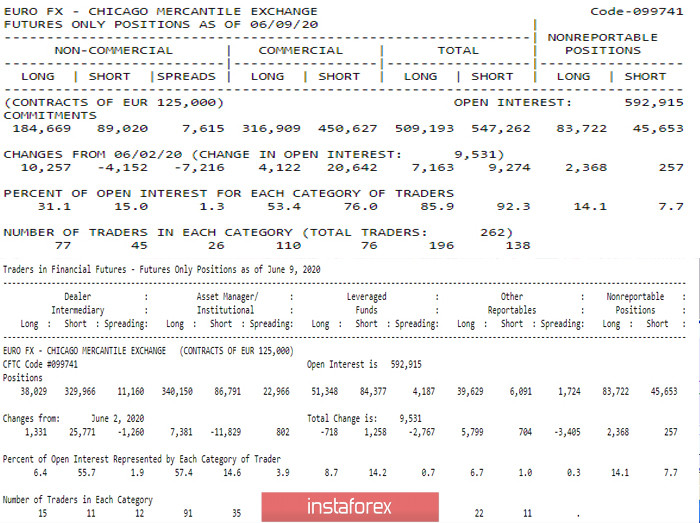

According to the latest COT report (06/09/20), the indicator of open interest in the euro increased again, which amounted to 592,915 at the time of reporting. This means that the euro continues to be in demand, and current trends in the long term will be maintained. It should be noted that the Commercials group actively gained positions in both directions during the reporting period, but short positions were clearly in priority (short + 20.642 - long + 4.122). Meanwhile, the reporting of market participants (Non-Commercial and Dealer Intermediary), characterized by greater mobility and support for the current distribution of forces, remains a gap in favor of players to increase, the percentage gap steadily continues to increase (31.1 against 15 - 55.7 against 6.4).

Main conclusion

Reporting statistics of global market players remains committed to the prevailing daily upward trend, but the expectation of a full-fledged correction has been strengthened. This circumstance was reflected in the decline indicated at the end of last week. The current week should reveal the extent of the nascent correction.

Technical picture

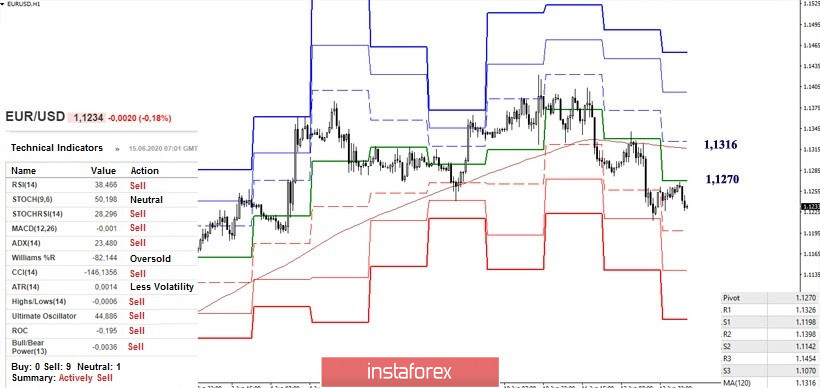

There is a slowdown for weeks, but the weekly candle does not have a pronounced reversal character. The pair remained in the bullish zone relative to the current weekly cloud of Ichimoku, which will retain the role of support (1.1225) in the near future. The emerging weekly cloud is ready to become bullish, while a golden cross arose in the weeks. In the daily timeframe, the emerging bull cloud continues to expand. The upward daily trend over the past week marked a new high, but the pair started a correctional decline at the end of the week, while losing support for the daily short-term trend. At the moment, the main support is provided by the upper boundary of the weekly cloud (1.1225), then in the case of a correction, the key value will be the support that has joined forces in the area of 1.1100-1.1065 (the lower limit of the weekly cloud + daily Kijun + daily cloud). Among the nearest upward trend targets, we can note the maximum extreme of 1.1496, the execution of the daily goal for the breakdown of the daily cloud (1.1499).

The key lower resistance is currently located at 1.1270 (central Pivot level) and 1.1316 (weekly long-term trend). If the minimum is updated and the support continues to decline, the classic pivot levels are located today at 1.1198 - 1.1142 - 1.1070.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)