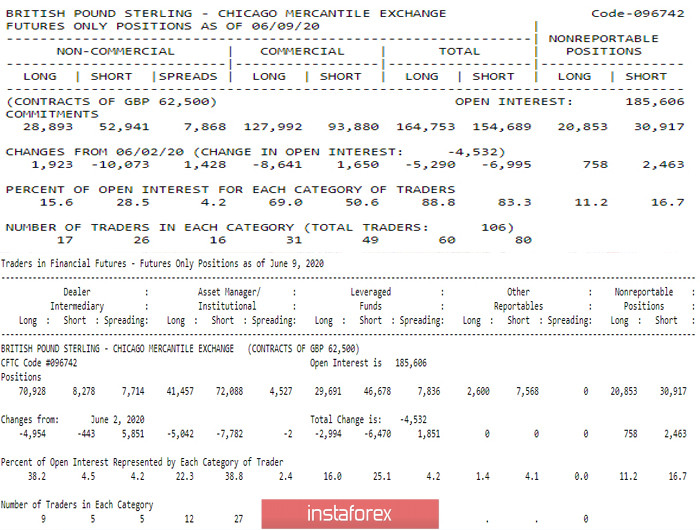

Latest COT report (Commitments of Traders). Weekly Outlook for GBP / USD

The June 09, 2020 COT report showed a decrease in open interest with 185.606 versus 190.138. The number of accountable market participants working with the pound also fell. All this may have negative consequences for the pound sterling in the long run. Thus, some uncertainty may await us. Major players over the past reporting period reduced the total values of both short (-6,995) and long (-5,290) positions. The Commercials group, which is more closely connected with the real sectors of the economy, no longer build up long positions, but, on the contrary, actively reduces them. Recall that in the previous report, there was an increase of 12.377, while in the latest report, there is a decrease of 8.641 in long positions. With short positions, the situation for these market participants has not changed so significantly.

Main conclusion:

From all of the indicated information above, we can conclude that there are no bright prospects for the pound in any direction. The situation will be characterized to a greater extent as uncertainty, pause, search for prospects.

Technical picture:

Technically, the GBP / USD pair is now located between strong resistances 1.2736–1.2938 (weekly cross + daily cloud + final borders of the daily cross Ichimoku, weekly cloud + final borders of the monthly dead cross) and no less strong supports 1.2443 - 1.2305 ) Long-term prospects, determined by the Hosoda method in the form of forming clouds of Ichimoku, now remain multidirectional in the week and day halves. Therefore, the conclusion of the COT report (Commitments of Traders) on possible uncertainty that could lead to consolidation in the technical plan finds sufficient confirmation on the chart. Further development of the pair's movement will largely depend on the result of interaction with the designated support and resistance zones.

At the moment, the upward players on the H1 timeframe have reached the first significant resistance which is the central Pivot level 1.2554. Consolidation above will make the weekly long-term trend 1.2659 the main reference point of the upward correction. Support for the classic Pivot levels, relevant inside today, is now located at 1.2454 - 1.2374 - 1.2274.

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)