Hello, dear colleagues!

On the first trading day of this week, the main currency pair showed an upward trend. Pressure on the US dollar was exerted by a decline in the yield of ten-year US government bonds, as well as the continued appetite of market participants for risk. In addition, the US Federal Reserve (FRS) announced the beginning of a large-scale program of buying up corporate debt, which also increased the attraction to risky assets.

At the same time, it is necessary to note the growing fears about the invasion of the second wave of COVID-19. For example, in southern Beijing, there is a surge in coronavirus infections. There are already a number of restrictions, including on public transport. The situation regarding COVID-19 in the US is also far from normalizing. Only this weekend, about 25 thousand new cases of infection with a new type of coronavirus were detected in the United States.

If you look at today's economic calendar, the main events, starting from 13:30 (London time), will come from overseas. It is worth highlighting reports on retail sales and industrial production. Apart from this is the semi-annual report on monetary policy by Fed Chairman Jerome Powell, which will begin at 15:00 (London time).

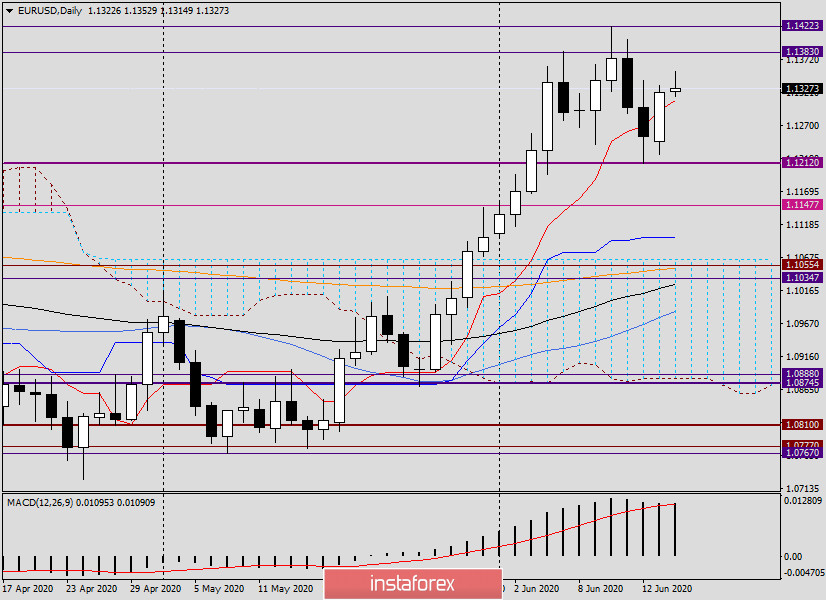

Daily

If we go to the technical picture for EUR/USD, then at yesterday's trading, without reaching the previous lows of 1.1212, the exchange rate turned in the north direction. The pair strengthened quite well, ending Monday's trading at 1.1322. Today, at the moment of writing this article, there is a moderate strengthening of the quote. If growth continues, its immediate targets will be strong technical levels of 1.1380 and 1.1420. In the case of a bearish scenario and leaving below 1.1300, the further benchmarks of sellers will be 1.1230 and 1.1200.

According to the daily chart, it is difficult to assume the further direction of the price. On the one hand, yesterday's bullish candle swallowed the previous bearish one, which can be considered a signal for a further rate rise. On the other hand, until the levels of 1.1380 and 1.1420 are broken, with the consolidation above the last mark, the prospects of bulls for the euro can be questioned.

As for today's trading, the most direct impact on their course will be the American statistics and the speech of Jerome Powell.

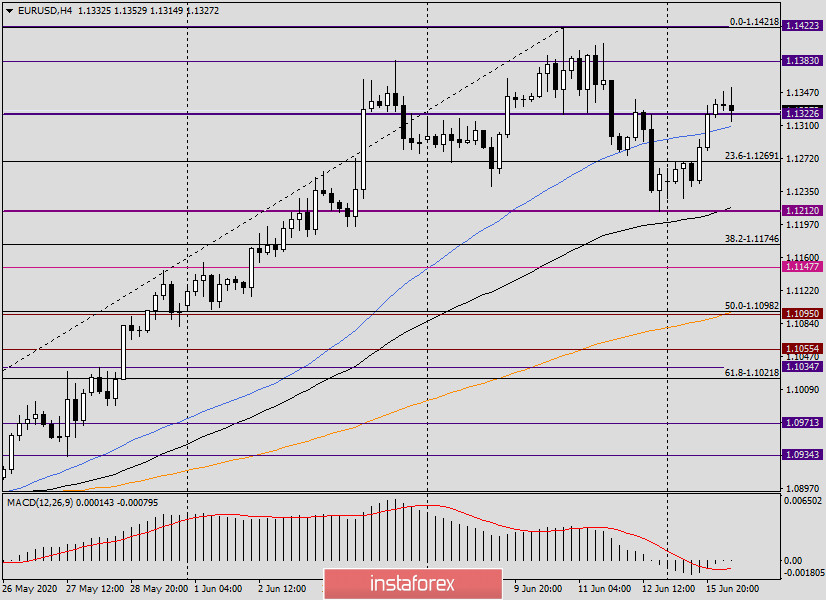

H4

On the four-hour chart, after the pair encountered strong resistance from sellers near the significant technical level of 1.1350 and there is an attempt to turn in the south direction. If the current candle remains approximately the same shape, we can expect a further decline to the 89 exponential moving average and the support level of 1.1212. The probability of such a scenario will increase significantly if the current candle closes at 50 MA (blue) and below the level of 1.1300. While the pair is trading higher, the probability of resuming growth attempts remains.

H1

There is also no certainty on the hourly chart. The morning growth of the pair stalled near 1.1353, from where the price started a fairly strong decline. If the downward trend continues, the euro/dollar will fall to the area of 1.1302-1.1277, where the moving averages used are: 89 EMA, 50 MA, and 200 EMA. If bullish candlestick signals appear in the selected zone, you can try opening buy deals with the nearest targets at 1.1340. I also recommend that you take a closer look at purchases in the event of a census of the current highs of 1.1353.

Regarding sales, I recommend waiting for the appearance of bearish reversal patterns of candle analysis, which will appear below 1.1353. In this case, it will become clear that the pair is unable to continue growing and will turn to decline. In conclusion, I would like to draw your attention once again to today's events in the economic calendar, the main one of which will be the speech of Fed Chairman Jerome Powell.

Good luck!