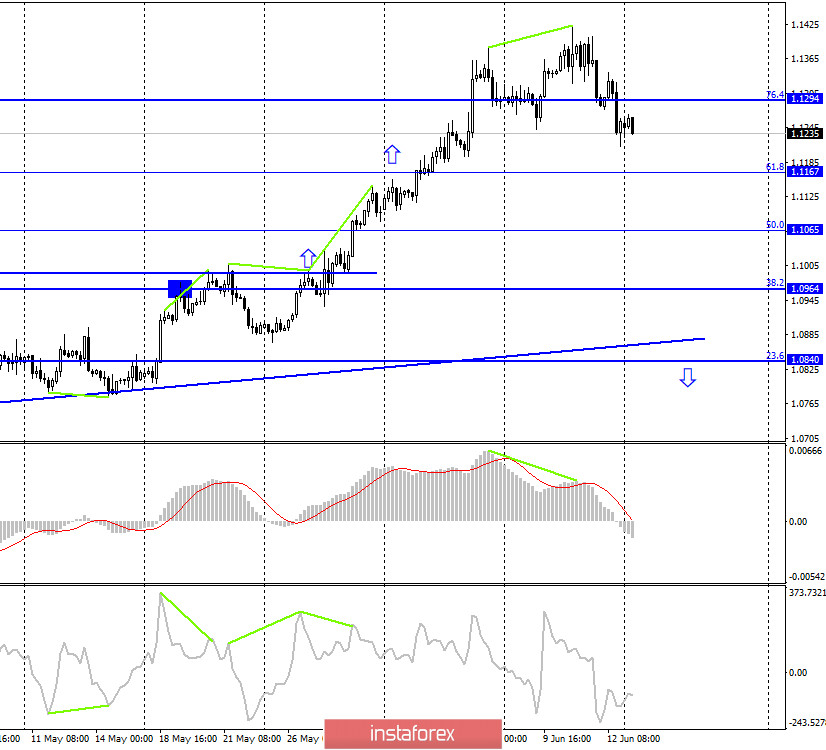

EUR/USD – 1H.

Hello, traders! The euro/dollar pair continued to fall on the hourly chart on June 12 after it secured under the upward trend corridor. Thus, at the moment, the graphical analysis accurately indicates the continuation of the fall in quotes. The mood for the euro/dollar pair in recent days has been characterized as "bearish". Meanwhile, traders now have to almost look for information background. There were very few economic reports on Friday, and traders didn't pay much attention to them. The US Treasury Secretary in the last days of last week made several statements at once, from which we understood that the US economy needs even more stimulus (this was previously mentioned by Fed Chairman Jerome Powell) and there will probably not be a second "lockdown" since this will mean another huge fall in the economy. However, it is with the adoption of a new package of assistance to the economy that problems may arise since Republicans and Democrats can not come to a common opinion on this issue in Congress.

EUR/USD – 4H.

On the 4-hour chart, the quotes of the euro/dollar pair, after the formation of a bearish divergence in the MACD indicator, performed a reversal in favor of the US currency and anchored under the Fibo level of 76.4% (1.1294). Thus, the process of falling quotes can be continued in the direction of the next corrective level of 61.8% (1.1167). No new emerging divergences are observed in any indicator today. The pair's rebound from the Fibo level of 61.8% will allow traders to expect a reversal in favor of the EU currency and some growth in the direction of 1.1294.

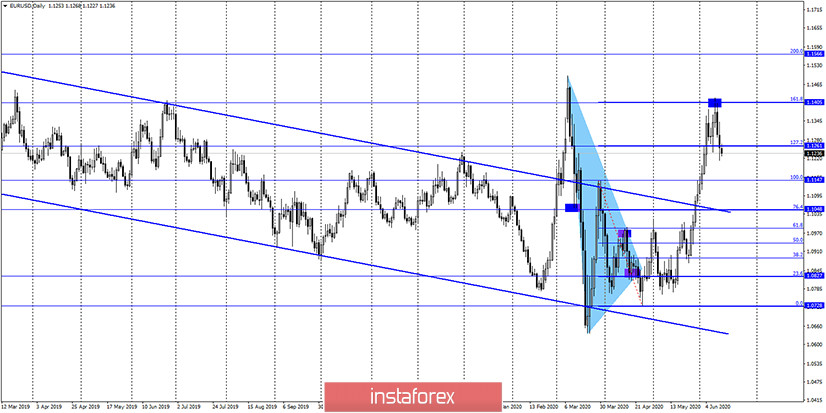

EUR/USD – Daily.

