Good day, dear traders!

At yesterday's trading, the pound/dollar currency pair showed mixed dynamics and still ended Monday's trading with a confident strengthening. We will return to the technical picture for GBP/USD later. However, for now, we will talk about today's events that have already had and will have an impact on the price dynamics of the instrument.

Today at 07:00 (London time), data on the UK labor market was published. The number of applications for unemployment benefits exceeded expectations and amounted to 528.9 thousand, with a forecast of 400 thousand. However, unemployment unexpectedly fell, and its level was 3.9%, while experts' expectations were reduced to 4.7%. Although it is not particularly surprising since, with the lifting of a number of restrictions caused by the spread of COVID-19, many employees returned to their jobs. Moreover, the number of new employees has increased.

If we finish the topic of British events, then, of course, the main one will be the decision of the Bank of England on the main interest rate. This decision will be announced on Thursday at 12:00 (London time). At the same time, the minutes of the meeting of the British Central Bank will be published. The Bank of England is expected to keep the rate at 0.10%, but may increase the volume of asset purchases to offset the negative effects of COVID-19. As you know, the UK was among the countries that were most affected by the coronavirus pandemic.

The main stream of macroeconomic statistics will come from the United States of America today. The main focus should be on reports on retail sales and industrial production, which will be published at 13:30 (London time) and 14:15 (London time), respectively. The speech of Fed Chairman Jerome Powell with the semi-annual report on monetary policy will be extremely important. Market participants will be waiting for more details about the large-scale program for buying up corporate debt. The speech of the head of the Federal Reserve will begin at 15:00 (London time).

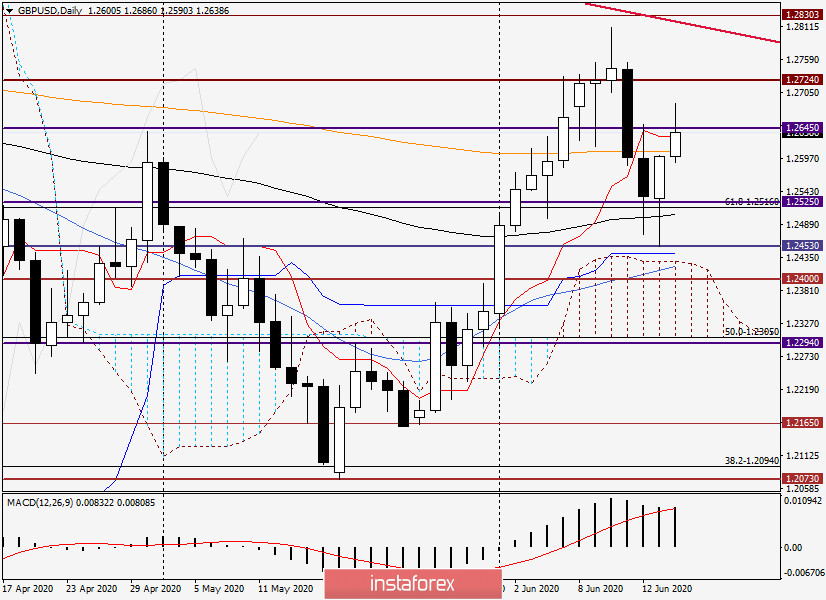

Daily

As noted at the beginning of the article, the pair was quite active in yesterday's trading and showed significant volatility. After falling to 1.2453, the exchange rate turned sharply and began to grow actively. As a result, Monday's trading ended at the landmark level of 1.2600.

During today's session, the pair continues to strengthen, however, it rebounded after reaching the level of 1.2686 and at the moment of writing this article, it is trading near 1.2646. At the moment, the pound/dollar is trading above the 200 exponential moving average and the Tenkan line of the Ichimoku indicator. However, for greater confidence in the ability to further strengthen, a confident close above the important technical mark of 1.2645 is necessary. Only in this case, you can expect to continue the upward movement to the area of 1.2700-1.2730. If the bulls on the pound loosen their grip and give the initiative to their opponents, GBP/USD may turn to decline, where the nearest target will be the area of 1.2525-1.2550. This development will be signaled by the closing of today's session below the Tenkan line, 200 EMA, and the formation of a bearish reversal model.

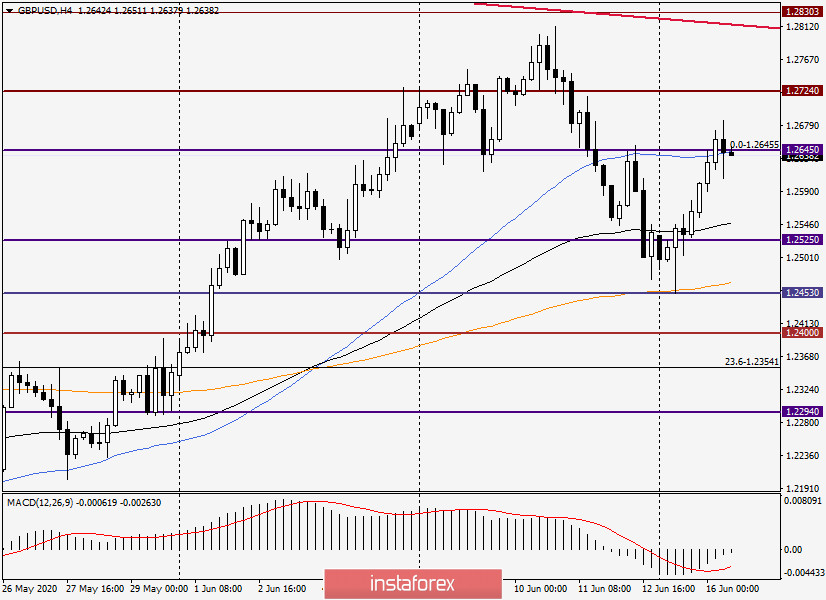

H4

In this timeframe, after the formation of the previous Doji candle "Rickshaw", we observe a rather important moment. This model is considered a reversal, however, it has a special force when it appears at the end of an upward movement. In the current situation, this is not quite true, and here the 50 simple exponential average becomes more important. Fixing above 50 MA will signal a further tendency of the pound to grow. If the quote is fixed below 50 MA, there will be prerequisites for the implementation of a downward scenario.

Conclusion and recommendations for GBP/USD:

Given yesterday's daily candle with a long lower shadow and no upper one, I am more inclined to assume an ascending scenario, however, do not forget about the events listed above, which can make significant adjustments to the price dynamics of GBP/USD. Nevertheless, I recommend considering purchases from current prices (risky) or after a decline in the area of 1.2600. If the pair breaks through this level and gains a foothold under it, the ascending scenario will be in question.

If a bearish candle or a combination of candles appears below 1.2686, this will be a signal to open short positions with targets near 1.2610-1.2600. I recommend setting targets for long positions at 1.2685, 1.2700, and 1.2730.

Good luck!