On the daily chart, the euro/dollar pair rebounded from the corrective level of 161.8% (1.1405) and fell to the Fibo level of 127.2% (1.1261). Closing quotes below this level will work in favor of a further fall in the direction of the next corrective level of 100.0% (1.1147).

EUR/USD – Weekly.

On the weekly chart, the euro/dollar pair rebounded from the lower line of the "narrowing triangle", which still allows traders to expect growth in the direction of the 1.1600 level (the upper line of the "triangle"). Given the growth of the euro currency in recent weeks, this goal may be "taken" soon.

Overview of fundamentals:

On June 12, the European Union released a report on industrial production, which quite predictably showed a strong decline. No more important reports were released during the day in either the US or the European Union.

News calendar for the United States and the European Union:

On June 15, the news calendar in the United States and the European Union is empty again. Thus, the information background will be absent for the pair today.

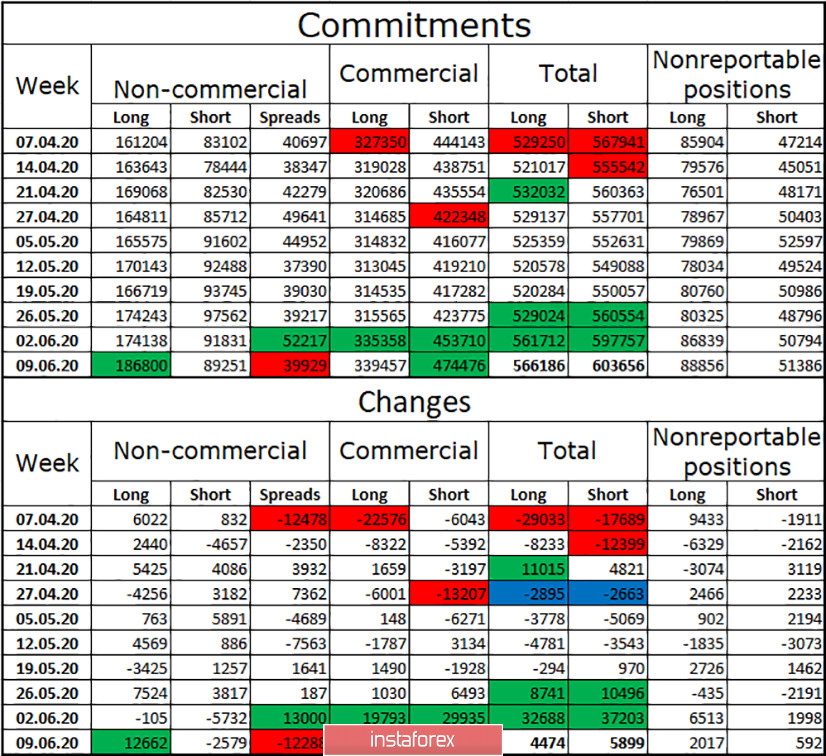

COT (Commitments of Traders) report:

The latest COT report showed very interesting changes in the mood of major traders. For example, the "Non-commercial" group has increased the number of long contracts by 12,500, while not forgetting to get rid of short contracts. Since it is believed that this group is driving the currency market, there is nothing surprising in the growth of the European currency according to this report. Hedgers very logically recruited opposite contracts, since this is the essence of their activity (+20766 short contracts). Thus, over the past two weeks, the euro currency has lost 8 thousand short contracts and gained 12,500 long contracts. The most interesting thing is whether this mood will remain among traders, which will allow the euro currency to continue the growth process? Recent days show that bull traders are fed up with buying the euro currency.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goal of 1.1167, since the closing was performed under the level of 1.1294 on the 4-hour chart. I recommend opening new purchases of the pair with the goal of 1.1405 if the closing is performed above the corrective level of 76.4% (1.1294) on the 4-hour chart.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.